Controlled burns baby, ya gotta do controlled burns. Let that brush and undergrowth build up and every fire ends up being a disaster. And with thousands and hundreds of thousands of people moving into formerly wild areas the chances of a) a fire getting started and b) that fire killing and injuring people has gone up exponentially over the last sixty years.

From the Wall Street Journal, May 26:

Insurers have faced higher costs and wildfire risks

State Farm is stopping the sale of new home-insurance policies in California effective Saturday, because of wildfire risk and rapid inflation in construction costs.

The move by one of California’s biggest insurers is a blow to the state’s efforts for years to maintain a vibrant market for homeowners in the wildfire-prone state. Nationally, inflation has been a serious problem for home and car insurers since last year, and many have posted underwriting losses as they continue to seek regulatory approvals for rate increases that they say they need for catching up with the surging costs.

State Farm is the nation’s biggest car and home insurer by premium volume. It said it “made this decision due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.” It posted the statement on its website and referred questions to trade groups.

The insurer’s move doesn’t affect existing home-insurance policyholders, whose policies will remain in effect, according to the statement and a representative of the state Department of Insurance.

The insurer said it would also quit accepting new applications for business policies, but it would continue selling new personal auto policies.Worried about wildfire exposure and frustrated by state regulations, insurers in California have cut back on their homeowner businesses. Mostly, those cutbacks and restrictions apply in wildfire-prone areas of the state, or to individual properties that lack fire-resiliency features, such as fire-resistant building materials and techniques, and cleared-back brush.

In its statement, State Farm said it takes “seriously our responsibility to manage risk.” It said it was “necessary to take these actions now to improve the company’s financial strength. We will continue to evaluate our approach based on changing market conditions.”

Many home insurers operating in California don’t think they are being granted appropriate-enough rates “for the risks we are facing,” said Janet Ruiz, a representative for trade group Insurance Information Institute in California. Insurers generally have continued “to sell at least some new policies but they are shrinking in areas where there is wildfire.”

For 2022, State Farm’s auto-insurance companies reported record underwriting losses, totaling $13.4 billion, due primarily to rapidly increasing claims severity. Its homeowners’ business reported an underwriting gain. State Farm is a mutual company, meaning it is owned by its policyholders, and it has deep pockets. It ended 2022 with net worth of $131.2 billion....

....MUCH MORE

California's population grew from 10,667,000 in 1950 to 15,717,204 in 1960 to 39,501,653 in 2020. It's been decreasing the last two years to an estimated 39,029,000 in 2022, down 472K since peak.

"The Wildfire West: Where Housing Sprawl and Wildfire-Prone Areas Collide"

If some idiot San Franciscan fleeing the urban hellscape sets the Lake Tahoe 'hood on fire I'm going to be pissed.

***

Though we would love a respite from calamity, there is no reason to believe that we’ll be spared from wildfires this year. With scientific certainty, we know which areas are prone to wildfires, though home construction continues in those areas.

At Cape Analytics, we use artificial intelligence to analyze vast quantities of geospatial imagery to help insurers and other companies better understand properties and property risk. Along with our partner HazardHub, we wanted to explore exactly how much sprawl there has been in the West’s high-risk fire zones. From the standpoint of insurance and danger to human life, these homes and adjacent communities are especially risky. Quantifying the risk can help homeowners and agencies such as CAL FIRE take more proactive and focused measures to protect lives and property.

The Hot Spots

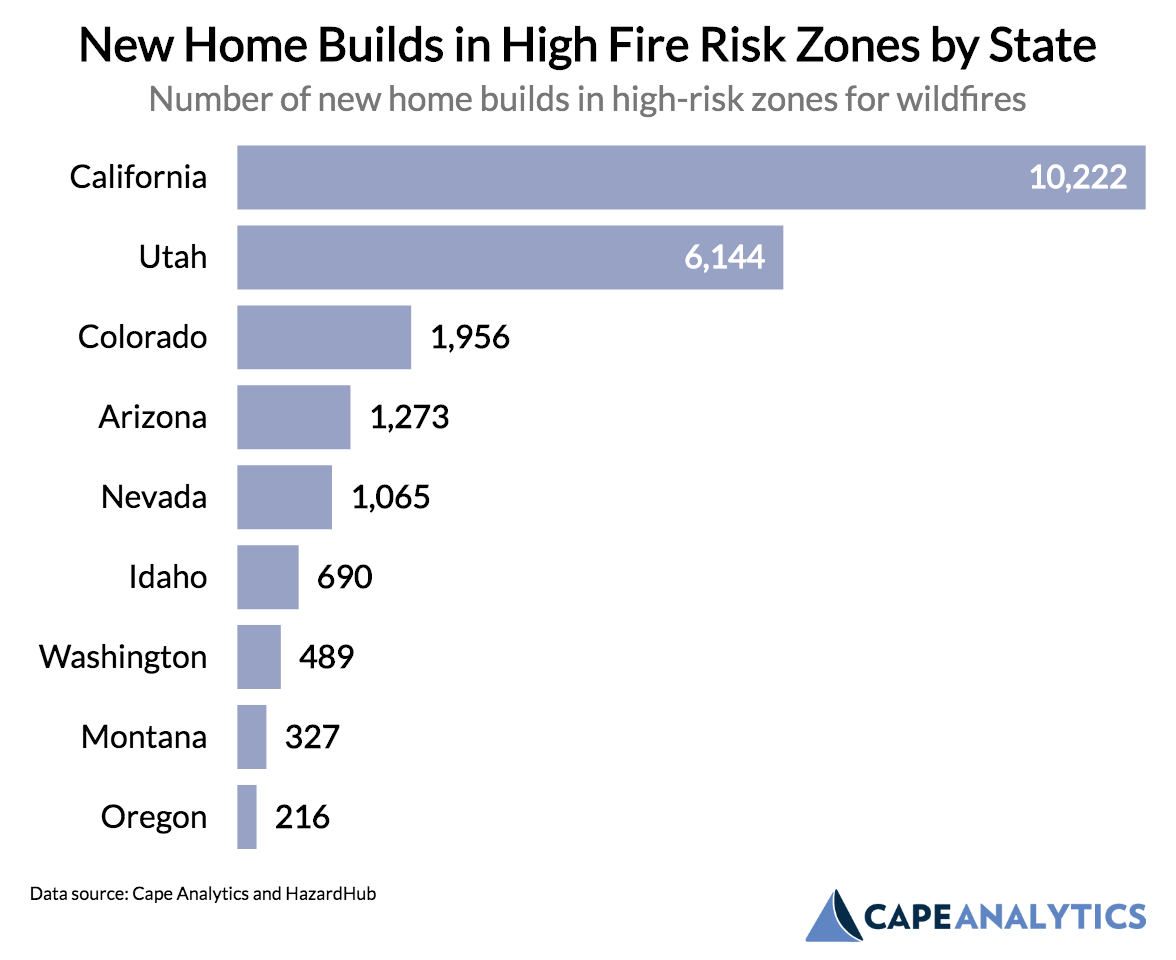

To create this report, we analyzed new homes built over the last decade and found that California leads the West when it comes to the most builds in high-risk areas. Given that California is the most populous state in the country, we can expect a lot of new construction. When adjusting for population size, Utah leads the West by a significant margin in building homes in places with high fire risks.

When looking at specific cities with the most new home construction in high-risk zones in the West, El Dorado Hills, California tops the list, followed by St. George, Utah. In addition, as the pandemic has precipitated an urban exodus, many residents are fleeing into higher-risk fire zones.

Research Strategy

Before diving into the analysis, it’s worth spending a moment on the data and methodology. In this project, we identified new home construction over the last decade in Western states prone to wildfires. Specifically, we focused on areas in or near the Wildland Urban Interface — areas designated by the U.S. Forest Service, where human development and fire-prone wilderness meet. Our hazard data partner, HazardHub, then provided us with a wildfire risk score for each locality. This risk score takes weather, wildfire history, and many other factors into account. Finally, we narrowed down our analysis to new homes built in those high wildfire risk zones.

Findings by State

First, let's look at the raw number of new homes built in the last decade in high wildfire risk zones out West:

Source: Cape Analytics

Over the last decade, California has built over 10,000 homes in areas deemed as high wildfire risk. High land prices and stringent zoning requirements in the California urban core have pushed builders further into rural areas, where the fire risk is much higher. Over the last few years, we have seen how dangerous wildfires can be in these areas of California, as places like Paradise and Santa Rosa have been devastated by fires. Among Western states, Utah ranks second in terms of high fire risk building, followed by Colorado.

However, it’s important to remember that California is the largest state in the United States by population and the third-largest by landmass. Given its size, we can expect more home construction in California compared to other states.

To account for this size question, we’ve adjusted by population, to see where states are building more homes in wildfire zones at the highest per capita rate (per 100,000 residents):....

....MUCH MORE

If interested see also September 2014's "California: The Last 200 Years Were The Happy Time For Weather, Get Ready For A Return to The West Without Water"

And as noted in the outro from a 2018 post:

....What follows are some historical comparisons with a couple caveats:

1) the further back in time you go the less precise/reliable the size of the burn area. Death statistics tend to be more accurate.As people move into formerly wild areas they cause a higher percentage of fires versus lightning. On the other hand fires that formerly burned until they ran out of fuel or until the rains came are now battled aggressively.....

2) Because of dramatic land use changes the dynamics of number of fires and extent have changed.

And 2019's "Wildfire: "Insurers Trim Their Risks in California"":

Speaking of fire insurance.Wires in the wood, no good....

We've talked about how wildfire risks multiply simply by having more and more and more people living in previously wild or semi-wild areas.

Then when you run electricity into these areas that are no longer allowed to burn naturally, when the wires break and the land does catch fire, you have a disaster on your hands....

Historically Significant Wildland Fires

| Date | Name | Location | Acres | Significance |

| October 1871 | Peshtigo | Wisconsin and Michigan | 3,780,000 | 1,500 lives lost in Wisconsin |

| 1871 | Great Chicago | Illinois | undetermined | 250 lives lost |

| 17,400 structures destroyed | ||||

| September 1881 | Lower Michigan | Michigan | 2,500,000 | 169 lives lost |

| 3,000 structures destroyed | ||||

| September 1894 | Hinckley | Minnesota | 160,000 | 418 lives lost |

| September 1894 | Wisconsin | Wisconsin | Several Million | Undetermined, some lives lost |

| February 1898 | Series of South Carolina fires | South Carolina | 3,000,000 | Unconfirmed reports indicate 14 lives lost and numerous structures and sawmills destroyed |

| September 1902 | Yacoult | Washington and Oregon | 1,000,000 + | 38 lives lost |

| April 1903 | Adirondack | New York | 637,000 | Large amount of acreage burned |

| August 1910 | Great Idaho | Idaho and Montana | 3,000,000 | 85 lives lost |

| October 1918 | Cloquet-Moose Lake | Minnesota | 1,200,000 | 450 lives lost |

| 38 communities destroyed | ||||

| September 1923 | Giant Berkley | California | undetermined | 624 structures destroyed and 50 city blocks were leveled |