Suspicious discontinuities

If you read any personal finance forums late last year, there's a decent chance you ran across a question from someone who was desperately trying to lose money before the end of the year. There are a number of ways someone could do this; one commonly suggested scheme was to buy put options that were expected to expire worthless, allowing the buyer to (probably) take a loss.

One reason people were looking for ways to lose money was that, in the U.S., there's a hard income cutoff for a health insurance subsidy at $48,560 for individuals (higher for larger households; $100,400 for a family of four). There are a number of factors that can cause the details to vary (age, location, household size, type of plan), but across all circumstances, it wouldn't have been uncommon for an individual going from one side of the cut-off to the other to have their health insurance cost increase by roughly $7200/yr. That means if an individual buying ACA insurance was going to earn $55k, they'd be better off reducing their income by $6440 and getting under the $48,560 subsidy ceiling than they are earning $55k.

Although that's an unusually severe example, U.S. tax policy is full of discontinuities that disincentivize increasing earnings and, in some cases, actually incentivize decreasing earnings. Some other discontinuities are the TANF income limit, the Medicaid income limit, the CHIP income limit for free coverage, and the CHIP income limit for reduced-cost coverage. These vary by location and circumstance; the TANF and Medicaid income limits fall into ranges generally considered to be "low income" and the CHIP limits fall into ranges generally considered to be "middle class". These subsidy discontinuities have the same impact as the ACA subsidy discontinuity -- at certain income levels, people are incentivized to lose money.

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.If you agree with the famous Learned Hand quote then losing money in order to reduce effective tax rate, increasing disposable income, is completely legitimate behavior at the individual level. However, a tax system that encourages people to lose money, perhaps by funneling it to (on average) much wealthier options traders by buying put options, seems sub-optimal.

A simple fix for the problems mentioned above would be to have slow phase-outs instead of sharp thresholds. Slow phase-outs are actually done for some subsidies and, while that can also have problems, they are typically less problematic than introducing a sharp discontinuity in tax/subsidy policy.

In this post, we'll look at a variety of discontinuities.

Hardware or software queues

A naive queue has discontinuous behavior. If the queue is full, new entries are dropped. If the queue isn't full, new entries are not dropped. Depending on your goals, this can often have impacts that are non-ideal. For example, in networking, a naive queue might be considered "unfair" to bursty workloads that have low overall bandwidth utilization because workloads that have low bandwidth utilization "shouldn't" suffer more drops than workloads that are less bursty but use more bandwidth (this is also arguably not unfair, depending on what your goals are).

A class of solutions to this problem are random early drop and its variants, which gives incoming items a probability of being dropped which can be determined by queue fullness (and possibly other factors), smoothing out the discontinuity and mitigating issues caused by having a discontinuous probability of queue drops.

This post on voting in link aggregators is fundamentally the same idea although, in some sense, the polarity is reversed. There's a very sharp discontinuity in how much traffic something gets based on whether or not it's on the front page. You could view this as a link getting dropped from a queue if it only receives N-1 votes and not getting dropped if it receives N votes.

College admissions and Pell Grant recipients

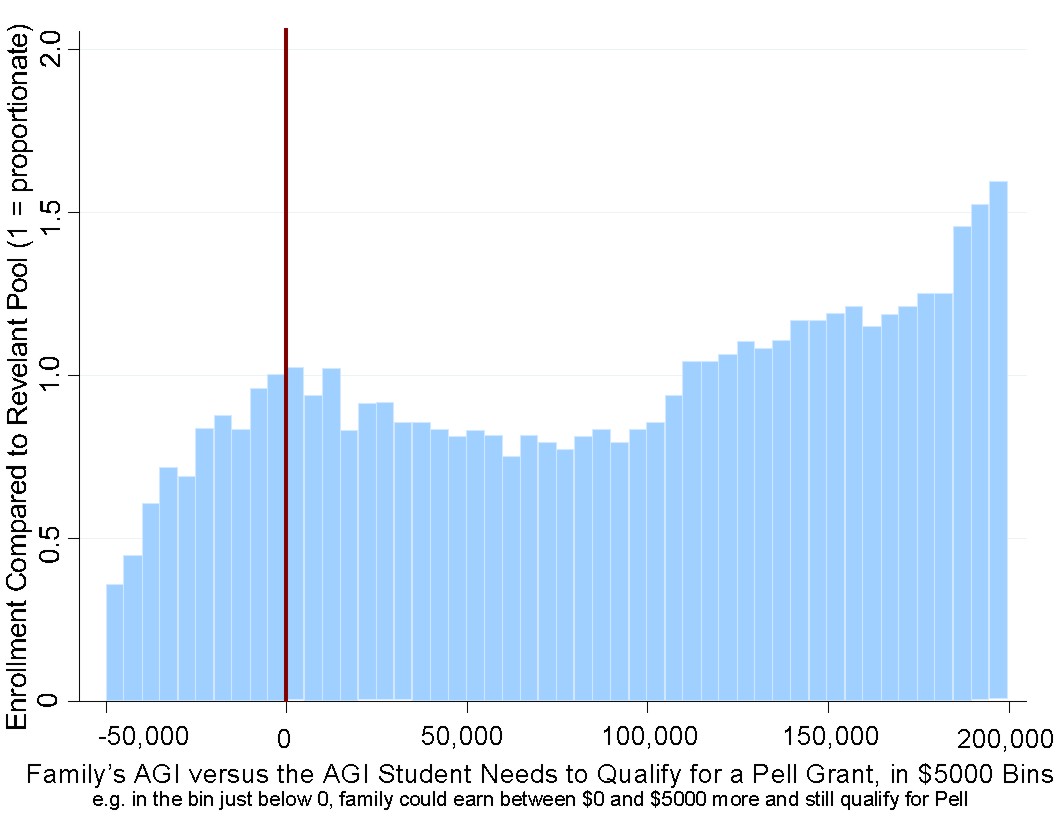

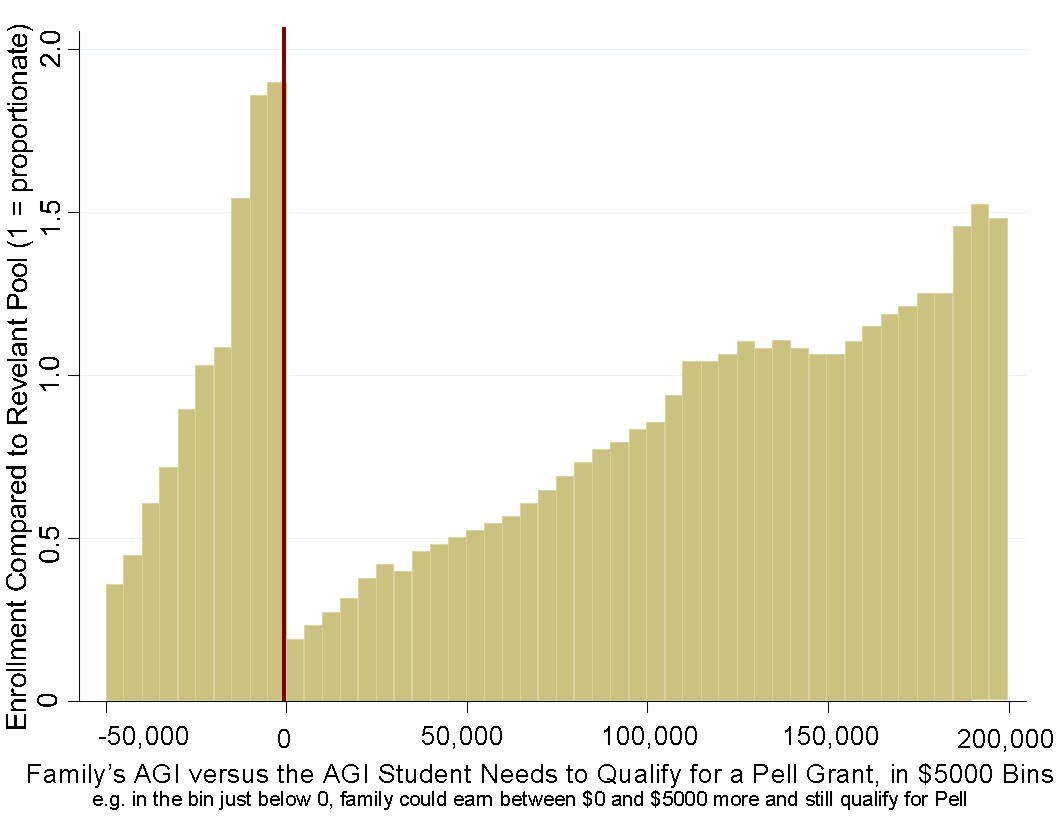

Pell Grants started getting used as a proxy for how serious schools are about helping/admitting low-income students. The first order impact is that students above the Pell Grant threshold had a significantly reduced probability of being admitted while students below the Pell Grant threshold had a significantly higher chance of being admitted. Phrased that way, it sounds like things are working as intended.

However, when we look at what happens within each group, we see outcomes that are the opposite of what we'd want if the goal is to benefit students from low income families. Among people who don't qualify for a Pell Grant, it's those with the lowest income who are the most severely impacted and have the most severely reduced probability of admission. Among people who do qualify, it's those with the highest income who are mostly likely to benefit, again the opposite of what you'd probably want if your goal is to benefit students from low income families.

We can see these in the graphs below, which are histograms of parental income among students at two universities in 2008 (first graph) and 2016 (second graph), where the red line indicates the Pell Grant threshold.

A second order effect of universities optimizing for Pell Grant recipients is that savvy parents can do the same thing that some people do to cut their taxable income at the last minute. Someone might put money into a traditional IRA instead of a Roth IRA and, if they're at their IRA contribution limit, they can try to lose money on options, effectively transferring money to options traders who are likely to be wealthier than them, in order to bring their income below the Pell Grant threshold, increasing the probability that their children will be admitted to a selective school.....MUCH MORE

Election statistics

The following histograms of Russian elections across polling stations shows curious spikes in turnout and results at nice, round, numbers (e.g., 95%) starting around 2004. This appears to indicate that there's election fraud via fabricated results and that at least some of the people fabricating results don't bother with fabricating results that have a smooth distribution....

Dan Luu home

Mr. Luu's Twitter feed