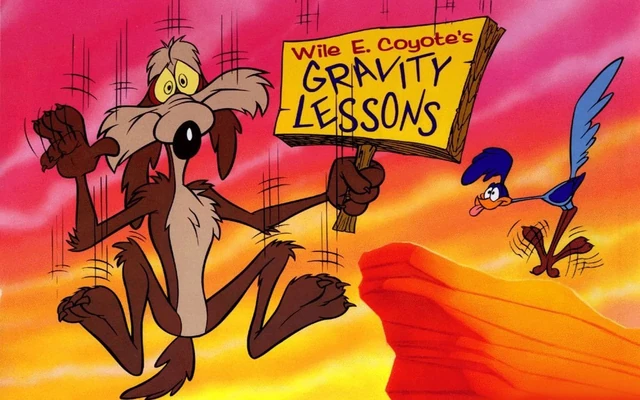

I have no explanation for the market's collective Wile E Coyote moments:...If yous see them together at some Chicago dive bar, Fama is the one with

the Nobel around his neck, French the one saying "For Chrissakes Gene."

but I am pretty sure that at Friday's close the market was not pricing in "all available information".

This lack of facile, erudite (sounding) verbiage on my part may necessitate the implementation of either a (tardy) "pivot to video" or cooking tips. We'll try the latter first.

From Britain's Royal Society:

....MORE (so much more)The physics of tossing fried rice

Published:12 February 2020AbstractFried rice is a 1500-year-old dish that is prepared using wok tossing, a technique that enables food to undergo temperatures of 1200°C without burning. Tossing of the heavy wok at high speed may be one contributor to shoulder pain, which is reported by 64.5% of Chinese restaurant chefs. In this combined experimental and theoretical study, we report the wok tossing kinematics of five professional restaurant chefs. The wok toss has a period of 0.3 s and involves two directions of movement: translation, which slides the rice along the wok, and rotation, which throws the rice into the air. We report the chosen kinematics of the chefs and use a theoretical model to predict the trajectory of rice based on projectile motion. Using our model, we rank all possible kinematics in terms of three metrics: the proportion of the rice that is tossed, its flight height and the angular displacement of the rice. We identify an optimal regime for making fried rice and suggest ways that wok tossing may be improved. This study may inspire the design of stir-fry robotics and exoskeletons to reduce the rate of muscle strain injury among professional chefs....

Alternatively, for our younger, and especially the male, readers you can just turn the heat up as high as it will go and fry until the smoke detector goes off.

HT on the wok: the geeks at Slashdot

If you've stuck with me this far here is the Fama/French Forum hosted at Dimensional Fund Advisors:

The efficient markets hypothesis (EMH), developed by Eugene Fama in the 1960s, simply states that prices reflect all available information. Despite its simplicity, the EMH has been difficult to test and generated decades of debate. In this video, Gene and Richard Thaler, a founding father of behavioral economics, discuss whether markets are efficient. Despite some areas of discord, Thaler sums up an important point of agreement: “Stock markets, good or bad, are the best thing we got going. So, nobody’s devised a way of allocating resources that’s better.”

(View the video)

Volatility Lessons

Eugene F. Fama and Kenneth R. French

Abstract

The high volatility of stock returns is common knowledge, but many investors may not fully appreciate the implications of return volatility. Investors

cannot draw strong inferences about expected returns from three, five,

or even ten years of realized returns. Those who act on such noisy

evidence should reconsider their approach.

Volatility Lessons (PDF)Inverted Yield Curves and Expected Stock Returns

Eugene F. Fama and Kenneth R. French

Abstract

We test the hypothesis that inverted yield curves predict

negative equity premiums. Using monthly observations for the U.S. and 11

other developed markets, we examine whether shifting from equities to

Treasury bills following a recent term structure inversion increases

expected returns relative to a passive strategy of simply holding the

value weight market. We find no evidence that inverted yield curves

predict stocks will underperform bills.Inverted Yield Curves and Expected Stock Returns (PDF)