From the Wall Street Journal's Fed Whisperer:

The Fed is firming up plans to slow down the pace of rate rises by skipping a June hike, barring a blowout jobs report on Friday https://t.co/0lj03snrNW

— Nick Timiraos (@NickTimiraos) May 31, 2023

From the Wall Street Journal's Fed Whisperer:

The Fed is firming up plans to slow down the pace of rate rises by skipping a June hike, barring a blowout jobs report on Friday https://t.co/0lj03snrNW

— Nick Timiraos (@NickTimiraos) May 31, 2023

Stellantis seems to "get it."

"Go big or go home," aren't just words, it's the reality that automakers are going to have to face if they want to be among the ten or so survivors in the electric vehicle business.

From Kitco News (also on blogroll at right), May 30:

Automaker Stellantis (NYSE: STLA) celebrated today the inauguration of Automotive Cells Company's (ACC) battery gigafactory in Billy-Berclau Douvrin, France, the first of three planned in Europe.

According to a company statement, ACC was founded by Stellantis and TotalEnergies/Saft in 2020. Mercedes-Benz became a partner in 2022.

"With an initial production line capacity of 13 gigawatt-hours (GWh), rising to 40GWh by 2030, the facility will deliver high-performance lithium-ion batteries with a minimal CO2 footprint," the company said.

Stellantis added that the first of the site's three European production units will be operational before the end of 2023....

....MORE

From GeekWire, May 30, 4:49 pm PDT:

The Amazon Web Services executive who oversaw the cloud giant’s massive network of data centers is suddenly gone, without explanation.

Amazon confirmed the departure of Chris Vonderhaar, who had been at the company for nearly 13 years, in response to a GeekWire inquiry on Tuesday.

Based in Seattle, Vonderhaar was responsible for “the design, planning, construction and operations of the AWS global data center fleet,” according to his LinkedIn profile. We’ve sent him a message seeking comment.

Word of his departure emerged after Amazon employees noticed that he was missing from the internal corporate directory. As of earlier today, there had been no announcement....

....MUCH MORE

"... Warns of 'Unpredictable Consequences' to Banks"

From Wall Street on Parade, May 31:

Last Friday, at the start of Memorial Day weekend, researchers at the International Monetary Fund (IMF) released an analysis of where they think the U.S. economy is headed and the headwinds (read gale force winds) that can, potentially, be expected along the way.

Folks on Wall Street who were hoping that the Fed was at the end of its rate-hiking cycle, with a more dovish Fed juicing stock market returns later this year, likely had their holiday weekend ruined with this projection from the IMF:

“Achieving a sustained disinflation will necessitate a loosening of labor market conditions that, so far, has not been evident in the data. To bring inflation firmly back to target will require an extended period of tight monetary policy, with the federal funds rate remaining at 5¼–5½ percent until late in 2024.”

The Fed’s inflation target is 2 percent. As of its last report on May 10, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index rose 0.4 percent in April on a seasonally-adjusted basis while the all-items index increased 4.9 percent over the last 12 months before seasonal adjustment.

The Fed’s inflation target of 2 percent remains elusive despite the fact that the Fed began its rate hikes more than a year ago on March 17, 2022 and has hiked rates 10 times – the fastest pace in 40 years. The Fed Funds rate has moved from 0-0.25 percent on March 16, 2022 to the current 5.0-5.25 percent, the highest level for Fed Funds in more than 15 years.

While the Fed has not cracked the tight labor market or inflation conundrums with its rapid rate increases, it has produced serious cracks in the banking system. Between March 10 and May 1 of this year, the second, third and fourth largest bank failures in U.S. history occurred: First Republic Bank, Silicon Valley Bank, and Signature Bank, respectively. (Washington Mutual was the largest bank failure in 2008.)

Thus, it is no surprise that the condition of the balance sheets of banks in the U.S. received a significant amount of attention in the recent IMF report – as did the timidity of federal regulators to do anything more than destroy a forest of trees interminably writing warnings to troubled banks while taking no concrete action. The IMF researchers write:

“First, a higher path for interest rates could reveal larger, more systemic balance sheet problems in banks, nonbanks, or corporates than we have seen to-date. Unrealized losses from holdings of long duration securities would increase in both banks and nonbanks and the cost of new financing for both households and corporates could become unmanageable.”....

Here's the story as it was told at the time:

January 18 2023

From Reuters via Mining.com:

Commodity trader Trafigura is planning to take large amounts of copper from London Metal Exchange registered warehouses, two people familiar with the matter said, adding that the metal was likely to remain in Europe.

Copper stocks in LME registered warehouses stand at 83,325 tonnes are already low. Cancelled warrants – metal earmarked for delivery – stand at 31.2% or 26,000 tonnes. This compares with 12% on Jan. 3.

Most of the cancelled warrants – 20,600 according to the latest data from the LME – are in Rotterdam, Netherlands....

....MUCH MORE

And January 19, 2023

Regarding Trafigura Taking Delivery of LME Copper

Following on yesterday's "Trafigura plans to take large amounts of LME copper", I'm not saying the big trader/producer is attempting to corner the market but if they were...

First, a couple definitions from a 2012 post, "The Paradox of Profit Margins and Another Look at the Theory of Everything":

...If you're interested in the effect of hoarding on commodities prices Janet Netz, PhD did a paper I liked, "The Effect of Futures Markets and Corners on Storage and Spot Price Variability". I'll see if we have an ungated copy.

Remember, the spectrum runs from storage to hoarding to market corners.

And corners in commodities refers to physical, you can't corner a commod by simply buying futures or forwards, you also have to take up the physical supply.

Conversely, squeezes are accomplished in the futures..

A couple decent papers on this aspect of the abundance theory are:

"Large Investors, Price Manipulation, and Limits to Arbitrage: An Anatomy of Market Corners" and

"Market Manipulation, Bubbles, Corners and Short Squeezes"

The only way to combat abundance is with artificial scarcity, i.e. manipulation....

The paper from Professor Netz is here:

"The Effect of Futures Markets and Corners on Storage and Spot Price Variability".

Over the years I've mentioned the snappy little paper (12 page) with the above title, but only yesterday realized we had not linked. Time to rectify the oversight. Here's a copy via Wharton...And possibly also of interest:See, the thing is, Trafigura has lots of sources of physical copper, but instead of going to producers they went to the LME. And just to make things curioser and curioser, less than two years ago they sold an actual copper mine that they owned (we happened to catch the purchase some years earlier). Which was followed a few months later (October 2021) by "Trafigura Played Key Role in Draining LME Copper Inventories".

So here's wishing them luck if that's what they're up to because if a corner is big enough and is broken, all sorts of things can ensue.

Boston Fed: In Which A Copper Speculator's Attempted Corner Causes A Stock Market Crash

From ZeroHedge:

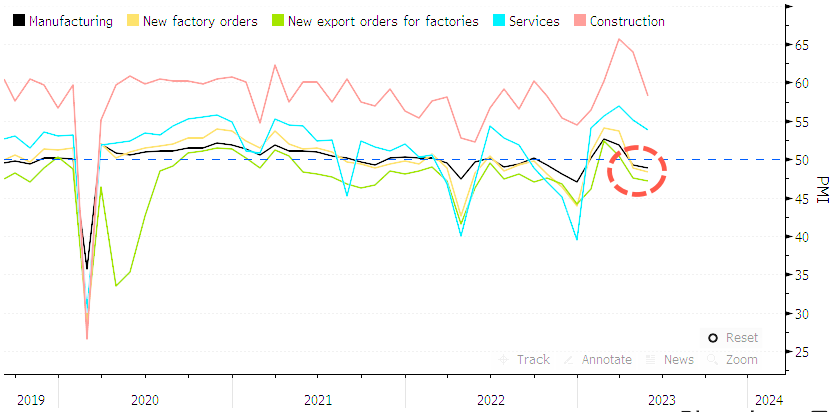

Chinese stocks slid into bear market territory after manufacturing activity contracted for a second month in May. The dismal data is more evidence that the post-Covid recovery in the second-largest economy in the world is faltering. Bad data might suggest additional policy easing is needed to prop up economic growth.

On Wednesday, the National Bureau of Statistics announced that China's official manufacturing purchasing managers' index had dropped to 48.8 in May, down from 49.2 in April. This was the lowest reading since December 2022 and missed the median estimate of 49.5 in a Bloomberg survey of economists. It also marked the second consecutive month the index printed sub-50.

Meanwhile, China's non-manufacturing PMI fell to 54.5 in May from 56.4 in April, also missing economists' expectations.

PMI data shows the post-Covid economic recovery is slowing after a surge in consumer activity earlier in the year after draconian lockdowns were lifted. Bloomberg noted:

Exports remain weak, a rebound in the property market has faded and the government has slowed spending on infrastructure. Businesses are also being hit by falling profits and heightened tensions with the US and its allies....

....MUCH MORE

Yeah, but other than that...

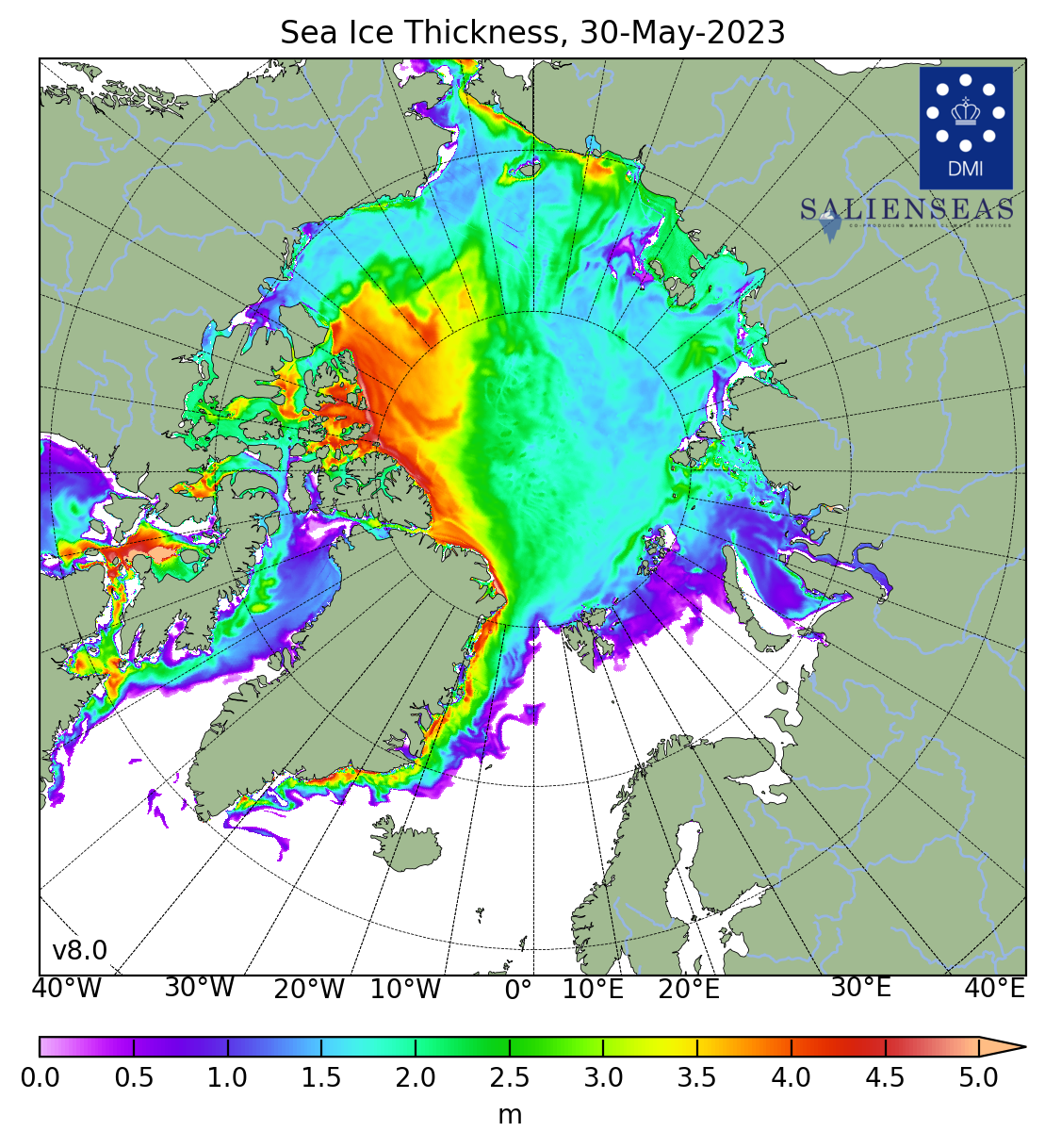

Although the ice on the Canadian side of the basin is thicker than it has been in recent years, the two chokepoints; the Bering Sea/Strait, Chukchi and Beaufort Seas at the top of the map and the Fram Strait between Greenland and Svalbard did not develop very thick ice this winter:

Danish Meteorological Institute

This is a problem because storms come across the Pole from the Bering Sea and flush the ice cap through the Fram Strait and into the open ocean. If the plugs aren't in place in both locations the probability of the ice breaking up due to mechanical (wave) action increases, exposing more dark water to the suns rays, melting more ice due to the loss of albedo and setting in motion a sort of doom-loop.

With that ice not making it through the summer there is less (and thinner) multi-year ice, which is what develops into those four and five meter-thick areas.

TL;dr: no good..

The only hope now is that the summer storms aren't too rambunctious and leave a base layer for the multi-year ice to grow on.

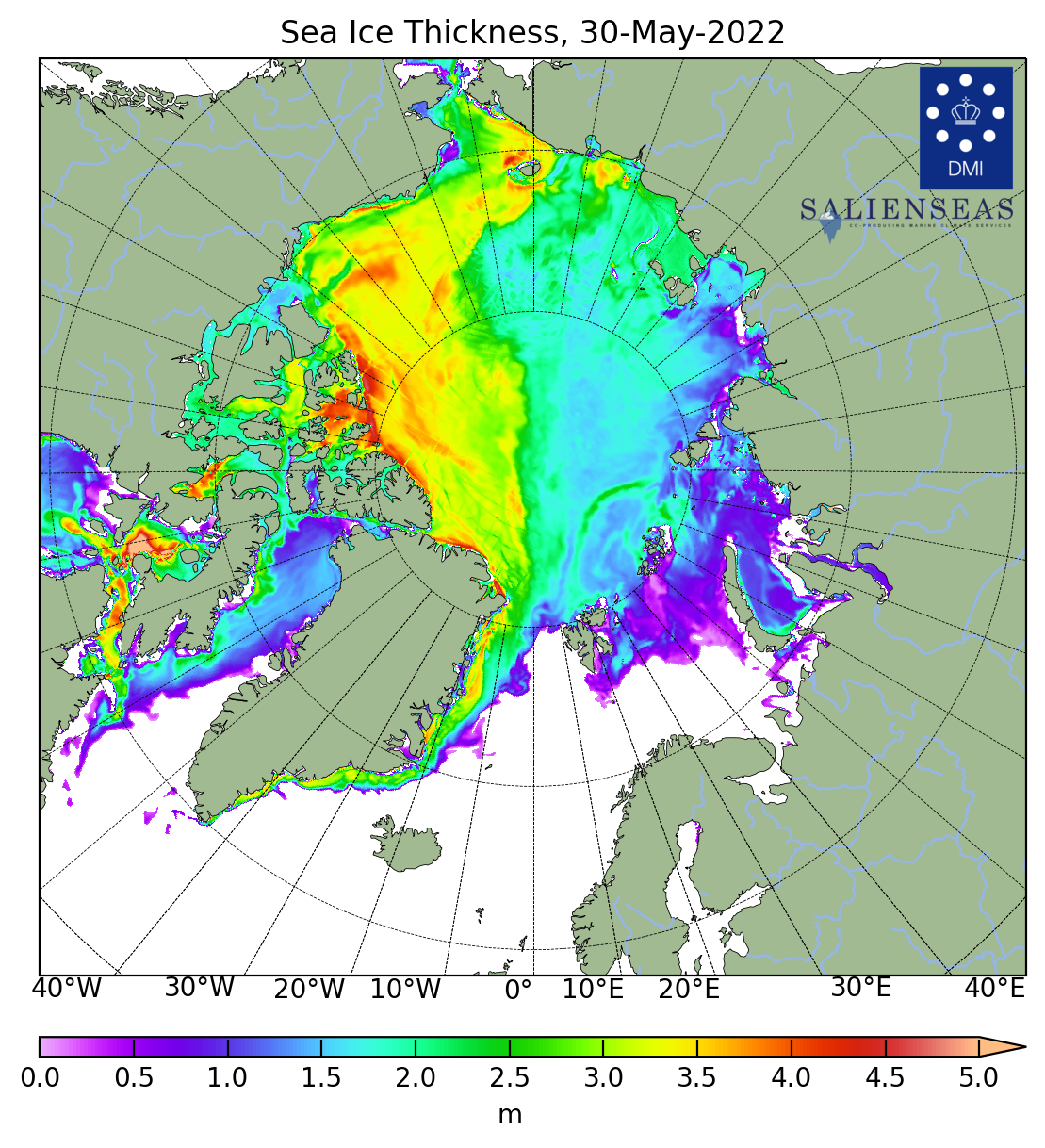

Here's last year's map for the same date, May 30. You can see the Bering Strait plug is much thicker which is, in part, why the ice on the Canadian side is so much thicker this year.

I blame, only half in jest, the Russian ice-breakers moving back and forth along the Northern Sea Route on the Russian Side of the Arctic basin and around the tip of Siberia to send stuff to Japan and China.

From Marc to Market:

Overview: The US budget agreement passed a House committee vote by 7-6 and the bill is scheduled to be voted on by the entire House today before the Senate take it up with the idea of passing it Monday. The procedural step plus the weakness of China and Japanese data and soft CPI figures from Europe has lifted the greenback against all the major currencies. The euro and Australian dollar have been sold to new lows, while the dollar holds ever so slightly below JPY140. Despite a stronger-than-expected Q1 GDP (4.0% vs. 3.5%), the Turkish lira leads emerging market currencies lower. The weakness of the euro and escalating hostilities in Kosovo is weighing on the central European currencies. The Philippine peso and Mexican peso have edged higher and stand out among the emerging market currencies today.

The weaker growth impulses send Asia Pacific stocks lows and snapped a three-day advance in MSCI regional index. Europe's Stoxx 600 is off for the third consecutive session and the sixth in the past seven. US equity futures are trading with a slightly heavier bias. European benchmark 10-year yields are off 8-9 bp with some soft inflation reports in hand. The 10-year US Treasury yield is around four basis points lower to 3.65%. It peaked at the end of last week near 3.86%. Gold posted a potential key reversal to the upside, recovering from almost $1930 to $1963.50. It is stalling today after nearing $1965.50, as it is pulled between falling rates and a stronger dollar. July WTI fell 4.4% yesterday to almost $69 a barrel. The selling pressure was not satiated, and it is trading below $68.50 now. OPEC is meeting in a few days and the sharp fall in prices may encourage a few to enact more voluntary cuts.....

....MUCH MORE

What a time to be alive.

From Web3 Is Going Just Great, May 13:

A year ago, Andreessen Horowitz general partner Arianna Simpson wrote about the firm's investment into Irreverent Labs. Simpson had joined their first $5 million funding round, and Andreessen Horowitz led their $40 million Series A. The company had yet to produce any product, but successfully pitched Simpson on what she described as "some sort of chicken game".

Now, the company has announced that the project will be paused "for the indefinite future", blaming "lack of clarity" and "regulatory confusion" in the United States. The company simultaneously announced "SOL 4 Cocks", in which they will repurchase the Mecha Fight Club NFTs for 18 SOL (~$380). The NFTs had originally minted for 6.969 SOL (~$290 on mint date)....

....MORE

It's the circle of life. Here's another example from May of 2008:

Chameleons on the Pink Sheets

On April 22 I was rambling about Planktos and penny stock deals:

...A classic history would be a Vancouver "junior resource" company in 1979, after the collapse of the oil and gold markets became a solar deal in '81 , an Aloe Vera deal to the yuppies mid '80's, a biotech in '86 ("we're the next Amgen"or "A cure for AIDS"), then on to neutraceuticals or spas, Indian casinos, software, then the great "i", "e-" and ".com" gold rush. Someday I'll get around to checking if some lunatic scammer actually went with "e-iTrade.com".Also at Web3 Is Going Just Great:

The next group of parasites were the "homeland security" companies, then land deals. The "resource" scams never went away and became more prominent in 2002 after gold had moved off its $252 bear market low. We're in the Green boom (happy Earth day by the way) now, who knows what's next....

Today in EuroInvestor:

...The recently re-named Homeland Security Network, Inc. (Pink Sheets:HYSN), doing business as Global Ecology Corporation (GEC) announced today that it has received their initial order from its soil remediation project in Juarez, Mexico. The total value of the purchase orders, involving several of the partnership’s soil-based products, is $2 million with delivery to begin this June....

From Bloomberg via Yahoo Finance, May 26:

Rarely does a tech-powered stock rally come along that isn’t pilloried for the fragility of its foundation. Now, with a snowballing craze for artificial intelligence pretty much propping up the market by itself, the haters are out in force.

Never have so few stocks shouldered so much of the load in indexes such as the S&P 500 and Nasdaq 100, upon which trillions of passively invested dollars ride.

The top-heaviness of advance, on display all year, can be seen by comparing the Nasdaq 100 to a version of the same index that strips out its market-value biases. The equal-weighted one, which treats Apple Inc. the same as Dollar Tree Inc., has trailed the standard benchmark by 16 percentage points since January. In the S&P 500, the unweighted version is losing by the widest margin since Bloomberg’s data began in 1990.

To much of the pundit class, the situation is replete with risk: what happens to the market when the hype-cycle around AI ends? Peter Tchir, head of macro strategy at Academy Securities, sees it differently. Piling into a few heavyweights is just investors “being rationally selective.”....

....MUCH MORE

Recently: "On Bubbles" or, if interested use the 'search blog' box upper left for a few hundred more posts. Or for a few hundred posts on NVIDIA going back to a split-adjusted six bucks.

Food price inflation is running at 13% in Ireland. The people creating policy are laughably unserious. The government is borrowing money to give to farmers to destroy the food supply. This is Robert Mugabe economic policy. https://t.co/K4oYnpwJu8

— Philip Pilkington (@philippilk) May 30, 2023

HOWEVER!!! Ireland as potential hidey-hole in the event of nuclear war:

From The Eriugena Review, May 30:

Neutrality as Ireland’s Strategic Super Weapon

Since the Russian invasion of Ukraine in February 2022, Irish commentators and politicians have lined up to attack yet another longstanding norm in the Republic: neutrality. This is a truly strange display and seems designed to try to curry favor abroad, something the current crop of commentators and politicians seem to prioritize over Irish national interest.

Ireland maintained its neutrality through far more controversial periods than we are currently experiencing, most notably in the Second World War. During the Second World War, the British in particular put enormous pressure on Ireland to jettison their position of neutrality but under De Valera’s leadership, the Irish never faltered. Today, on the other hand, many in Ireland, due to some combination of insecurity and obsession with foreign perceptions, want to ditch neutrality and join NATO. Some seem to even possess amusing delusions about how Ireland can play a part in a US-China conflict – apparently these people are less than acquainted with basic geography.

Yet the reality is that, as true leaders like De Valera knew well, Ireland joining NATO, or any other military alliance would not make any difference to that alliance. Doing so would be like a child pouring a bucket of water into the sea in the hope that the tide will rise. Thinking that a small country like Ireland, with no serious military, makes any difference to a large military alliance like NATO is based only on intellectual immaturity and juvenile conceit. The commentators and politicians who line up on the pier with their little buckets of water are only calling attention to their own intellectual shortcomings. They try to distract from these with moralizing and hectoring but it is obvious to serious people that they are, to quote the bard, “full of sound and fury, signifying nothing.”Properly understood, neutrality is Ireland’s strategic super weapon. It was not designed this way. Although early Irish leaders knew that Ireland was too small to make a difference in any global conflict, they could not have known how powerful a super weapon Irish neutrality would become. It was only after the development of nuclear weapons that the true meaning of neutrality became clear. When the potential for total nuclear war came on the scene, Irish neutrality was upgraded from a strategically wise decision into a strategic super weapon.

Shadows of Iona

In 563 AD St Columba and twelve of his companions arrived on the small island of Iona, just off the Isle of Mull on the west coast of Scotland. St Columba and his merry band had come from Ireland, a country that had only recently begun the transition from paganism to Christianity, and their intention was to spread Christianity amongst the Picts and the Scots. In large part they were successful, but it is not this part of the story that is of interest for the question of Irish neutrality.

As time went on this tiny island became a hotbed of intellectual and cultural production. The monks on Iona recorded annals that are key to understanding early history in Ireland and other parts of the British Isles in this period. They also probably produced the Book of Kells, an incredible work of art. These developments happened against the backdrop of the Dark Ages when Europe became unstable amidst the fall of the Roman Empire. While the Dark Ages were far less dark than some make out, there is no doubt that civilization in this period was under threat from barbarians and Vikings. It was only thanks to monks in places like Iona that it survived. Monks on these remote islands copied key texts and in doing so preserved the Greco-Roman and early Christian tradition. It was only due to their work that we saw a flowering of Christian civilization in the Middle Ages.Today, with the development of nuclear weapons, the possibility is once more raised that civilization might be destroyed. In the event of a full-scale nuclear war, a good part of Europe, Eurasia and the Americas would likely be destroyed. It is fashionable today to think that a nuclear war would mean the extinction of humanity due to the potential for so-called ‘nuclear winter’, but these claims are likely overstated. There is no doubt that a full-scale nuclear war would cause severe short-term fluctuations in global weather, but historical precedent suggests that these would be survivable.

In 1816, for example, the world experienced severe short-term climate fluctuations that caused global temperatures to decrease by 0.4-0.7°C. This led to 1816 being popularly referred to as “The Year Without a Summer”. The most likely cause of The Year Without a Summer is the 1815 eruption of Mount Tambora in the Dutch East Indies (modern-day Indonesia). This eruption was the largest in at least 1,300 years and caused what is known as a ‘volcanic winter’ which is very similar to the nuclear winter hypothesized to result from a full-scale nuclear war....

....MUCH MORE

HT: also P. Pilkington

Continuing with Memorial Day, harsh reality edition.

From AFNS, March 21, 2023:

On the 20th anniversary of the U.S. invasion of Iraq, it’s important for us as a nation to reflect on that conflict and its consequences. As the vice president of the United States in 2003, I was one of the architects of the project to go after Saddam Hussein and his weapons of mass destruction. Today, I believe it’s important to offer an honest assessment of my role in the Iraq War. Looking back on it now, I have to say that, wow, I mostly got it right.

Seriously, the Iraq War went basically as well as I could have hoped.

We in the Bush administration justified the war on the basis of destroying Saddam’s WMDs and bringing democracy to the Iraqi people. Twenty years later, we know that Saddam didn’t have any WMDs, and that the United States left Iraq in the throes of poverty and violence. Critics then and now have suggested that we deliberately misrepresented intelligence, and that spreading democracy was merely a fig leaf for our true goal of maintaining U.S. political and economic dominance over the world.

To that, I say, no shit. Duh. Of course we were lying. Of course we only went in to maintain American hegemony. That was the whole plan all along.

Christ, what country do you think we are?

In hindsight, it’s stunning to see how right I was about the long-term impacts of invading Iraq....

....MUCH MORE

Later this week, how the Atlantic's Jeffrey Goldberg and David Frum lied us into the war.

Last month, after winning the election but before being sworn in, Hizzoner commenting on what sure looked like a riot said "...it is not constructive to demonize youth who have otherwise been starved of opportunities in their own communities.”—Chicago Tribune, April 17, 2023. The Chicago political machine has held the mayor's office for 92 years, so it's not exactly a secret who has been starving the youth of opportunities in their own communities.

As with San Francisco, it has taken decades for the politicians and policymakers to achieve the current realities.

From Hey Jackass!, May 30:

Final Demonized Tally 12 killed, 49 wounded

2022 Memorial Day tally: 12 killed, 43 wounded

2021 Memorial Day tally: 4 killed, 38 wounded

2020 Memorial Day tally: 10 killed, 43 wounded

2019 Memorial Day tally: 8 killed, 35 wounded

2018 Memorial Day tally: 8 killed, 31 wounded

2017 Memorial Day tally: 7 killed, 44 wounded

2016 Memorial Day tally: 10 killed, 67 wounded

2015 Memorial Day tally: 12 killed, 45 wounded

2014 Memorial Day tally: 8 killed, 22 wounded

Average tally: 9 killed, 41 wounded

....MUCH MORE

It looks like you have to go back to Rahm Emanuel's second term to have a higher number of wounded for the weekend.Although he leaves out a couple possible wrinkles, this is a pretty straightforward/succinct analysis:

If cash stays in reverse repo, banks pay with reserves, AND the Fed is still running QT, you'd have two vacuums working in tandem to weaken systemic liquidity. Red flag for risk.

— 𝐓𝐗𝐌𝐂 (@TXMCtrades) May 29, 2023

FWIW when the Treasury refilled its coffers last May, it was the banks who paid. pic.twitter.com/BWs9m5mKpS

With the official start of the season a couple days away it is time to start paying greater attention to the perils.

From CatBond mavens Artemis, May 30:

A 2023 Atlantic hurricane season forecast from the UK Met Office is calling for a high level of tropical storm activity this year, with an above normal number of hurricanes and major hurricanes expected to form, the first of the forecasters we track to suggest a more active season is coming.

The rest of the hurricane season forecasts we track here at Artemis had opted for below-average to about average levels of activity, citing an expectation that the development of an El Niño will quench storm activity in the tropics.

But, as we’ve reported before, some meteorologists are saying that warmer than normal sea surface temperatures (SST’s) in the Atlantic tropics introduce a lot of uncertainty and the UK Met Office appears to be opting for this warm SST dynamic and also lower than normal wind shear to accentuate storm activity throughout this 2023 hurricane season.

The UK Met Office forecasts 20 named tropical storms will form this season (with a 70% chance that the number will be in the range 14 to 26), 11 of which becoming hurricanes (with a 70% chance that the number will be in the range 8 to 14), and 5 intensifying to major hurricane status (with a 70% chance that the number will be in the range 3 to 7).

That’s a forecast some way above the long-term average of 14 named storms, 7 hurricanes and 3 major hurricanes....

....MUCH MORE

From ZeroHedge:

Update (0756ET):

According to an official government statement, Elon Musk told Chinese Foreign Minister Qin Gang in Beijing that Tesla opposes "decoupling" and is willing to invest more in China.

Here are the highlights of the meeting (courtesy of Bloomberg)....

....MUCH MORE

And from Bob Marley:

Easy skanking (skankin' it easy)

Easy skanking (skankin' it slow)

Easy skanking (skankin' it easy)

Easy skanking (skankin' it slow)

Excuse me while I light my spliff; (spliff)

Good God, I gotta take a lift: (lift)

From reality I just can't drift; (drift)

That's why I am staying with this riff. (riff)

You may have noticed that for the last year or so the former First Lady's press peeps have kept her mentions on a low simmer, nothing dramatic or flamboyant or controversial but enough to keep the public from forgetting her. For example, our last post re: Michelle was in January of this year:

"Top secret documents reportedly found in Biden cache"

For the purposes of the powers that be, President Biden has to hang in there until January 20. If he were to leave office prior to that date Vice-President Harris could only fill-in for his remaining term and run for President once, in 2024. Should the transition take place more than half-way into President Biden's term, the Veep can fill out the remainder of his term and run herself in 2024 and 2028.

It gets really interesting if President Harris chooses a V.P. and steps aside herself and/or Michelle Obama, despite her protestations to the contrary, decides to run for Prez (no Veep for her, I'm sure). President (Barack) Obama didn't become the first ex-President to buy a house in D.C. for the:

And before that November 2021.*

The fact that deep embed Susan Rice just left the O'Biden-Harris administration without discussing her future plans certainly is in keeping with the possibility of a fourth and fifth Obama term (placeholder Joe being #3 and fall guy should one be required)

From Cornell Law Prof William Jacobson's Legal Insurrection blog, May 27:

The fierce urgency of now may come into play if there is a realistic prospect of Trump returning to the White House or America becoming DeSantistan.

Joe Biden’s approval ratings are in the sewer, and a majority of Democrats want someone else to be the nominee in 2024. A supermajority of Americans don’t want another rematch of Biden v. Trump.

Enter one Michelle Obama.

Or at least the thought of Michelle Obama.

Longtime readers will recall that I’ve been predicting a Michelle Obama savior project for many years.

- Get Ready for Michelle Obama 2020 (Sept. 10, 2017 – Fuzzy)

- Michelle Obama 2020. Yes She Can. But will she run? (Jan. 29, 2018)

- Michelle Obama 2020 coming into focus with Memoirs release just after 2018 midterms (Feb. 25, 2018)

- Michelle Obama may be best Dem hope for 2020, but says she doesn’t want the job (April 7, 2018)

- Rasmussen Poll: Michelle Obama would beat Trump (Nov. 19, 2018 – Kemberlee)

- Michelle Obama is the Democrat 2020 frontrunner, even if she doesn’t want to be (Nov. 23, 2018)

- With Bread Line Bernie rising, expect Michelle-mentum (February 21, 2019)

- Don’t rule out Michelle Obama as Democrats’ Hail Mary Pass to prevent a Bernie apocalypse (April 24, 2019)

- Michael Moore: Only Michelle Obama can save us from 4 more years of Trump (Aug. 1, 2019)

- Michelle Obama floated as savior of Democrats from radical left general election disaster (Oct. 22, 2019)

- Michelle Obama 2020 Chatter Rising — As We Predicted Over Two Years Ago (Nov. 26, 2019)

- The Democrat beating Trump in the polls isn’t running …. yet (Dec. 21,2019)

Then Covid happened, and the Dems rigged the selection process to get rid of Bernie and install zombie candidate Joe Biden. The rest is history. We are now in Barack Obama’s third term, with the Team Obama running Biden doing damage beyond their wildest dreams.

But to complete the fundamental transformation of the nation laid out by Barack Obama, a fourth term is needed. And it’s far from clear that Biden is the guy to do it, or Kamala Harris. Democrats’ best hope is that Trump is the Republican nominee and there is another huge anti-

ObamaTrump turnout.So once again there is Michelle Obama chatter.

Michelle Obama would be Democrats’ best chance to win in 2024

There has been some recent media buzz, as well as hope, about the possibility that former First Lady Michelle Obama might be persuaded to enter the 2024 presidential race. While that prospect is very unlikely – she has always rebuffed any notion that she might run for office – the enthusiasm is understandable. As the Democratic presidential nominee, or even the vice-presidential nominee, she would give Democrats their best chance at retaining the White House.

As it stands, President Biden’s chances of winning reelection against a credible Republican presidential candidate (which excludes former President Trump) aren’t great . . . .

But if Biden can’t win, who can? Michelle Obama would have a good chance . . . . .

Michelle Obama for president in 2024?

Former White House and Pentagon official Douglas MacKinnon said if not Biden or Vice President Kamala Harris, Democrats could look to a past superstar to create a more viable ticket.

Among the names of possible contenders, former first lady Michelle Obama’s name was floated ahead of the last Democratic presidential primary, although she has repeatedly denied any interest in seeking office. At 59, and with her “it” factor (as McKinnon labels it) she could emerge as a top candidate and Democrats could look to push her to run. She has previously denied any desire to seek candidacy.

Democrats say Michelle Obama has the “it” factor that could maybe beat Donald Trump in 2024.

While Democratic leaders are publicly rallying behind Joe Biden to be their guy for the 2024 presidential election, behind the scenes Democrats are still mulling the best leader for the party who could win a stand-off against former President Donald Trump in 2024.

Seriously, about the presidency thing, there is talk that Vice-President Harris gets bought off to depart the stage for personal reasons while Mme Secretary is nominated for the V.P. slot, only to be elevated to President due to the rapidly increasing deterioration of President Biden. The First Lady, Dr. Jill also being bought off to agree to the above. You could probably accomplish it for under $100 million, leaving only two questions: 1) Does Michelle Obama throw her hat in the ring in 2024 and 2) Does Hillary get to keep the gown and robe from Queens University, Belfast, or is that a loaner?

Okay,

three questions. 3) Will the young lady holding the hem of the gown/robe off

the ground become a permanent member of the retinue, perhaps replacing

Huma?

From Bloomberg via Yahoo Finance May 23:

Commodity cheerleader Goldman Sachs Group Inc. said its forecasts for major rises in raw materials this year hadn’t panned out well so far, but coupled that assessment with another call for a major rally.

“Bulls, like ourselves, find comfort in the fact that end-use demand across the commodity complex has not shown recessionary signs and investment in supply remains elusive,” analysts including Jeffrey Currie said in a note. “But this misses the point that we were wrong on price expectations.”

Commodities have sunk this year, with a Bloomberg gauge tumbling by almost 10% to hit the lowest since 2021 this week. The declines in energy and metals have been driven largely by China’s weaker-than-expected emergence from Covid Zero and concerns that the US is now headed for recession after an aggressive round of rate hikes from the Federal Reserve to contain inflation....

....MUCH MORE

Dec. 2, 2010

More on Goldman's Top Trades 2011: "We Like Finance Stocks for First Time Since ‘08" (GS; BKX; XLF)

Hot on the heels of this morning's "Goldman Sachs: Here Are our First ‘Top Trades’ of 2011 (GS)" MarketBeat comes right back with a follow-up. And: a more in-depth look at GS2011.

But first, a note on how to read Goldy's pronouncements:Mother: .....And remember, the Lord loves a working man.

Navin: ........Lord loves a working man.

Father: ......And son, don't never, ever trust whitey.

—The Jerk (1979)

From Marc Chandler at Bannockburn Global Forex:

Overview: The debt ceiling drama is not over. The agreement between the negotiating teams of President Biden and House Speaker McCarthy sets the stage for the next act in the drama: each side must deliver the votes. A preliminary vote today in the House of Representatives is likely today ahead of floor vote tomorrow. Still, the market is optimistic, and risk is favored. Asia Pacific bourses were mixed today. We note that the chip sector helped lift South Korea's Kospi up over 1%. Europe's Stoxx 600 is recouping yesterday's marginal loss, and US equity futures are trading higher. The S&P 500 and NASDAQ are poised to gap higher. Bonds are rallying. European yields are mostly 4-6 bp lower, though Gilts are lagging. The 10-year US Treasury yield is off nearly eight basis points to 3.72%.

The dollar is offered. Among the G10 currencies, only the New Zealand dollar and Swedish krona are nursing small losses. Sterling is doing best with a nearly 0.5% gain and resurfacing above previous support near $1.2400. The euro slipped through $1.07 but rebounded in the European morning. Emerging market currencies are mixed. The Turkish lira has been hammered for around 1.5%. The Hungarian forint and Mexican peso lead the advancer. Gold initially fell to two-month lows near $1932 but has rebounded as the dollar and interest rates have come off. It is probing the $1950 area. July WTI is posting an outside down session. It is off around 2.1% today to test the $71 area. Last week's low was closer to $70.65....

....MUCH MORE

From Simple Flying, May 24:

The largest exercise of air forces in NATO's history will involve 10,000 participants and 220 aircraft.

This is unprecedented. Between June 12-23, twenty-five nations will participate in the largest-ever military exercise in the European airspace.

Air Defender 23: what do we know?

Air Defender 23 will be the most significant military exercise ever carried out over the European skies. The event will take place from June 12th until June 23rd, involving the air forces of 25 nations.

More specifically, Air Defender 23 will represent the most extensive deployment exercise of air forces in the history of the North Atlantic Treaty Organization, commonly known as NATO. The unprecedented event will involve up to 10,000 exercise participants who will train their flying skills with approximately 220 aircraft. The military exercise will take place in European airspace and under the command of the German Air Force, or Luftwaffe....

....MUCH MORE

Via ZeroHedge, May 28:

By Charlie Zhu, Bloomberg Markets Live reporter and analyst

Three things we learned last week:

1. A town builder’s last-minute bond repayment reignited fears over a potential default by such issuers. Investors are watching out for the first missed payment by a local government financing vehicle, something regional authorities are trying hard to avoid. The possibility has recently increased, as a weakening fiscal situation means authorities are less able to provide support.

Research from GF Securities Co. shows there were 73 cases of shadow-banking defaults in the first four months, already a full-year record since data became available in 2018.

“Missing payments in shadow banking are a signal that debt risks in a certain region have become more prominent,” GF analysts led by Liu Yu wrote in a report.

Yields on Kunming Dianchi Investment Co.’s note due in December surged to over 20% last week, as two holders said they didn’t receive payments until after business hours for a note due this month. Premiums of three-year AA rated LGFV bonds widened to the most since March, and investors cited local-debt worries as one of the reasons behind a decline in Chinese stocks.

China’s LGFVs had 13.5 trillion yuan ($1.9 trillion) of bonds in total outstanding as of end-2022, or almost half of the nation’s non-financial corporate notes, data from Moody’s Investors Service show.

Steps by authorities “to lower LGFV debt risks will not fully resolve long-term issues,” and their refinancing ability depends on investors’ confidence in government support, especially in weaker provinces, Moody’s analysts led by Ivan Chung wrote in a report.

2. With the financial strength of both town builders and their sponsors deteriorating, investors became more pessimistic about China’s demand for raw materials. Copper dived below $8,000 a ton while iron ore breached $100, unwinding gains since Beijing ended its Covid Zero policies late last year.

At the London Metal Exchange’s annual Asian event in Hong Kong, participants reported lackluster activity and said that any market optimism from the National People’s Congress in March had evaporated.

The selloff in Chinese stocks also extended, with the benchmark CSI 300 Index erasing all of its gains for the year. Now, even bulls are rethinking their calls, with Citigroup Inc.’s global allocation team cutting its overweight rating on China to neutral.

3. Luckily, positive developments on China-US bilateral relations helped to alleviate some of the pessimism. Soon after President Joe Biden said he expected ties with China to improve “very shortly”....

....MORE

Yeah.This is one of the effects of the fact that the huge (eventually multi-trillion yuan) Chinese government effort to stabilize the property sector will not stimulate new construction. With all the implication for commodities that understanding entails.

From Reuters via The Asahi Shimbun, December 12:

Waning trust: China shadow banks pivot away from property to survive

For more than a decade, Chinese developers’ debt-fueled construction boom enriched the country’s shadow banks, who were eager to capitalize on the needs of an industry desperate for credit and too risky for traditional lenders.

Now, in the wake of a government clampdown on real estate firms’ debt binge, that credit demand has collapsed--and so too has the single biggest revenue stream for shadow banks, also known as trust firms.

China’s shadow banking industry--worth about $3 trillion, roughly the size of Britain’s economy--is scrambling for new business, including direct investment in companies, family offices and asset management.

It is also shrinking, with once-well-paid employees leaving for other jobs after scavenging for new deals. The industry’s plight is a sharp contrast to China’s main street financial firms, which the crisis has not yet seriously affected.

“Everyone was eating a mouthful of rice, surviving another day,” said Jason Hao, who left his job this year at a Shanghai trust firm after his pay plunged from as much as 4 million yuan ($570,000) a year to about 240,000 yuan ($34,000).

He is now working at an asset management company....

....MUCH MORE

Related:

What If Our Understanding Of China's "Zero Covid" Is 180 Degrees Wrong?

"China Quietly Launches QE: Beijing Orders Large Insurers To Buy Bonds To Contain Selling Panic"

"...that from these honored dead we take increased devotion to that cause for which they gave the last full measure of devotion--that we here highly resolve that these dead shall not have died in vain, that this nation under God shall have a new birth of freedom, and that government of the people, by the people, for the people shall not perish from the earth."

—Abraham Lincoln at Gettysburg, November 19, 1863

One of the reasons we keep pitching French startups: someone has to create jobs, and new companies (not small, new) create more than their share on a GDP basis.

From free-range economist Philip Pilkington:

Germany is deindustrialising right before our eyes. It appears to be happening very quickly too. I’d say we’re on a five year time horizon here. pic.twitter.com/mSjfQtRrmZ

— Philip Pilkington (@philippilk) May 27, 2023

Shades of Paul Murphy.

From Robin Wigglesworth, Editor, FT Alphaville:

Après debt ceiling deal, le T-bill déluge

Gird yourselves

So we have a debt ceiling deal. It still needs to actually be passed by Congress and the Senate, and only punts this weapons-grade idiocy into late 2024, but as Matt Yglesias writes, it seems a reasonable deal overall.

However, as we wrote last week, even a debt ceiling deal doesn’t mean that we will avoid negative financial and economic consequences from the whole tedious saga.

Since it hit the debt ceiling the US government has been drawing down money held in the Treasury General Account with the Fed. As a result its balance there has dropped from about $700bn at the end of 2022 to under $50bn now. Quickly rebuilding that buffer will boost Treasury bill issuance to $730bn over the next three months, and about $1.25tn over the rest of the year, according to Morgan Stanley....

....MUCH MORE (hyperlinks omitted, available at original)

Although September 13, 2007 was a Thursday rather than a Sunday, the following post, originally bylined with the overly modest, overly generic "FT Alphaville" later revealed to be FTAV's founder and editor Paul Murphy, although it wasn't the weekend, the post was timestamped at 38 minutes to midnight:

September 13, 2007, 23:22 British Summer Time!

From FT Alphaville:

All Chauffeur Alert! Bank of England Court convenes

It’s not the sort of invitation you’d turn down: 9.30 pm, Threadneedle Street, don’t be late. FT Alphaville understands that the governor, Mervyn King, his two deputies and the 16 non-executive members of the Bank of England’s Court of Directors convened on Thursday evening.

Needless to say, this will have been quite a confab, attendees ranging from Arun Sarin of Vodafone to Sir Callum McCarthy of the FSA, along with the in-house Bank team and the rest of the gang.

Top of the agenda, of course, was Northern Rock - known by another name to regular readers of Markets Live. News that the mortgage bank has had to seek emergency funding from its lender of last resort was broken by the BBC’s Robert Peston earlier in the evening.

But an All Chauffeur Alert? At 9.30? On a Thursday evening? Surely this must point to something more toxic - or at least something big and bad that we have yet to learn about. Rock is not a shock. The mortgage bank has been looking dangerously brittle for weeks, and when a share price falls by 3/4/5 per cent each and every day, people do tend to talk… We are assured, however, that Rock is as far as it goes. For now.

—Via our anniversary post, September 13, 2010The convening of the Council was a technical matter, required to sanction the launch of what is effectively a lifeboat.

Whether the threat of a run on Rock, and perhaps other overly ambitious mortgage lenders with synthetic balance sheets, will be treated as something technical remains to be seen.....

And for those unfamiliar with the technique, a repost from October 2014:

The Week Ahead--"How to Gird Up Your Loins: An Illustrated Guide"

Although we don't plan a Dress & Grooming column, this may come in handy should the markets descend into madness.

From The Art of Manliness:

If you’ve read the Bible, then you’ve probably come across the phrase “gird up your loins.” I’ve always thought it was a funny turn of phrase. Loins….heh.

Back in the days of the ancient Near East, both men and women wore flowing tunics. Around the tunic, they’d wear a belt or girdle. While tunics were comfortable and breezy, the hem of the tunic would often get in the way when a man was fighting or performing hard labor. So when ancient Hebrew men had to battle the Philistines, the men would lift the hem of their tunic up and tuck it into their girdle or tie it in a knot to keep it off the ground. The effect basically created a pair of shorts that provided more freedom of movement....MORE

From Bloomberg via Yahoo Finance, May 27:

The outlook on France’s credit rating was reduced to negative from stable by Scope Ratings, raising questions about President Emmanuel Macron’s efforts to spur growth and reduce a crisis-swollen debt burden.

The Europe-based credit rating firm said it changed the outlook on its AA rating due to weakening public finances and implementation risks to the agenda for economic reforms.

The change comes after Fitch Ratings cut France to AA- from AA last month, also flagging high government debt and risks that political deadlock after the protests over pension reform could hamper future economic overhauls.

The rating actions are sharpening focus on challenges France faces to pare back a budget deficit that ballooned during Covid pandemic and has only decreased slowly as the government spent vast sums limiting energy prices.

While Scope is not among the major rating firms, it is recognized by the European Securities and Markets Authority and has applied for recognition in the European Central Bank’s credit assessment framework.

Standard & Poor’s could also take rating action on France a week from now, according to its calendar....

....MUCH MORE

A repost from 2021

From SafeHaven:

Generation warfare goes back to the Greek ancient Greek philosopher Aristotle and can be found in the strangest of places, including the mafia.

It is a fact that older generations are traditionally disgruntled with younger ones. They dislike their money saving habits, house buying priorities, stock investing, how they dress, how they speak, how they educate themselves, and generally how they dare to change things for better or worse

Now, imagine a mafia youngster speaking to his boss in the same manner as that trending now on the internet: “OK, Boomer.”

But organized crime isn’t immune to the generational shifts. Just like any other “industry”, it has to deal with the gap.

That necessity came to light in September when the Feds arrested Colombo crime family boss Andrew "Mush" Russo and a dozen of his close associates, charging them with a series of crimes in Brooklyn federal court, ranging from labor racketeering and extortion to money laundering.

The majority of the defendants are 65-years-old or older. Russo himself is 87. The underboss Benjamin “The Claw” Castellazzo is 83, and Colombo family head Vincent Ricciardo is 75.

It’s a rather old age to be in this business, but they didn’t trust their younger clan members.

In an interview with the Wall Street Journal, Scott Curtis, the former FBI agent who investigated the Colombos’, said that Russo has been too hands-on, suggesting he should have retired long ago and he wouldn’t have ended up in jail.

Custis said that Russo and other crime families bosses have failed to follow established practice by past generations of mobsters: maintaining a healthy distance between the actual crime itself and the boss man....

....MORE

Ditto for Japan:Controlled burns baby, ya gotta do controlled burns. Let that brush and undergrowth build up and every fire ends up being a disaster. And with thousands and hundreds of thousands of people moving into formerly wild areas the chances of a) a fire getting started and b) that fire killing and injuring people has gone up exponentially over the last sixty years.

From the Wall Street Journal, May 26:

Insurers have faced higher costs and wildfire risks

State Farm is stopping the sale of new home-insurance policies in California effective Saturday, because of wildfire risk and rapid inflation in construction costs.

The move by one of California’s biggest insurers is a blow to the state’s efforts for years to maintain a vibrant market for homeowners in the wildfire-prone state. Nationally, inflation has been a serious problem for home and car insurers since last year, and many have posted underwriting losses as they continue to seek regulatory approvals for rate increases that they say they need for catching up with the surging costs.

State Farm is the nation’s biggest car and home insurer by premium volume. It said it “made this decision due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.” It posted the statement on its website and referred questions to trade groups.

The insurer’s move doesn’t affect existing home-insurance policyholders, whose policies will remain in effect, according to the statement and a representative of the state Department of Insurance.

The insurer said it would also quit accepting new applications for business policies, but it would continue selling new personal auto policies.Worried about wildfire exposure and frustrated by state regulations, insurers in California have cut back on their homeowner businesses. Mostly, those cutbacks and restrictions apply in wildfire-prone areas of the state, or to individual properties that lack fire-resiliency features, such as fire-resistant building materials and techniques, and cleared-back brush.

In its statement, State Farm said it takes “seriously our responsibility to manage risk.” It said it was “necessary to take these actions now to improve the company’s financial strength. We will continue to evaluate our approach based on changing market conditions.”

Many home insurers operating in California don’t think they are being granted appropriate-enough rates “for the risks we are facing,” said Janet Ruiz, a representative for trade group Insurance Information Institute in California. Insurers generally have continued “to sell at least some new policies but they are shrinking in areas where there is wildfire.”

For 2022, State Farm’s auto-insurance companies reported record underwriting losses, totaling $13.4 billion, due primarily to rapidly increasing claims severity. Its homeowners’ business reported an underwriting gain. State Farm is a mutual company, meaning it is owned by its policyholders, and it has deep pockets. It ended 2022 with net worth of $131.2 billion....

....MUCH MORE

California's population grew from 10,667,000 in 1950 to 15,717,204 in 1960 to 39,501,653 in 2020. It's been decreasing the last two years to an estimated 39,029,000 in 2022, down 472K since peak.

If some idiot San Franciscan fleeing the urban hellscape sets the Lake Tahoe 'hood on fire I'm going to be pissed.

Though we would love a respite from calamity, there is no reason to believe that we’ll be spared from wildfires this year. With scientific certainty, we know which areas are prone to wildfires, though home construction continues in those areas.

At Cape Analytics, we use artificial intelligence to analyze vast quantities of geospatial imagery to help insurers and other companies better understand properties and property risk. Along with our partner HazardHub, we wanted to explore exactly how much sprawl there has been in the West’s high-risk fire zones. From the standpoint of insurance and danger to human life, these homes and adjacent communities are especially risky. Quantifying the risk can help homeowners and agencies such as CAL FIRE take more proactive and focused measures to protect lives and property.

The Hot Spots

To create this report, we analyzed new homes built over the last decade and found that California leads the West when it comes to the most builds in high-risk areas. Given that California is the most populous state in the country, we can expect a lot of new construction. When adjusting for population size, Utah leads the West by a significant margin in building homes in places with high fire risks.

When looking at specific cities with the most new home construction in high-risk zones in the West, El Dorado Hills, California tops the list, followed by St. George, Utah. In addition, as the pandemic has precipitated an urban exodus, many residents are fleeing into higher-risk fire zones.

Research Strategy

Before diving into the analysis, it’s worth spending a moment on the data and methodology. In this project, we identified new home construction over the last decade in Western states prone to wildfires. Specifically, we focused on areas in or near the Wildland Urban Interface — areas designated by the U.S. Forest Service, where human development and fire-prone wilderness meet. Our hazard data partner, HazardHub, then provided us with a wildfire risk score for each locality. This risk score takes weather, wildfire history, and many other factors into account. Finally, we narrowed down our analysis to new homes built in those high wildfire risk zones.

Findings by State

First, let's look at the raw number of new homes built in the last decade in high wildfire risk zones out West:

Source: Cape Analytics

Over the last decade, California has built over 10,000 homes in areas deemed as high wildfire risk. High land prices and stringent zoning requirements in the California urban core have pushed builders further into rural areas, where the fire risk is much higher. Over the last few years, we have seen how dangerous wildfires can be in these areas of California, as places like Paradise and Santa Rosa have been devastated by fires. Among Western states, Utah ranks second in terms of high fire risk building, followed by Colorado.

However, it’s important to remember that California is the largest state in the United States by population and the third-largest by landmass. Given its size, we can expect more home construction in California compared to other states.

To account for this size question, we’ve adjusted by population, to see where states are building more homes in wildfire zones at the highest per capita rate (per 100,000 residents):....

....MUCH MORE

If interested see also September 2014's "California: The Last 200 Years Were The Happy Time For Weather, Get Ready For A Return to The West Without Water"

And as noted in the outro from a 2018 post:

....What follows are some historical comparisons with a couple caveats:

1) the further back in time you go the less precise/reliable the size of the burn area. Death statistics tend to be more accurate.As people move into formerly wild areas they cause a higher percentage of fires versus lightning. On the other hand fires that formerly burned until they ran out of fuel or until the rains came are now battled aggressively.....

2) Because of dramatic land use changes the dynamics of number of fires and extent have changed.

And 2019's "Wildfire: "Insurers Trim Their Risks in California"":

Speaking of fire insurance.Wires in the wood, no good....

We've talked about how wildfire risks multiply simply by having more and more and more people living in previously wild or semi-wild areas.

Then when you run electricity into these areas that are no longer allowed to burn naturally, when the wires break and the land does catch fire, you have a disaster on your hands....

| Date | Name | Location | Acres | Significance |

| October 1871 | Peshtigo | Wisconsin and Michigan | 3,780,000 | 1,500 lives lost in Wisconsin |

| 1871 | Great Chicago | Illinois | undetermined | 250 lives lost |

| 17,400 structures destroyed | ||||

| September 1881 | Lower Michigan | Michigan | 2,500,000 | 169 lives lost |

| 3,000 structures destroyed | ||||

| September 1894 | Hinckley | Minnesota | 160,000 | 418 lives lost |

| September 1894 | Wisconsin | Wisconsin | Several Million | Undetermined, some lives lost |

| February 1898 | Series of South Carolina fires | South Carolina | 3,000,000 | Unconfirmed reports indicate 14 lives lost and numerous structures and sawmills destroyed |

| September 1902 | Yacoult | Washington and Oregon | 1,000,000 + | 38 lives lost |

| April 1903 | Adirondack | New York | 637,000 | Large amount of acreage burned |

| August 1910 | Great Idaho | Idaho and Montana | 3,000,000 | 85 lives lost |

| October 1918 | Cloquet-Moose Lake | Minnesota | 1,200,000 | 450 lives lost |

| 38 communities destroyed | ||||

| September 1923 | Giant Berkley | California | undetermined | 624 structures destroyed and 50 city blocks were leveled |

I didn't know of the writer so I went to the all-knowing one. From the author's Wikipedia entry:

Lee Hu Fang is an American journalist. He was previously an investigative reporter at The Intercept, a contributing writer at The Nation, and a writer at progressive outlet the Republic Report. He began his career as an investigative blogger for ThinkProgress...

From Lee Fang's Substack, May 25:

Pierre Omidyar stands to gain financially from the rapid growth in private security.

Pierre Omidyar, the billionaire founder of eBay, is one of the most generous patrons of activist groups seeking to defund, or in some cases, even abolish police.

Foundations connected to Omidyar have lavished financial support on anti-police activists in recent years. In June 2020, in response to protests over the police killing of George Floyd, funds tied to Omidyar’s philanthropic network announced donations of $500,000 to organizations supporting the protest movement.

The Movement for Black Lives, an “abolitionist” coalition of activists seeking to eradicate public policing, was one of the recipients of Omidyar money that year. Disclosures show that the Omidyar Network provided $300,000 to the group.

“When we say ‘defund and abolish the police,’ we mean exactly that,” the Movement for Black Lives stated in a press release.

In Chicago, the Movement for Black Lives partnered with a local group, Equity and Transformation, to “defund police.” Omidyar Network gave the partner group $100,000, tax records show.

The website DefundPolice.org, which provides legislative and communication tools for activists to advocate for cutting police funding, is a collaboration between Omidyar-funded groups. The sponsors of the organization include PolicyLink, which received $700,000 from Omidyar Network and Law for Black Lives, a group that received $600,000 from the Democracy Fund, another Omidyar foundation.

Meanwhile, in his personal capacity, Omidyar has invested in start-ups that specialize in monetizing the growing demand for private security.

One of those investments is Bond, an app that provides licensed bodyguards at the click of a button. Doron Kempel, the founder of Bond, is a former member of Israeli special forces who has pitched his company in the past as a way for customers to “order a bodyguard as easily as they might order dinner online.”...

....MORE (just a bit)

I thought we had a post on "Bond" but don't see it after a cursory search. The upshot was: it's not the most efficient way to approach security, if for no other reason than having the logistics issue of having security peeps "on-call."

Mr. Fang's stint at the Intercept is interesting in that Omidyar along with Glenn Greenwald founded The Intercept to much hoopla. Some links in March 7's "Mystery Solved: Left-Wing Billionaire Pierre Omidyar Bankrolls Shadowy Anti-Musk Group" (EBAY; TSLA):From Elliott Management-backed (Paul Singer) Washington Free Beacon, February 21:

Omidyar money behind organizations pushing corporate boycott of Twitter

The left-wing billionaire and media donor Pierre Omidyar is behind the dark-money group that has kept its donors secret for nearly a year and is leading a corporate boycott campaign against Twitter owner Elon Musk.

Omidyar, the eBay founder and financial backer of the Intercept and ProPublica, donated $509,500 to Accountable Tech in 2021 and 2022, according to a recently updated list of grants disclosed by Omidyar's foundation. Omidyar also gave $2 million to at least six other organizations that targeted Musk, criticizing him in letters and op-eds as "uniquely ill-suited for the job of running a social media platform" and warning that he would turn Twitter into a "free-for-all of hate and harassment."

The news reveals one of the primary forces behind the anti-Musk campaign. Accountable Tech has been dodging questions about its donors for months. Over the past year, Accountable Tech and other groups bankrolled by Omidyar organized campaigns to pressure corporations to boycott Twitter and issued statements and op-eds denouncing Musk and calling for government investigations into the billionaire. "I wonder who funds them," wrote Musk in May, in response to a Washington Free Beacon report about the organization's secretiveness.

A spokeswoman for the Omidyar Network confirmed the funding but told the Free Beacon that the foundation didn't order the Twitter boycott campaign. "We routinely support organizations that share our vision for a responsible technology system, but do not direct their day-to-day activities," said spokeswoman Beth Kanter....

January 2017 "My next book won’t be the non-fiction Silicon Valley exposé we desperately need (but here’s what it will be)"

Similarly, when Mark Ames showed me a document proving that eBay founder Pierre Omidyar had funded opposition groups in Ukraine right before the Maidan revolution, I assumed Omidyar – the Pez dispenser guy! – must have been duped by his friends in the State Department. Tech founders simply didn’t go around instigating military coups.

Perhaps I saw the first glimmer of the real story when I dug out the White House visitor logs and saw how many times Omidyar’s name appeared, and who he met. Or when I noticed the growing line of tech billionaires leading to the Oval Office, the Kremlin and various Saudi royal palaces....

November 2014 At the Intersection of Money and Power: "Pierre Omidyar’s man in India is named to Modi’s cabinet" (EBAY; AMZN; WMT)

And a bunch of links regarding The Intercept

And many more.