This is one of the three or four most likely bankruptcies among the gas Exploration & Production companies.

0.3011 down 0.1428 (-32.1694%)

From TheStreet:

Chesapeake Energy Shares Slump on Revenue Miss, Reverse-Split Plan

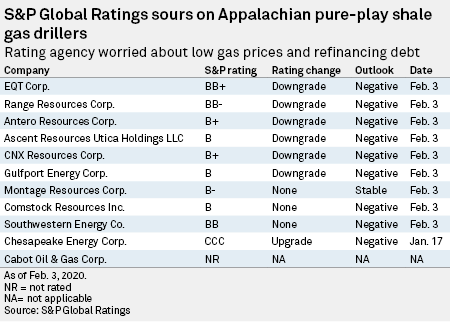

Chesapeake Energy shares dropped sharply after the oil and natural gas exploration and production company missed Wall Street's fourth-quarter revenue expectations and said it planned a reverse stock split.In early February S&P downgraded six of the E&P names:

Chesapeake Energy (CHK) - Get Report shares dropped sharply after the oil and natural gas exploration and production company missed Wall Street's fourth-quarter revenue expectations and said it planned a reverse stock split.

At last check the Oklahoma City company's shares were off 22% at 35 cents.

Chesapeake swung to a net loss of $346 million, or 18 cents a share, from earnings of $576 million, or 57 cents, in the year-earlier period.

The adjusted loss came to 4 cents a share, better than the FactSet consensus of a 6-cent loss.

Revenue fell 31% to $1.93 billion, missing FactSet's call for $2.02 billion. ...MUCH MORE

S&P Ratings downgrades 6 shale gas producers; outlook 'negative' on sector

...MORE

EQT is the big one and the one that has the bankers worried.

Among the possible survivors we have always appreciated the way Devon ran their business.

Related:

Natural Gas: Giant EQT Takes Impairment, Downgraded To Junk Status

Don't Look Now But There's Something Funny Going On Over At Chesapeake, George (CHK)

Chesapeake Energy Downgraded At Tudor Pickering, Price Target Lowered to $0.00 (CHK)

Natural Gas: Chesapeake Energy Gets a 'Going Concern' Warning from the Auditors (CHK)

May 2016

Barclays: Chesapeake Energy Still Worth Only a Buck (CHK)

The stock of the country's second-largest natural gas producer closed at $4.59, down 19.61%.

March 2016

Oil & Gas: Peak Chesapeake (CHK)

The stock is at $5.33 up 25 cents after trading as high as $5.76.

"Chesapeake Energy Comments On Market Volatility" (plus Morgan Stanley says nice things) CHK