It was in the intro to a December 8 post that I tried to be as blunt as possible:

I'm telling you, there is something very wrong with China's economy.

It's sort of become a theme of ours.

From ZeroHedge, May 15:

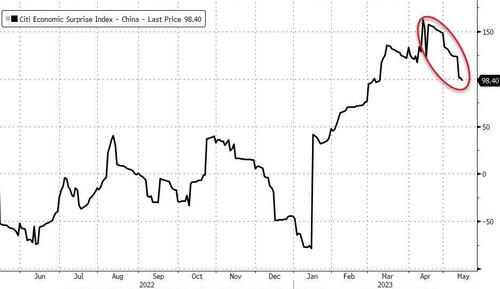

In the run-up to tonight's extravaganza of centrally-managed "economic" data, China's macro data has been serially disappointing for six weeks as the re-opening narrative fails to deliver...

Source: Bloomberg

Even with the almost infallible credit impulse on the rise again, recent aggregate financing data has been dramatically weaker than expected...

Source: Bloomberg

And before we break down the data, one huge caveat, the official headline figures that China’s National Bureau of Statistics released tonight compares with last year - when much of country was in total lockdown due to COVID, bringing the economy to a standstill everywhere.

Therefore, what’s more telling is that the pace of overall growth on a month-on-month basis – that’s the key gauge of the recovery’s health right now.

EVERYTHING MISSED!

*CHINA JAN.-APRIL FIXED INVESTMENT FALLS 0.64% M/M;RISES 4.7% Y/Y; EST. 5.7%

*CHINA JAN.-APRIL PROPERTY DEV. INVESTMENT FELL 6.2% Y/Y, EST. -5.7%

*CHINA APRIL RETAIL SALES ROSE ONLY 18.4% Y/Y; EST. 21.9%

*CHINA JAN.-APRIL INDUSTRIAL OUTPUT FALLS 0.47% M/M; RISES 3.6% Y/Y; EST. 4.9%

There was a modest silver lining with the Surveyed Jobless rate dropped to 5.2% (exp 5.3%), BUT, Youth unemployment soared to a record high 20.4%...

Source: Bloomberg

The numbers are significantly worse than expected (and in most cases worse than the worst economist forecasts).

As Bloomberg reports, Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd noted it "is a weak print."

"The headline data fail to impress despite base effect from Shanghai lockdown last year. Youth jobless rate passed 20%. The reopening dividend is losing steam."

China's NBS said "China faces insufficient domestic demand."....

....MORE

We've been repeating either the words or the sentiment pretty much monthly. Here's February 2023:

"'Tsunami Of New Supply': China Slumping Office Rental Market Faces Historic Crisis"

There is something very wrong with China's Economy....

What If China Had A Reopening And Nobody Cared?, Part II

IMF: China Should "Coax" The Masses Into Saving Less and Consuming More

The underlying fact set was the point of the intro to and outro from January 31's "What If China Had A Reopening And Nobody Cared?":

China isn't reopening, it has reopened. This is it. And despite the record savings the population has accumulated over the last three years we are not seeing a wave of demand in the domestic economy. Using one of the most basic proxies for what is actually going on, the price of pork, the grand reopening, is, to say the least, muted. This is especially true considering the country just celebrated the largest, most festive holiday on the calendar.*****One data point does not make a trend but it does raise the possibility that the facile expectation of a boom in Chinese consumption is wrong.What if, and I'm just spitballing here, what if the giant ball of savings is being targeted by the rapidly aging population as a retirement cushion, i.e. future consumption, not current?

That would leave China's export economy to carry the weight.

And that is not looking very promising at the moment:....

And the headline story from Asia Times, February 11:....Also: "Weak domestic demand threatens China’s rebound

Wha, uh, hey. I'm just confirming my priors, give me one minute:.... "