I'm telling you, there is something very wrong with China's economy.

Via ZeroHedge:

At its core, when stripped away of all rhetoric and technicalities, the Fed's QE is just one big bond-buying operation by the so-called Lender (and Buyer) of Last Resort, an operation meant to stabilize the market and restore order and price transparency even if it means creating an artificial market (as the Fed found out the hard way 12 years of QE will do). And if one goes by that simple definition, last night China - which has so far been against replicating the Fed's repertoire of market intervention amid concerns it would exacerbate the country's giant debt bubble - quietly launched QE.

According to Bloomberg, Chinese regulators asked the nation’s biggest insurers to buy bonds being offloaded as retail customers pull their cash from fixed-income investments. At a meeting on Wednesday, Chinese regulators told top insurers to backstop the market and buy bonds sold by wealth management units at banks to prevent further volatility. Some banks also proposed to use their proprietary trading desks to scoop up bonds, one source said.

Of course, in China where virtually every major financial enterprise is a SOE - i.e., state -wned - there is no such thing as "big independent insurers": they are all essentially government entities, and just one-step removed from official state apparatus to preserve some semblance of a private market (with state characteristics). But at the end of the day, what the regulators just greenlighted is nothing shy of QE, and what's more, unlike the US where at least there is some pretense of an asset swap as banks exchange bonds for reserves, in China the flow of funds is much simpler: someone, anyone, buys bonds to calm down the market. And since this is a step that is usually taken as a last-ditch resort, one can confidently say that we may have very well seen the bottom in Chinese assets.

The guidance, handed down at a meeting that was also attended by big (state-owned) banks and lenders, comes as Chinese traders and retail investors have been ditching fixed-income assets and pouring money into stocks on growing economic optimism as China rolls back its strict Covid Zero approach. The turmoil last month, which saw large withdrawals from bond-backed wealth management products, earlier also prompted regulators to ask banks to report on their liquidity situation.

According to the report, some insurance firms, whose investment products are less vulnerable to short-term redemptions, have already heeded the call and "purchased bonds on a positive market outlook" even before the latest guidance. The biggest insurance firms include China Life Insurance Co. and Ping An Insurance Group of China. The asset management arms of just those two manage a combined 8.74 trillion yuan ($1.3 trillion), according to their websites. Both are, of course, majority state-owned, and thus all that is taking place, is China's state now actively buying up bonds to stabilize the market....

....MUCH MORE

"Chinese factories are shutting down two weeks earlier than usual ahead of Chinese New Year"

It really is starting to appear that China could see a recession* caused by slowdowns in their Western customers' economies.It's only recently that we've started thinking the previously unthinkable:

November 24: "Copper: What's Your Timeframe?":

....For now and into Q2 2023 the West and maybe China have a recession they have to get through.December 1: "What If Our Understanding Of China's "Zero Covid" Is 180 Degrees Wrong?"

That last post floats the idea that the economic downturn is not a result of the insane lockdowns but rather that the lockdowns are a tool to keep inflation from going bonkers as the government/Communist Party pours liquidity into the system to prevent collapse initiated by the property developers.

If this is the case, the insurance company/bank bond buying isn't so much a QE move but an effort to contain the growing suspicion among the Chinese investor class that all efforts to stave off economic collapse will have the same result they saw in the West: Inflation.

Ergo, get out of fixed income while you can.

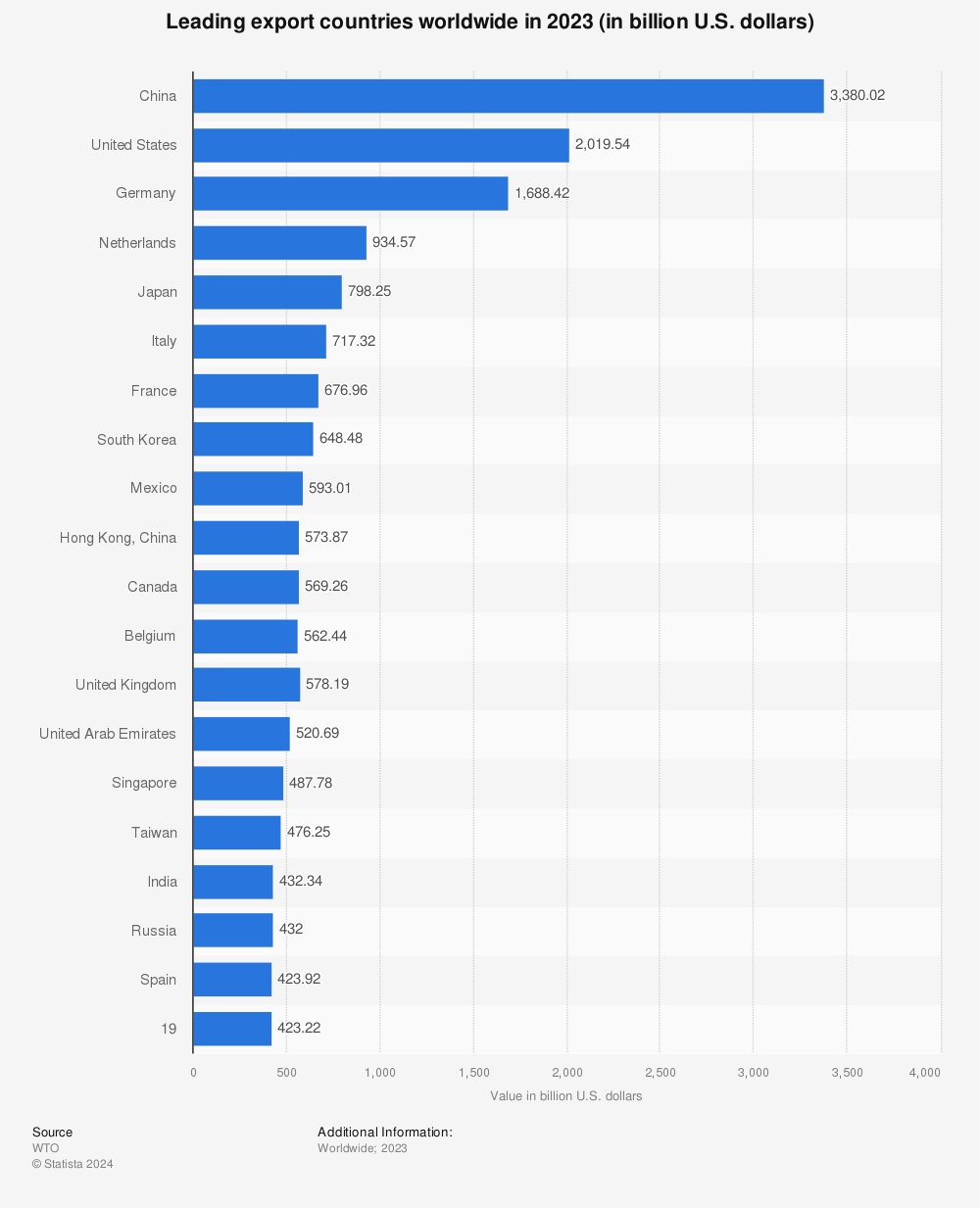

One further point along these lines. You would think that China, being by far the world's largest exporter, would welcome currency depreciation:

But no. After the move in the yuan above from ~6.31 to ~7.30 to buy a dollar, the Bank of China and the government have been intervening to keep the yuan from depreciating further:

It's back under 7.00 at 6.9585.

There are two reasons they would do this that come to mind:

1) The weak yuan means those companies that have dollar denominated debt, and there's a lot of it, something over $2 trillion, those companies have a harder and harder time buying dollars to pay the interest, much less the principal.

2) The weaker yuan is also highly inflationary, something the U.S. Fed and Treasury are looking at as the Dollar index has dropped from 114.78 to 104.59.

That 10.19 decline has raised the cost of U.S. imports ex-China by 8.87%, all else being equal.

We remove China because the yuan isn't included in the DXY.

Anyhoo, something big is going down with the Chinese economy and the rulers of the country are being less forthcoming than usual about what it is.