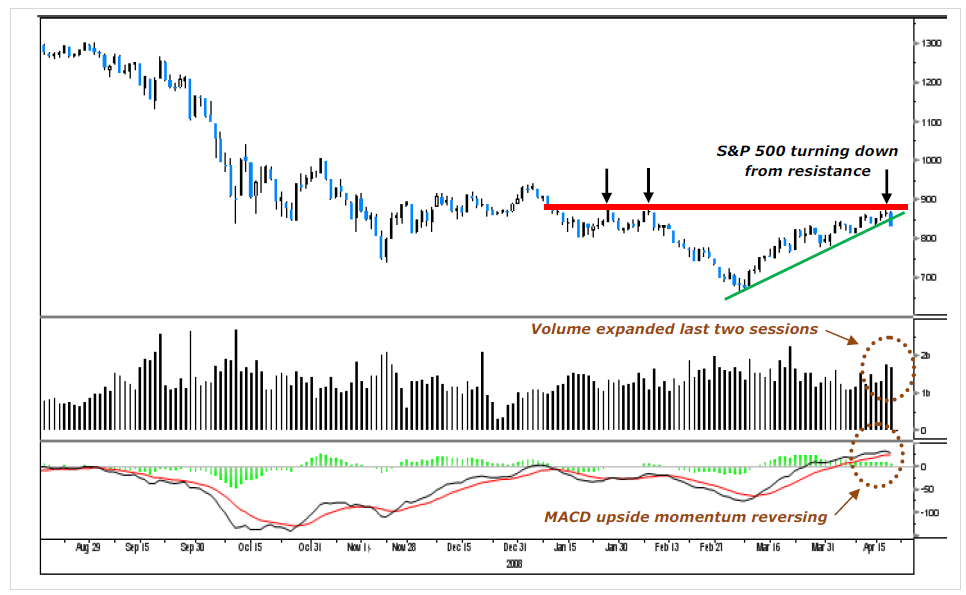

Original post:On Tuesday, the day after a 37 point (4.27%) spanking of the S&P, The Big Picture had a post with a chart of the resistance line for the S&P 500:

>...As seen in the above S&P 500 research note the index stalled at resistance and then subsequently broke its’ minor uptrend line on expanding volume. Directional volume is important as it suggests the conviction behind the move and as much as it was bullish not far off the lows, yesterday’s action while not equally negative was ugly. The skew of decliners on the S&P was torrential with 479 of 500 issues scoring price losses for the session....

A week ago we closed at 869.60.

As I type this the index just ticked at 863.16 so we are bumping up against it once again.

The problem is I don't know if resistance is futile and the fourth time is charming, or not.

Back with more after consultation with a chartmeister.