The Mix Tape of the Gods

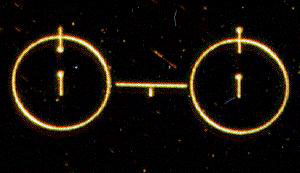

Here's the cover of the disc (from NASA)-

THIRTY years ago today, the Voyager 1 space probe — a one-ton robotic craft whose long antennas make it look rather like a spider the size of a school bus — was launched from Cape Canaveral, Fla., on a mission to reconnoiter Jupiter and Saturn. To succeed, Voyager would have to survive five years in the vacuum of space, where it would encounter cosmic rays, solar flares, the hurtling rocks and sand of the asteroid belt, and Jupiter’s intense radiation bands.

The probe did all that, transmitting back reams of scientific data and memorable color photos: of the sputtering red and yellow volcanoes of Jupiter’s moon Io; of the shimmering blue ice that shrouds Io’s fellow satellite Europa, beneath which a liquid ocean is suspected to dwell; of Saturn’s myriad rings and the murky mysteries of its orange satellite, Titan, whose hazy atmosphere is thought to approximate that of the early Earth .

Having accomplished its mission, Voyager 1 might have quietly retired. Instead it remains active to this day, faithfully calling home from nearly 10 billion miles away — so great a distance that its radio signals, traveling at the speed of light, take more than 14 hours to reach Earth. From Voyager’s perch, the Sun is just another star, south of Rigel in the constellation Orion, and the Sun’s planets have faded to invisibility.

Like its twin, Voyager 2 — which dallied behind to examine the outer planets Uranus and Neptune and is departing the solar system on another trajectory — Voyager 1 is approaching the edge of the solar system. That limit is defined by a teardrop-shaped bubble called the heliosphere, where the solar wind (particles blown off the Sun’s outer atmosphere) comes to a halt.

If all continues to go well, Voyager should pierce the heliosphere’s outer skin by around 2015. It will then depart into the void of interstellar space, where it is destined to wander among the stars forever.

Mindful of this mind-boggling fact, the astronomers Carl Sagan and Frank Drake persuaded NASA to attach a gold-plated phonograph record to each of the Voyager spacecraft.

Containing photographs, natural sounds of Earth and 90 minutes of music from all over our world, the record was intended to preserve something of human culture beyond what an intelligent extraterrestrial, encountering the craft at some far-distant time and place, might infer from the spacecraft itself.

The information etched into the grooves of the Voyager record is expected to last at least one billion years. That’s a long time: A billion years ago, life on Earth was first venturing forth from the seas....MORE

Read more about the Golden Record Cover

(Click on the image for a larger view)

This illustration on the lower right of the Voyager record cover could be considered the "Rosetta Stone" of the record, as it provides the key to interpreting the remaining cover illustrations. This illustrates the hyperfine transition of the hydrogen atom where it changes between its two lowest states. The time interval for this is a mathematical constant equal to 0.7 billionths of a second, or more precisely 7.04024183647E-10 seconds. The 1 between the two states indicates the length of the transition should be equal to a binary 1. The binary numbering system, with just two symbols, 0 and 1, is the simplest numbering system, and is more likely to be understood by other civilizations than our decimal system adopted simply because humans have 10 fingers. With hydrogen being the most abundant element in the galaxy, any advanced civilization likely to encounter the Voyager should be able to interpret the meaning of this diagram....MUCH MORE

This illustration on the lower right of the Voyager record cover could be considered the "Rosetta Stone" of the record, as it provides the key to interpreting the remaining cover illustrations. This illustrates the hyperfine transition of the hydrogen atom where it changes between its two lowest states. The time interval for this is a mathematical constant equal to 0.7 billionths of a second, or more precisely 7.04024183647E-10 seconds. The 1 between the two states indicates the length of the transition should be equal to a binary 1. The binary numbering system, with just two symbols, 0 and 1, is the simplest numbering system, and is more likely to be understood by other civilizations than our decimal system adopted simply because humans have 10 fingers. With hydrogen being the most abundant element in the galaxy, any advanced civilization likely to encounter the Voyager should be able to interpret the meaning of this diagram....MUCH MORE

Here are the first ten tunes on the musical playlist-

Music On Voyager Record

- Bach, Brandenburg Concerto No. 2 in F. First Movement, Munich Bach Orchestra, Karl Richter, conductor. 4:40

- Java, court gamelan, "Kinds of Flowers," recorded by Robert Brown. 4:43

- Senegal, percussion, recorded by Charles Duvelle. 2:08

- Zaire, Pygmy girls' initiation song, recorded by Colin Turnbull. 0:56

- Australia, Aborigine songs, "Morning Star" and "Devil Bird," recorded by Sandra LeBrun Holmes. 1:26

- Mexico, "El Cascabel," performed by Lorenzo Barcelata and the Mariachi México. 3:14

- "Johnny B. Goode," written and performed by Chuck Berry. 2:38

- New Guinea, men's house song, recorded by Robert MacLennan. 1:20

- Japan, shakuhachi, "Tsuru No Sugomori" ("Crane's Nest,") performed by Goro Yamaguchi. 4:51

- Bach, "Gavotte en rondeaux" from the Partita No. 3 in E major for Violin, performed by Arthur Grumiaux. 2:55...

On April 22, 1978 during an SNL segment, "Next Week in Review" it was announced that after capturing the Voyager spacecraft, the first alien message received by earth would be:

Sources: CollectSpace, The Hits Just Keep on Comin', Amazon.

The next day gold was up $42.00 and we posted "Climateer Investing on Gold: Sometimes You Get Lucky". Today gold is trading hands at $880.40, up $9.20 and I am thinking of going short.

Looking at Kitco's 1-year chart you see the series of lower highs and lower lows that defines a downtrending market. The test will be in the $910 area. If the shiny stuff can't get there and hold, it confirms the downtrend (for me) and may go all the way back to its November $680 spike bottom:

P.S.

An India/Pakistan nuclear war would be bad for the climate too.

From Reuters:

SCENARIOS: Assessing risks of India, Pakistan confrontation

From EurekAlert:

Regional nuclear conflict would create near-global ozone hole, says CU-Boulder study