President Biden should immediately, right now, today, make some sort of agreement with Saudi Arabia to refill the U.S. Strategic Petroleum Reserve over the next six or eight months, coincidentally an implied rate of around 1mm Bpd .

But he and his handlers probably won't see the opportunity and our Energy Secretary is an energy moron and much like the Transportation Secretary, was promoted far past her/his abilities, so who's left to push for the prize and seize the opportunity?

From ZeroHedge, June 4:

Update (6:10pm ET): As expected oil has moved sharply higher upon reopening of trading, WTI was last up around 3% at just over $74 and likely to rise more now that Saudi Arabia has made it very clear that mid-$70s is a red line, and the price of oil will not be allowed top drop even if it means temporarily conceding Saudi market share to other OPEC members.

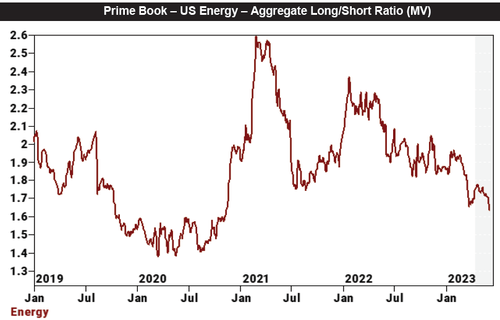

While we expect a more powerful commodity squeeze in the coming hours, the real pain will be in energy stocks, where as Goldman's Prime Brokerage showed, the net exposure is the lowest it has been in three years amid aggressive hedge fund selling and shorting which is about to reverse, to wit: "Hedge funds accelerated selling in US Energy amid price declines this week. This week’s notional net selling in US Energy was the largest in 10 weeks and ranks in the 97th percentile vs. the past five years."

And for those who missed the action earlier, here is a recap of what happened via Goldman's commodities team:

Today’s OPEC+ meeting was moderately bullish, on net, with three main developments.

- First, Saudi Arabia pledged to deliver an additional 1mb/d unilateral “extendible” output cut in July (bullish).

- Second, the voluntary cuts from the 9 OPEC+ countries are scheduled to extend until December 2024, from December 2023 previously (somewhat bullish).

- Third, output baselines will be redistributed in 2024 from countries struggling to reach their targets to those with ample spare capacity (somewhat bearish output effect, but bullish cohesion).

It is important to put these decisions in the context of sentiment and positioning, which remain very weak and short. While the extra Saudi cut is worth +$1-6/bbl in terms of fundamentals, depending on whether the cut lasts 1-6 months, and strength in physical markets (borrowing a recession) should eventually boost positioning and prices, the delivery of Saudi’s first production cut within three months of a prior cut with stocks as low as today and the Saudi Energy Minister’s “whatever is necessary” (Draghi-like) quote signal the group’s commitment to continue to lean against the shorts and preemptively leverage its unusually high pricing power.

Overall, today’s moderately bullish meeting partly offsets some bearish downside risks to our December 2023 price forecast of $95/bbl, including supply beats in Russia, Iran, and Venezuela, and downside risks to China demand. Our balances and price path are under review until our next Oil Analyst.* * *Earlier....

....MUCH MORE