As just one example, what is the trade if the world is confronted by a real-life version of "Blindness (2008, Fernando Meirelles), which deals with a fictional disease that causes epidemic blindness, leading to collective hysteria?"

I mean beyond the simplistic "short Luxottica." Duh.

From Emerging Infectious Diseases Journal, Volume 26, Number 2—February 2020:

Qijun Han and Daniel R. Curtis

Abstract Films illustrate 2 ways that epidemics can affect societies: fear leading to a breakdown in sociability and fear stimulating preservation of tightly held social norms. The first response is often informed by concern over perceived moral failings within society, the second response by the application of arbitrary or excessive controls from outside the community.

Films related to themes of disease, infection, and contagion often fall into 1 of 3 broad categories connected to fantasy, science fiction, or horror: apocalyptic destruction or near destruction of the whole of humanity, rising concerns over bioterrorism, and the rise of an undead or form of zombie existence (1). Although films traditionally deal sensitively or realistically with the topic of HIV/AIDS (e.g., Dallas Buyers Club, Philadelphia, And the Band Played On, Kids), often through melodrama, fewer films have dealt with other epidemic diseases, as either direct subject material or background context. Of these more realistic or semirealistic films about epidemics, scholarly literature has focused on the inadequacy of capturing the correct science behind disease transmission, spread, and illness (2–4) or anachronistic characters in films concerning historical epidemics (5).....MUCH MORE

Notwithstanding broader discussions of society–disease interaction in the media (6), the social responses to various diseases portrayed in films have been discussed less frequently.

In this article, we bring together a sample of films that we manually selected from a consolidated database of epidemic-related films built from assorted scholarly literature and catalogs (2,4,5,7–9). This database was supplemented by accessing “Films about viral outbreaks” on Wikipedia

https://en.wikipedia.org/wiki/Category:Films_about_viral_outbreaks and a list of “Apocalyptic, epidemic, pandemic and disaster movies” on the Internet Movie Database https://www.imdb.com/list/ls058975821.

We manually selected the films and eliminated those that corresponded to the 3 broad categories mentioned above (i.e., those that are overly fantastical, not based or loosely based on an actual epidemic disease) and focused on films that pay explicit attention to social responses to disease (rather than being a peripheral backdrop to an unrelated story). Furthermore, the absence of comprehensive indexing of films containing narratives around epidemics makes construction of a systematic sample impractical (4).

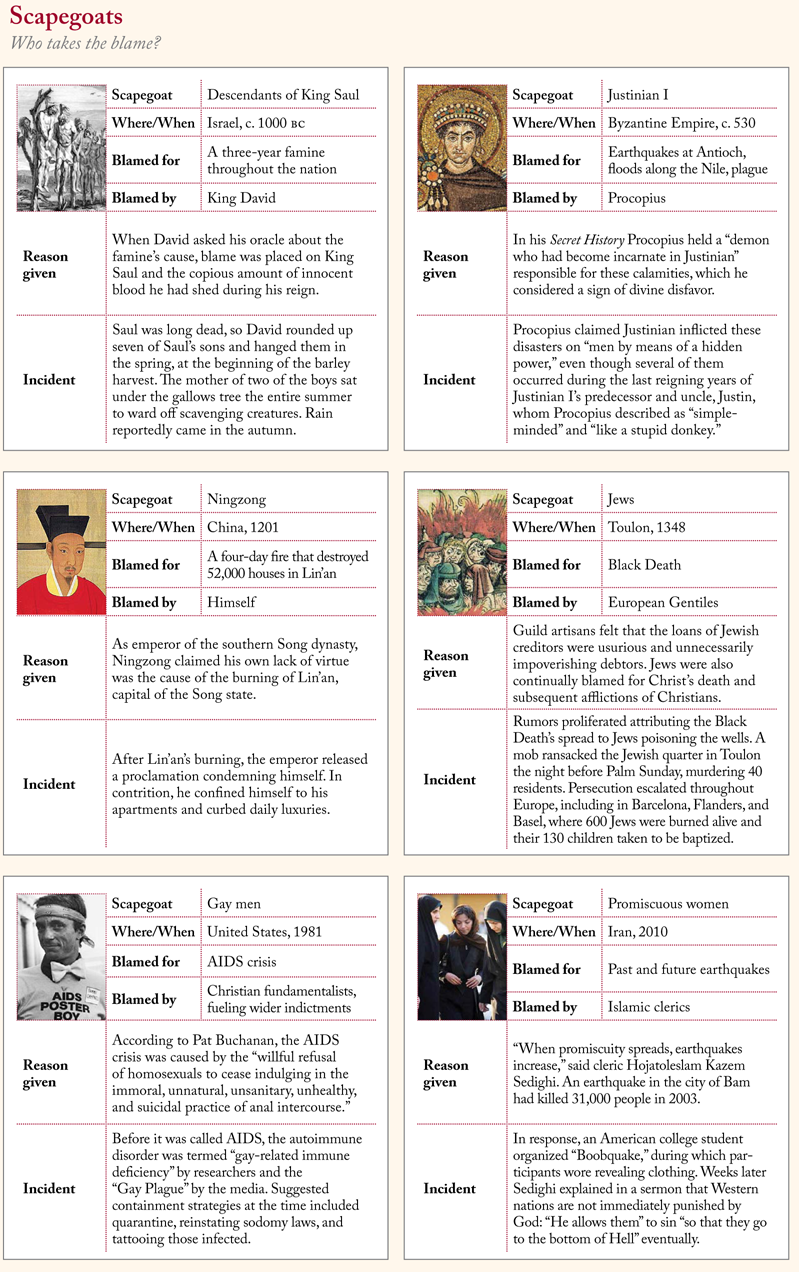

Scholarly literature that focuses on contemporary disease psychology holds central a connection between fear, panic, and epidemics (10), often focusing on the unique characteristics of infectious diseases themselves (11). Indeed, in an article about the psychosocial effects of diseases, the disproportionate degree of fear was describe as connected to the fact that “it is transmitted rapidly and invisibly; historically, it has accounted for major morbidity and mortality; old forms re-emerge and new forms emerge; and both the media and society are often in awe” (12). However, after analyzing this selection of epidemics-related films, we suggest that although social reactions such as panic (an emotive response caused by fear) are typically found in films concerning epidemics, films also remind us that the fear seen during epidemics is often little associated with the disease itself. In fact, films show that epidemics can push societies in 2 directions: fear leading to a breakdown in sociability, but also fear stimulating the preservation of tightly held social norms. The first social response to epidemics is often informed by concern over broader moral failings within society at large, leading, for example, to violence or scapegoating. In accordance with the “outbreak narrative,” a concept developed by Priscilla Wald, a fear of the spread of disease is developed in only 1 direction, from marginalized, deviant, or underdeveloped groups to native, mainstream, or developed society (6). In recent films, this kind of orientalization (perpetuating stereotypes about Middle Eastern, Asian, and North African societies) and othering (viewing or treating others as intrinsically different from and alien to oneself) has been taken a step further as traditional or underdeveloped societies are heroically saved by outsiders. The second social response to epidemics is often informed by the perceived application of arbitrary or excessive controls from above or outside the community in question. Films have shown that epidemics produce active responses such as resistance or unrest—sometimes violent—to paradoxically retain aspects of normal life under threat (often from elites and authorities), such as perceived freedoms and liberties and customary traditions and practices.

Social Morality during Epidemics in Cinema

Many films dealing with epidemics have tended to see panic as an inevitable social response; their main focus has been the process of authorities withholding information to guard against chaos or the circulation of misinformation by the media. For example, in Panic on the Streets (1950, directed by Elia Kazan), to avoid mass panic across the city of New Orleans, the US Public Health Service and the police agree to not notify the press of a death resulting from pneumonic plague. Appearing in the same year, The Killer That Stalked New York (1950, Earl McEvoy) was based on an actual threat of smallpox that occurred in New York in 1947. In the film, public health officials develop a widespread vaccination program, but after the necessary serum runs out, the city descends into mass panic—after the authorities tried to cover up this information. In the UK film 80,000 Suspects (1963, Val Guest), the doctor tackling an outbreak of smallpox uses a quarantining process with the explicitly mentioned goal of reducing the chances of public panic. In Morte a Venezia (1971, Luchino Visconti), a film based on the 1912 novel by German author Thomas Mann, Der Tod in Venedig [Death in Venice], the city authorities do not inform those on vacation of cholera problems within the city for fear they will frantically leave—an approach also taken by town officials in John Ford’s depiction of a community during a typhoid epidemic, Dr. Bull (1933). Another common feature is defiance of the film’s protagonists against a perceived lack of official information. For example, in Quiet Killer (1992, Sheldon Larry), when the doctor realizes that her patient has succumbed to plague, she tries to push authorities to warn the citizens of New York, against considerable reluctance from the mayor, who envisages widespread panic.

Other films, however, have gone further and tried to examine some of the causes of this fear and panic; in many films, the roots lie in society’s response to perceived declines in social morality. One of the earliest examples is Die Pest in Florenz [The Plague of Florence] (1918, Fritz Lang), which focused on the real outbreak of the Black Death in Florence in the mid-14th century and portrayed death from plague as a response to immoral behavior and sexual debauchery. The connection between disease and deteriorating social morality came from actual observations of contemporaries at the time, for example, the views of Giovanni Villani (Nuova Cronica) and Giovanni Boccaccio (Decameron). In several films, the plague became used as an explicit punishment for immorality and wrongdoing: The Pied Piper (1972, Jacques Demy), The Hour of the Pig (1993, Leslie Megahey), and especially Anazapta (2002, Alberto Sciamma), in which plague was a supposed consequence of the brutal rape of a lord’s wife by the village.

Similar kinds of existentialist angst and pessimism over social values in connection with the Black Death were later famously exploited by Ingmar Bergman in The Seventh Seal (1957), Lars von Trier in Epidemic (1987), Luis Puenzo in The Plague (1992), and Christopher Smith in The Black Death (2010). Those 4 films focus especially on intolerance in the form of scapegoating and persecution of women as witches, but visualization of dread had already appeared earlier in lesser known films, such as Singoalla (1949, Christian-Jaque), Häxan (1922, Benjamin Christensen), and Skeleton on Horseback (1937, Hugo Haas). In the film Trollsyn (1994, Ola Solum), set in Norway, the initial stage of the Black Death outbreak is presented as mass hysteria among the villagers: crying and shouting, desperate prayers, suicides, and frantic searching for buboes and panicked movements. Also, in reference to social decline, one scene shows simultaneously the aggressive inquisition of a female scapegoat while amid the chaos a couple are having sex and others have taken off their clothes and are rolling down a grassy hill.

Many films focusing on outbreaks of epidemic disease focus on outbreaks of senseless violence indicative of a society completely out of control. In The Horseman on the Roof (1995, Jean-Paul Rappeneau), set during a cholera epidemic in 19th-century Manosque, southern France, the film’s protagonist, Angelo, is captured by a paranoid mob who accuse him of poisoning the town fountain and take him to the authorities. Elsewhere, in the Masque of the Red Death (1964, Roger Corman [adapted in 1989 by Larry Brand/Jeffrey Delman]), which focuses on a fictional disease with loose parallels to plague, rural villagers become increasingly desperate and seek to escape the devastating death, only to have soldiers shoot them down by crossbow. In Jezebel (1939, William Wyler), chaotic and violent scenes of 19th-century New Orleans are overlaid with a dramatic, flashing, capitalized “YELLOW FEVER” text across the screen, as if to heighten the emphasis on uncontrolled panic....