From Phoenix Capital Research via ZeroHedge, originally published under the headline:

If You’re Worried About Inflation, You Need to Read This

A headline we wouldn't use because a) most of our readers don't "worry" about much of anything and b) the day I begin to tell people they "need" to do something is the day I should probably check-in to the Arrogant Narcissists Home & Spa.

From ZH, July 24:

Inflation has very likely bottomed for 2023.

The inflation data published in the U.S. is based on year over year comparisons. When the Consumer Price Index (CPI) comes out at 5%, what it’s really stating is that a basket of goods and services costs ~5% more currently than it did a year ago.

This is called the base effect: a comparison between two data points in which the current one is expressed as a ratio of the older one. And it can result in some pretty strange circumstances if you’re not careful.

Situations like the one we’re in today.

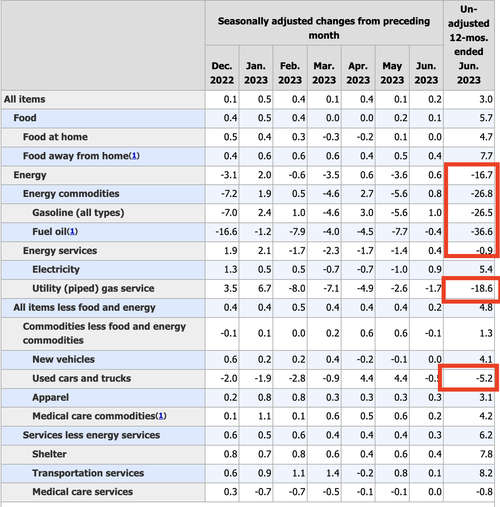

For most of the first half of 2023, inflation, as measured by the year over year comparison for the CPI has been trending down. However, as I’ve noted repeatedly, the only part of the inflationary data that is declining is energy prices (well that and used car prices).

See for yourself.

I mention this, because it is increasingly looking as though oil prices have bottomed.

Oil has spent much of the last 18 months in a downtrend. But that downtrend is about to be broken.

If oil prices rip higher from here, then the inflationary data will begin to turn back upwards. Remember, energy prices are the ONLY part of the CPI that are DOWN. The price of everything else continues to RISE, albeit a slower rate....

....MORE

Here's the action in WTI and Brent via FinViz futures over the last three months (also on blogroll at right:

Related, yesterday:

Gasoline Is Surging All Over the World in Fresh Inflation Blow

And this morning:

PCE Inflation Up 0.2% in June, Up 3.0% Year-over-Year

There was a fleeting chance for a rapprochement with the Saudis in that long ago first week of June:

"Oil Surges After Saudis Make Additional 1 Million Bpd Voluntary Production Cut"President Biden should immediately, right now, today, make some sort of agreement with Saudi Arabia to refill the U.S. Strategic Petroleum Reserve over the next six or eight months, coincidentally an implied rate of around 1mm Bpd .

But he and his handlers probably won't see the opportunity and our Energy Secretary is an energy moron and much like the Transportation Secretary, was promoted far past her/his abilities, so who's left to push for the prize and seize the opportunity?....

Emphasis added.