Further into the Twitter thread Mr. B makes the point that the low ESG stocks are distinct from the Vice stocks and he's right both in his catagorization and in their performance. The Vice stocks tend to be deep value issues which have dramatically underperformed large-cap growth during the current bull run.Granted it's a truism but like many truisms it's a truism because it's true.

Here are a couple of ZeroHedge's Feb. 20 posts, both written after the throwaway line above:

11:22

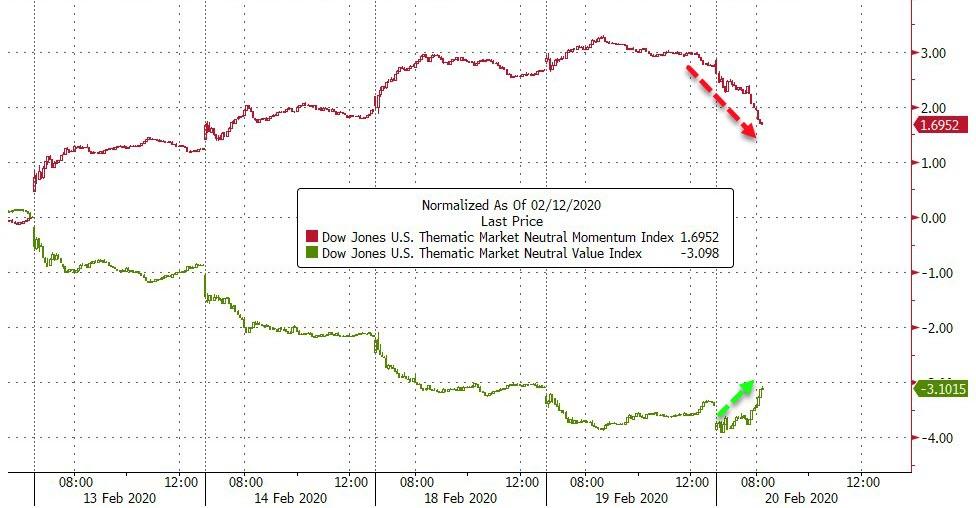

Momo Massacre? Nasdaq Is Crashing As Major Factor Reversal Strikes

While the catalyst for this sudden move is unclear, the fact is a notable regime shift is underway today in factors as the long-momo-short-value trade is reversing fast as Treasury yields tumble.

Is this the start of a September-like reversal?

Notably the almost incessant rise in low-vol strategies is getting hammered today...

As all the insane high-flyers are getting hammered...

And that is weighing down the overall market...

And Nasdaq is collapsing...

Erasing the week's irrational gains...

With 30Y Yields back at their lowest since Sept 2019...

A notable break in the correlation between rates and momentum...They followed up with the headline story:

12:21

In the past few weeks, there has been much investor speculation whether the recent record crowding in factor investing would have an adverse impact on the broader market. As a reminder, just yesterday, JPM's Marko Kolanovic called the low-vol (i.e., "tech") factor a "bubble" which he compared to events during the dot com bubble to get a sense of the prevailing market exuberance:

For instance, the ratio of the S&P 500 technology to energy sector is now the same as during the tech bubble.Commenting on the charts above, Kolanovic says is that "the bubble we are describing is expressed in equity factors (sector-neutral momentum and low volatility factors), however signs of this bubble can be seen in sectors’ performance as well" which as we showed yesterday, had pushed the divergence between growth and value stocks to unprecedented YTD levels.