From World Maritime News:

John Fredriksen’s shipping company Frontline posted the highest quarterly net income in more than eleven years, reaching USD 108.8 million for the fourth quarter of 2019, the company’s data shows.

The figures point to a major rebound when compared to a net loss of USD 10.0 million in the previous quarter. For the entire year, the company’s net income stood at USD 139.9 million....MORE

“Frontline’s ability to generate significant income has been proven in our fourth quarter results, and the strong market continued into the first quarter of 2020, resulting in the strongest earnings period since 2008 for owners of modern, fuel-efficient vessels,”

Robert Hvide Macleod, Chief Executive Officer of Frontline Management AS commented.

“However, primarily due to the effect of the coronavirus, we have a near-term macro headwind with a slowdown in oil demand, particularly in China. We can’t forecast the duration of this impact, but once the coronavirus is contained Frontline is exceptionally well positioned for the strong rebound we believe will follow.”

Frontline said that its performance in the fourth quarter was driven by higher tanker demand as ton-miles increased due to the growing Atlantic to Asia trade, tighter available fleet capacity and early effects of the IMO 2020 implementation.

These factors coincided with the attacks on oil facilities in Saudi Arabia and the sanctions on the Cosco fleet, which further strengthened the market.

“Just a few short weeks into 2020, the market strength reversed as Libya lost 1mb/day of oil production, Nigeria declared force majeure on Bonny crude and the world held its breath during attacks in the Middle East. Then the sanctions were lifted on the Cosco fleet and the coronavirus appeared, having made an immediate impact on world trade, oil demand and the freight market,” Frontline pointed out.

The VLCC segment is particularly weak as ton-miles demand has decreased, while suezmaxes and LR2/aframaxes, two segments where Frontline has significant exposure, are enjoying better earnings on a relative basis.

Despite the negative market sentiment created by the coronavirus, Frontline’s long-term view has not changed, as the company believes that crude demand will continue to increase and that the fallout will be temporary.

“We are cautiously optimistic that the spread of the virus will be contained sooner rather than later, even though it according to news headlines only is getting worse,” the tanker owner commented.

“Rates for modern vessels are still at reasonably high levels compared to the same period in recent years, which speaks to the underlying conditions and the IMO 2020 shift. Last year a very heavy refinery maintenance season contributed to weaker tanker markets before giving way to a surge of demand towards the end of the year. Combined with increasing sailing distance and reduced effective fleet supply, this is in the simplest of terms a powerful combination.”...

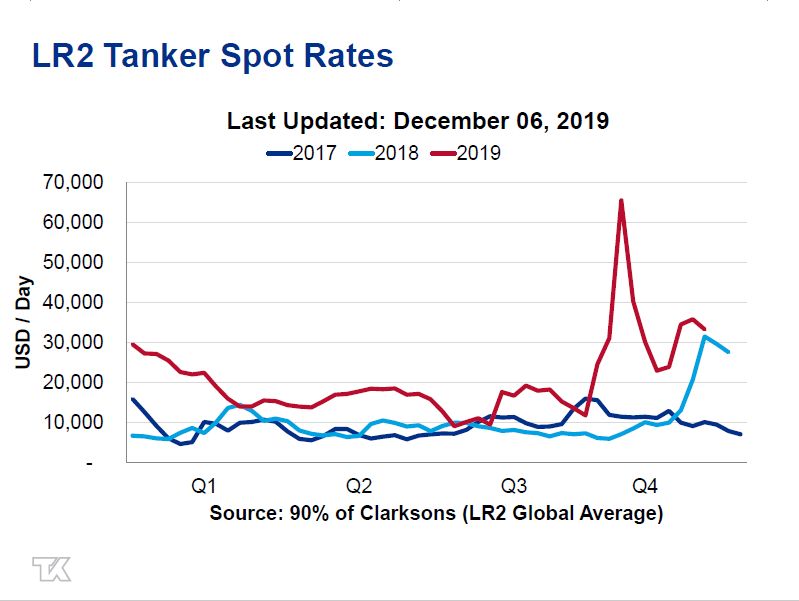

We looked at the exceptional profitability of the tanker owners in February 5's Euronav Comments on the Tanker Market (EURN; TNK; FRO):

via Teekay

And speaking of the group here's American Shipper at FreightWaves:

Great Quarter For Tankers Coincides With Stock-Market Rout

Pity the public tanker owners. After years of suffering through terrible freight markets, they finally have a breakout quarter to boast about — and just as they do so, the broader stock market is crashing around them on coronavirus fears.....MUCH MORE

“It has actually felt like a bit of a horror movie at times, to be honest,” said Frontline (NYSE: FRO) CEO Robert Macleod during a conference call with analysts on Thursday. “It seems that the world is getting one shock after another but surely there must be some good news soon.”

Two of the largest publicly listed tanker owners have just reported results for the fourth quarter of 2019 — Frontline and Teekay Tankers (NYSE: TNK). Frontline announced “its highest quarterly income in more than 11 years.” Teekay Tankers CEO Kevin Mackay touted “one of the most profitable quarters since the end of the tanker-market super cycle in 2009.”

Despite this outperformance, shares of Frontline and Teekay Tankers are down around 45% and 38%, respectively, year to date (on a positive note, shares of both companies were up at midday on Thursday, Teekay Tankers in particular on strong forward guidance).

Strong first-quarter performance

Even more disappointing for tanker execs amidst the stock slide is that the first quarter of 2020 looks even better than the fourth quarter of 2019. A significant portion of quarterly bookings are done in the prior quarter, thus first-quarter voyage rates are buoyed not just by early bookings in the current period, but by bookings made at the end of last year, when rates were very strong.

On the call with analysts, Macleod said the company’s VLCCs (very large crude carriers, with capacity of around 300,000 deadweight tons or DWT) earned $58,000 per day in the fourth quarter and 83% of available VLCC days are booked in the first quarter at $90,000 per day. Frontline’s Suezmaxes (120,000-199,999 DWT) earned $38,000 per day in the fourth quarter and 75% of available days in the first quarter have been booked at around $72,000 per day.

Teekay Tankers’ has secured spot deals at an average rate of $51,700 per day for its Suezmaxes in the first quarter (77% of available days fixed), versus $39,100 per day in the fourth. Its Aframaxes (80,000-119,000 DWT) have been booked at $38,600 per day in the first quarter (63% of available days fixed), versus $33,000 per day in the fourth.

As Jefferies analyst Randy Giveans lamented during an interview with FreightWaves on Monday, “Stock prices are back to where they were during the third quarter of 2019. They’re priced as if the fourth quarter didn’t happen. They’re priced as if the first quarter — which could be even better than the fourth quarter — didn’t happen.”

Positive supply side factors ahead

Macleod stressed the positives going forward, while acknowledging the current weakness. “The negative market effect created by the coronavirus is certainly strong and has hit oil demand head on, but we believe the current situation is temporary rather than permanent,” he said....

WTI 45.06 down 2.03

Brent 49.97 down 2.21

And some of the stocks (all via FinViz):