Remember the pitch from last year, speculators have nothing to do with oil prices? Here's a stub from the

Regulators are investigating the giant U.S. Oil Fund LP exchange-traded fund and others in the market over price moves that coincided with its trades in and out of crude-oil contracts earlier this month.

The Commodity Futures Trading Commission confirmed late Thursday that its enforcement staff is investigating USO ...

FT Alphaville has been all over the story for the last couple weeks:

Feb 18: A ‘cancer’ in the oil markets?

Olivier Jakob at Petromatrix has commendably taken a strong stance against the USO ETF fund over the last few weeks, or rather, exposed to what degree the fund’s market inexperience is causing all sorts of mayhem for the WTI contract. All of this, he says, is because the fund has now achieved ‘’critical mass’.

Unsurprisingly, his Wednesday note shows a similarly strong view:

Despite the flat price weakness on crude oil, the contango on the expiring spread continues to narrow, in a pattern very similar to the previous expiry. The convergence of the expiring contract is now being done pre-expiry on a narrowing of the spread rather than post-expiry on a flat price basis. This re-enforces our view that the extreme contango on the WTI contract is primarily due to market distortions created by the USO WTI ETF. This cancer to the oil markets is however not yet over as positions in the USO were increased further yesterday and now reach 93′000 WTI April Futures contract....MUCH MORE

Feb 20: Is WTI becoming an ETF derivative?It’s rollover day for the March WTI contract on Friday. And the WTI disparity continues to hold, something analyst Olivier Jakob at Petromatrix increasingly thinks has more to do with the United States Oil Fund (USO) than any real fundamentals. As can be seen below, the divergence between the WTI and Brent contracts, which usually track each other quite efficiently, has really intensified in the last few months.

On Friday, the Nymex WTI contract was trading around $37.38 per barrel, while the ICE Brent contract was at $40.55.

What’s really worrying Jakob, however, is the soaring size of the USO in particular - even despite relatively dismal returns since the start of the year. The fund’s NAV is down 33 per cent year to date.

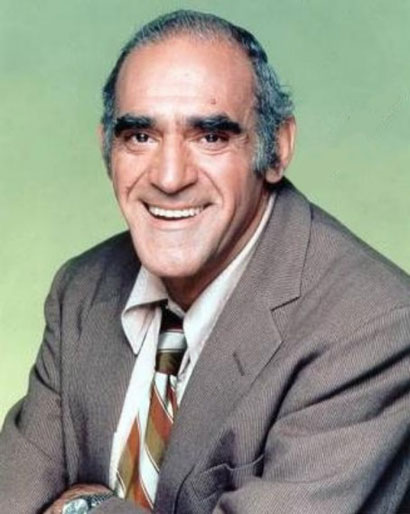

At the current rate of expansion, Jakob expects the fund — operated out of California by former (unsuccessful) US Republican candidate for congress Nicholas Gerber — to hit 100,000 WTI futures contracts by Monday.

Just to compare, this time last year the fund held only 2,855 WTI futures....MUCH MORE

Feb 24: The United States Oil Fund mystery

Olivier Jakob at Petromatrix continues his crusade against the United States Oil Fund in his Tuesday note, an issue increasingly being picked up across the commodities and investment spectrum.

Jakob’s specific case is with the distortions being caused in the WTI market on account of the ETF’s size and predictability. He notes people are already rolling positions from the front-month April contract and into May just to avoid the distortions. This is making the front-month contract somewhat of a farce, with a number of oil traders telling FT Alphaville the contract’s viability as a hedging instrument is truly in question. The volatility, meanwhile, is also immense relative to any other contracts further down the curve.

Consequently, Jakob calls it a USO free-lunch:

Open Interest data for Friday is confirming that positions are already being rolled into May. This is unusual to have positions being rolled so early before the next expiry but the USO has created a different crude oil market. The front timespread on WTI (Apr/May) is logically starting to weaken as length is taken out of April WTI and as traders start to position themselves for the USO free lunch. This in turn is making for a wider Brent premium to WTI and an improvement of the product crack. If Petrologistics is right on the level of compliance then given that WTI will remain for a while distorted on the USO rolls, this could make for an even wider prompt premium of Brent versus WTI and a strong rebound of US Gulf cash physical values during the roll of indices.

To make the point Jakob produces this rather nifty chart. He seems to have a point:...MUCH MORE

Feb 25: A self-propelled pyramid?

Stephen Schork of the Schork report jumps on the United States Oil Fund issue on Wednesday. He too is blaming the size of the ETF for current distortions in front-month Nymex WTI contracts.

He refers specifically to the March/April roll when spreads moved from $3.26 to $8.18 and expired at $1.09. Quite a volatile move. He explains (our emphasis):

As we outlined at the time, this volatility was largely attributable to “the roll” by long-only commodity index funds, particularly the United States Oil Fund ETF (USO). Open interest in the March contract was 363,757 on February 05th. Per the fund’s website, the USO rolled 85,057 contracts the next day. In other words, the USO held sway over the market, i.e. these funds (USO, S&P GSCI et al) are artificially skewing the front of the NYMEX curve; putting downward pressure as they sell a massive percentage of open interest in the spot over the course of a few sessions....MUCH MORE

Feb 26: Whatever happened to speculator limits on Nymex?

Stephen Schork of the Schork report highlights a response, as received from a reader, to his Wednesday point on the USO ETF:

A response to our USO observation from a client…

re: USO - they are NOT a hedger - why they are allowed to exceed the spec levels is beyond me - oh wait yeah NYMEX [now CME] and ICE love the volume and fees it gets from the USO trading… The CFTC should classify USO as a spec and require the NYMEX/ICE to impose spec. levels to USO - and if they try to roll out a USO II or USO III they should be treated as one entity and their position combined for the purposes of position totals .

They certainly have a point.

The “speculator limits”, says Nymex are there to “effectively restrict the size of a position that market participants can carry at one time and are set at a level that greatly restricts the opportunity to engage in possible manipulative activity on NYMEX.”

The position limit during the last three days of the expiring delivery month on Nymex WTI is 3,000 contracts....MORE