From Bloomberg via ZeroHedge, a clear-eyed look at the competing demands of liquid good collateral markets for reverse repo and the Fed's struggle to reduce its balance sheet.

Dec 28, 2022:

Authored by Simon White, Bloomberg macro strategist,

Quantitative tightening in 2022 has lagged relative to expectations, but next year the pace is set to pick up. Money-market funds’ (MMFs) continued lack of interest in buying Treasury bills would mean QT will have an increasingly negative impact on liquidity and risk assets.

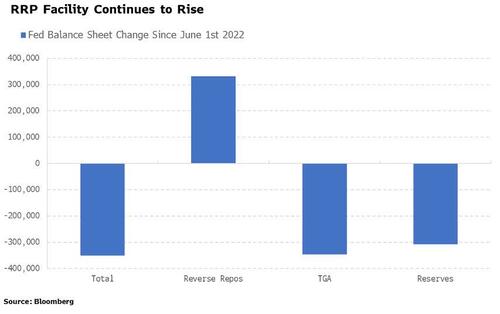

The Fed began shrinking its balance sheet through QT in June of this year.

Since then, it has fallen $350 billion, considerably less than the Fed’s $560 billion intended target.

This has been in large part due to rising rates meaning fewer MBS are naturally rolling off as mortgage borrowers are prepaying less. The Fed, though, may start to sell MBS outright, which would increase the pace of the Fed’s balance-sheet run-off.

As well as the pace of QT, how it manifests is important to gauge its impact. As the Fed is no longer a buyer for new debt that must be issued to replace maturing debt, someone else must buy it.

Ideally, one of two things happen.

Either an MMF buys the debt in the form of T-bills, in which case the net effect would be a fall in the RRP and a rise in bank reserves. Or,

...a MMF holder buys the debt by drawing down on their MMF asset, putting the proceeds in the bank, and using the deposit for the debt. The net impact is again a fall in the RRP and a rise in reserves.

The loss of bank reserves is what makes QT bite, and if the RRP intermediates in the Treasury financing its new issuance, this mitigates the fall in bank reserves that would occur if the debt buyer simply drew down on an existing bank deposit.

But rather than the RRP falling it is stubbornly rising, now sitting at $2.6 trillion, up $300 billion since QT started. And it does not look likely this is about to change. MMFs have been continuing to spurn T-bills, with the fall in their holdings mirroring the rise in the RRP facility....

....MUCH MORE