From ZeroHedge:

Morgan Stanley: If We Close Below 3,235, Systematic Selling Will Become "Self-Fulfilling"

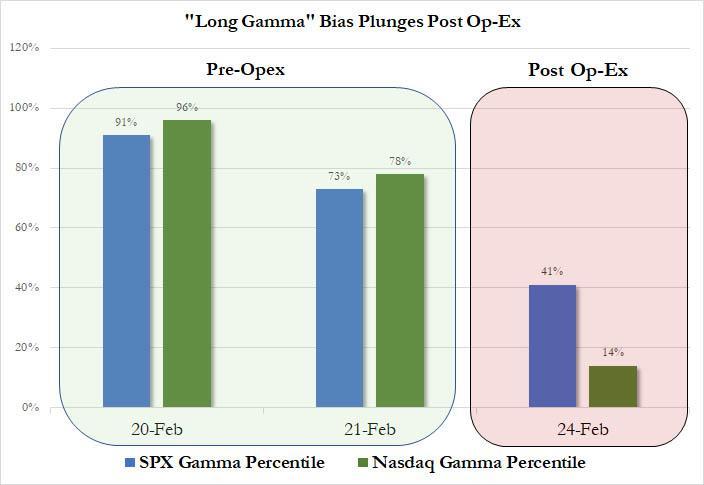

Earlier today we noted that according to Nomura's Charlie McElligott, the biggest risk facing the market was a "shock down" as dealer gamma bias had evaporated following Friday's Op-Ex (especially in the Qs)...

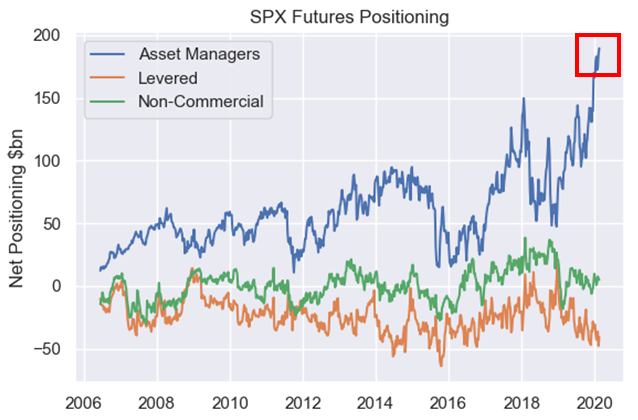

... which meant that instead of providing a natural buffer to any selling ("buy weakness/sell strength"), dealers are now procyclically positioned, and any accelerated selling would only lead to more selling, resulting in even lower gamma, even more selling, and so on, in a typical gamma feedback loop. A separate, and just as tangible risk according to McElligott, was the record positioning (100%ile) across asset managers, whose net long exposure across SPX futures hit a record $190BN....

here are the first few lines of that earlier ZH post:

When commenting on the market's surprising resilience on Friday, and remarkable index "pins" at the key numbers of 29,000 for the Dow and 3,333 for the S&P, we said that much if not all of this had to do with the build up of dealer gamma, most of which however was set to fade away after Friday's opex.Sure enough, while it may be a coincidence, the Monday mauling observed so far is taking place not only as a result of the dismal coronavirus news over the weekend but as much of the massive dealer gamma buffer has vaporized.Commenting on his favorite topic, namely market bias and positioning due to gamma imbalances, Nomura's Charlie McElligott writes that this post-opex “release” of mechanically-insulating “Long Gamma” flow from Dealers finally "sees the market allowed to come unhinged" with the specific catalyst being the weekend escalation of offshore covid-19 cases.

...At roughly the same time, Morgan Stanley's Christopher Metli, executive director in the bank's QDS division, looked at selling pressure from another source, and calculated that while there is up to $10BN in notional selling pressure today from "systematic and price reactive traders", this liquidation amount could soar to $60BN which would "generate a self-fulfilling downward move in QDS’ view" if the S&P closes below 3,235 or just a handful of points from here........MUCH MORE

3234.50 down 103.25 (-3.09%) with minutes to go 'til the close