Just so we know the rules of the game, it's rentseeking raised to the fifth power.

Current:1) Raise the price of electricity via cap and trade.

2) Directly subsidize the purchase of solar panels with a 30% investment tax credit or convertible ITC.

3) Mandate the use of the electricity produced by means of Renewable Portfolio Standards.

Proposed:4) Feed In Tariff's to guarantee above-market prices paid for the electricity generated.

5) A special carve-out for solar panel manufacturers.

This last bit is just disgusting. Anyone who has looked at the technologies knows that solar thermal is the most efficient tech we have to turn sunlight into electricity, benefiting from the ability to generate electricity at night.

Because this is a political rather than a business/economic issue, we will repost our best observation on rentseeking, below. It is very dangerous to play a game without knowing the rules.

From the Wall Street Journal:

The solar industry, the smallest part of the U.S. renewable-energy sector, is seeking to boost its position through legislation being pushed in the U.S. Congress. The industry's trade group, the Solar Energy Industries Association, or SEIA, wants Congress to carve out a special place for solar power if the government mandates that a certain amount of electricity come from renewable sources. Companies such as First Solar Inc. (FSLR) are also hoping for a share of the revenue that would be produced if companies were forced to buy allowances for emitting global-warming gases into the atmosphere.

"There are proposals on the table to invest revenues that might be generated from a cap-and-trade system or from an allocation system into renewable energy," Dennis Fitzgibbons, who recently became First Solar's first in-house Washington lobbyist after serving as a chief of staff on the House Energy and Commerce Committee, said in an interview earlier this month. "How that might be done is a matter of interest."...

...For years, the solar industry has lagged behind wind, because solar panels are relatively expensive. In 2007, solar energy accounted for just 1% of total renewable energy consumption, while wind accounted for 5%.

While state and federal tax incentives have helped, national climate-change legislation holds the potential to put the solar industry on better footing. Under a plan being pushed by Rep. Jay Inslee, D-Wash., utilities would be required to buy electricity from renewable-energy producers at rates above their cost of production. The expense associated with more costly solar energy would be mitigated by handing out to utilities pollution allowances that would be required to buy the electricity...

...The solar industry is also hoping to benefit from a measure that would require as much as 25% of electricity come from renewable sources by 2025. Because of solar energy's expense, a such a policy would tend to bring the most benefit to energies such as wind, unless a special place is carved out for solar.

The SEIA is asking that Congress require 20% of the mandated renewable energy be reserved for distributed generation - an alternative to the big, centralized power plants. As a practical matter, that could lead to solar panels sprouting up in places such as parking lots and rooftops, rather than forming the basis for big generating facilities operated by utilities...MORE

HT: Environmental Capital

The first inductee into the prestigious Climateer "Our Hero" Hall of Fame (posted many, many times):

...This stuff is all political and investors must keep an ear to the political ground or risk tremendous losses. There are only two viable approaches to rentseeking investing and politicians,

buy 'em or play 'em.

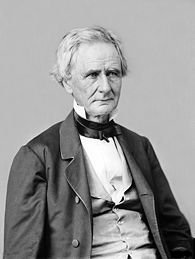

We must have the mindset of the first recipient of the prestigious Climateer Investing "Our Hero" award, the 26th Secretary of War and Democrat and Republican (!) Senator from Pennsylvania:

I'll close with my standard quote, from Simon Cameron.

From our post on biofuels, March '07:

Finally for investors in rent-seeking organizations there is the real risk that the politicians will change the rules. Heed the words of Sen. Simon Cameron (R&D!-Pa.):

"The honest politician is one who when he is bought, will stay bought."

Our Hero

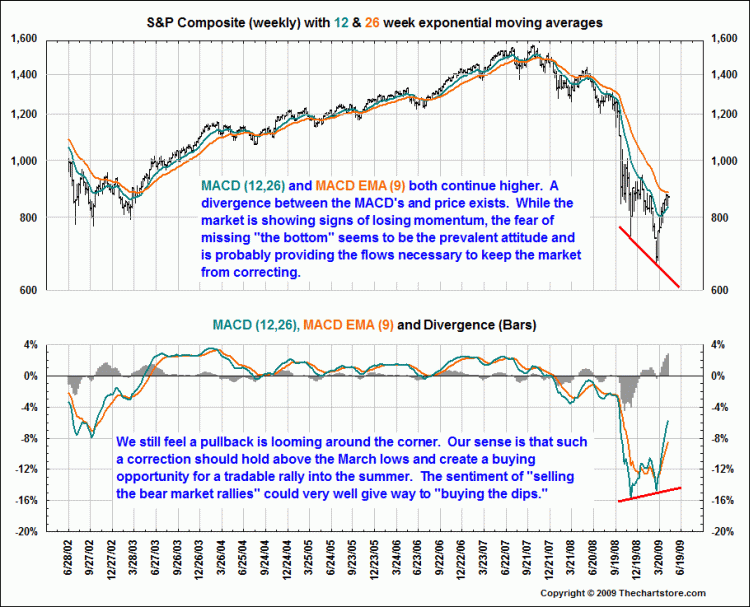

It's just a small pattern on the hourly charts but deserves attention from market watchers, investors and traders. The S&P 500 reached the 884 Fibonacci level I've mentioned for many days, and also a projection that Andre Gratian had at 888. Now, I will not speak for Andre except to note that he's been tracking both Elliott Wave counts as well as the A/D line. What I can point out is that the market has turned back down under these levels (along with the Nasdaq 100 doing the same at 1409.71, and the QQQQ's doing similar with the $35 level described earlier this morning in the post about the P&F chart).

Yesterday's bearish bias stands in contrast to recent activity on the ISE, where POT has garnered a 10-day call/put volume ratio of 1.44. However, short-term option players are firmly aligned in the skeptics' camp, as the stock's Schaeffer's put/call open interest ratio (SOIR) checks in at 1.26, just 1 percentage point from a new 52-week high....

Yesterday's bearish bias stands in contrast to recent activity on the ISE, where POT has garnered a 10-day call/put volume ratio of 1.44. However, short-term option players are firmly aligned in the skeptics' camp, as the stock's Schaeffer's put/call open interest ratio (SOIR) checks in at 1.26, just 1 percentage point from a new 52-week high.... In a bold campaign to help unhealthy animals at the Manila Zoo, four sexy animal rights group staffers willingly bared their skin on Tuesday to spread awareness about the ills of keeping animals in captivity.

In a bold campaign to help unhealthy animals at the Manila Zoo, four sexy animal rights group staffers willingly bared their skin on Tuesday to spread awareness about the ills of keeping animals in captivity.