How Germany Is Able To Run The World’s Second Largest Export Economy In The Post-Industrial Era

“The Germany Shock” describes European growth & the efficiency-maximizing centralization of European manufacturing activity after the launch of the Single Market and the Euro.Two questions sparked this: 1) why did Europe only adopt the Euro & the Single Market after its Cold War-era existential challenge was over, and 2) how has Germany maintained an export-oriented Industrial Manufacturing Powerhouse while every other developed nation is going post-Industrial?“The Germany Shock” — a summary:

- Germany is a major outlier among high-GDP developed

nations and nobody talks about it

- International trade is a primary source of German

economic prosperity

- Only China runs a larger Surplus from Trade

- Only China runs a larger Surplus from Trade

- No other nation has a customer base anywhere near as

diversified as Germany

- International trade is a primary source of German

economic prosperity

- A China-USA Manufacturing Case Study:

- i) It is possible for a region to straight up lose at

trade

- International competition can reduce employment in

one geographic region without producing an offsetting increase in

employment in that same region

- International competition can reduce employment in

one geographic region without producing an offsetting increase in

employment in that same region

- ii) Manufacturing Network Effects: 3 - 1 = 0

- When the primary economic engine leaves a community, all

the supporting economic activity leaves too, from barbershops

to component suppliers

- When the primary economic engine leaves a community, all

the supporting economic activity leaves too, from barbershops

to component suppliers

- iii) Exchange rates are a Cheat Code for selling

stuff — you might not be willing to cheat, but China is

- When China undervalues its currency, Chinese goods start

looking real cheap

- Foreigners then buy way more Chinese goods than they

otherwise would have

- Foreigners then buy way more Chinese goods than they

otherwise would have

- When China undervalues its currency, Chinese goods start

looking real cheap

- iv) The price of your currency is a reflection of

how desirable your whole nation’s economy is

- The more successful your nation is, the more expensive

it becomes for you to fight the free market and maintain the

fiction of a cheap — undesirable — currency

- China deals with this via intense autocratic market

interventions that are unthinkable in the West or — when tried

in our free markets — lead immediately to failure

- China deals with this via intense autocratic market

interventions that are unthinkable in the West or — when tried

in our free markets — lead immediately to failure

- The more successful your nation is, the more expensive

it becomes for you to fight the free market and maintain the

fiction of a cheap — undesirable — currency

- i) It is possible for a region to straight up lose at

trade

- Case Study Takeaway:

- v) The price of industrial success is eventual failure:

Industrial Exporter nations tend to become stable, regionally

dominant economies…

- …their currencies then become highly sought-after

“Reserve Currencies” — making their products expensive

and undermining the export-driven success that made their

economies so great in the first place

- This spells doom for Germany because of how dependant they

are on selling to other countries

- This spells doom for Germany because of how dependant they

are on selling to other countries

- …their currencies then become highly sought-after

“Reserve Currencies” — making their products expensive

and undermining the export-driven success that made their

economies so great in the first place

- v) The price of industrial success is eventual failure:

Industrial Exporter nations tend to become stable, regionally

dominant economies…

- The German Solution:

- vi) The European Single Market functions to make

German goods maximally attractive to trading partners within

the EU by raising the effective-cost of imported goods

- vii) The German Euro — the currency — then has

its value suppressed via contamination with all the other

(poorer-performing, non-Exporting) European

nations

- This means German goods look cheaper than they otherwise

would to non-EU markets

- This means German goods look cheaper than they otherwise

would to non-EU markets

- vi) The European Single Market functions to make

German goods maximally attractive to trading partners within

the EU by raising the effective-cost of imported goods

- Result:

- viii) The Euro & the Single Market make it possible for

Germany to pursue a strategy of Export-driven Wealth-creation that

would be considered impossible in

any other Western, high-GDP, high-population, high-wage-paying

nation

- European nations that have found a way to support the

German Productivity Engine have built a symbiotic relationship

that strengthens their union

- European nations that have found a way to support the

German Productivity Engine have built a symbiotic relationship

that strengthens their union

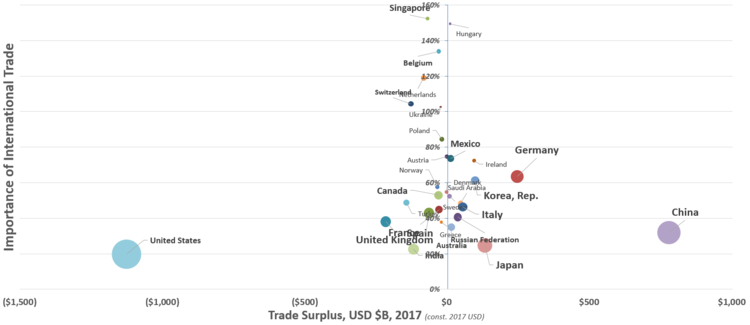

Here’s some data most people never see. None of this essay makes sense if you aren’t familiar with it. It’s a bit academic at first, but you’ve got to understand it if you want to get to the entertaining stuff later. Given my focus on the Euro (as a mechanism of exchange and therefore Trade) and the Single Market (obviously about Trade) both being adopted post-German-reunification, the data I want to see is: - viii) The Euro & the Single Market make it possible for

Germany to pursue a strategy of Export-driven Wealth-creation that

would be considered impossible in

any other Western, high-GDP, high-population, high-wage-paying

nation

- Who is making money by Trading with other countries, and exactly how much?

- How important is that Trade to each nation?

- +some way to show the massive GDP differences between nations — some business models only work at a small scaleTake a good look. The tagline here is “Germany is a major outlier among high-GDP developed nations and nobody talks about it.”:

Barely legible, I know, let me zoom in

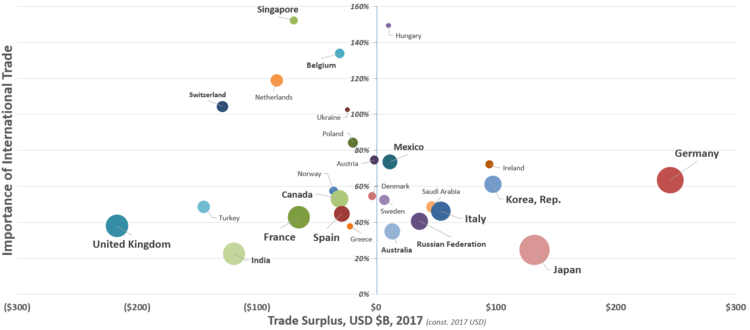

The USA and China are massive outliers in their own right, so I’m going to shrink the X-axis and exclude them for now so we can actually compare normal nations:

Click to embiggen — The area of each bubble is based on each country’s GDP. See Notes [0] and

[1] for data sourcing — I made zero adjustments, these are all World Trade Organization numbers

The X-axis here represents “money a country makes by Trading with other countries”. Countries to the left spend more money buying foreign products (imports > exports), and countries to the right make more money selling to foreign nations (exports > imports). The X-axis therefore shows how profitable International Trade is to a country....

....MUCH MORE

HT: Rory Sutherland