This piece is four days old. Oil is now over $81 (WTI) and $85 (Brent)

From ZeroHedge, July 27:

Oil Jumps Over $80 Ahead Of Looming 2 Million Bpd Q3 Deficit

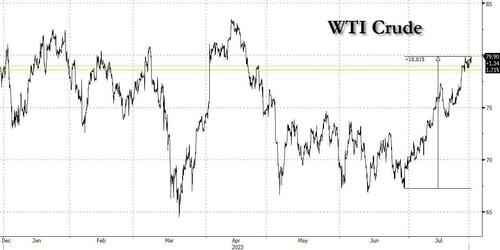

Having been crushed for much of 2023, and left for dead by momentum chasers, oil has staged a long-overdue rebound from the YTD lows in the mid-60s in late June, rising almost 20% to a three month high of $80 earlier today, and back over the 200DMA, something it hadn't done since August of 2022.

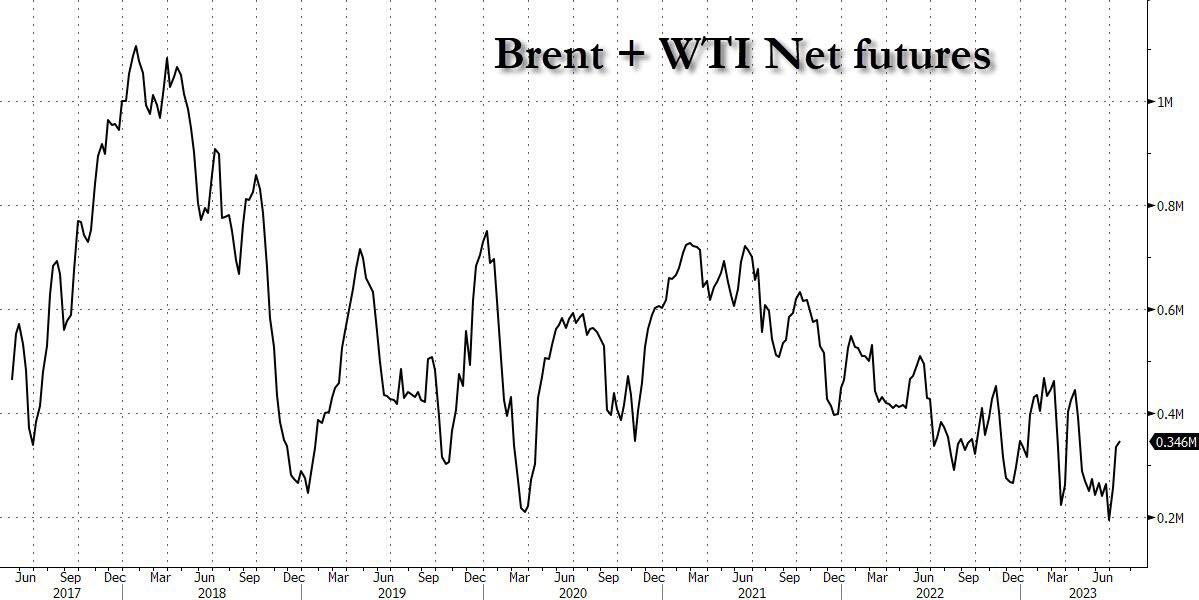

And while there are numerous reasons for oil's sharp bounce (which will flow through into headline CPI next month, slamming the brakes on any hope that the Fed will reverse its tightening posture soon) including expectations of Chinese stimulus, near record low futures positioning...

...the most recent bullish thesis is that as a result of the recent sharp cut in OPEC+ production which is only now starting to emerge (especially when it comes to Russian output), oil markets are set for large supply deficits over the next two months as a seasonal increase in demand combines with producer output restraint.

One proponent of this theory is long-running commodities bull Goldman Sachs whose chief commodity strategist Daan Struyven told CNBC's “Squawk Box Asia” that the bank expects record demand in oil markets to send deficits soaring and drive crude prices higher in the near term.

“We expect pretty sizable deficits in the second half with deficits of almost 2 million barrels per day in the third quarter as demand reaches an all-time high" Struyven said and added that the bank forecasts Brent crude to rise from just above $80 per barrel on Monday to $86 per barrel by year-end. It's already at $84 and rising fast....

....MUCH MORE

Recently:

If You Watch Inflation Professionally, This May Be Of Interest

Gasoline Is Surging All Over the World in Fresh Inflation Blow

PCE Inflation Up 0.2% in June, Up 3.0% Year-over-Year

There was a fleeting chance for a rapprochement with the Saudis in that long ago first week of June:

"Oil Surges After Saudis Make Additional 1 Million Bpd Voluntary Production Cut"Emphasis added.President Biden should immediately, right now, today, make some sort of agreement with Saudi Arabia to refill the U.S. Strategic Petroleum Reserve over the next six or eight months, coincidentally an implied rate of around 1mm Bpd .

But he and his handlers probably won't see the opportunity and our Energy Secretary is an energy moron and much like the Transportation Secretary, was promoted far past her/his abilities, so who's left to push for the prize and seize the opportunity?....