Via the Further Reading post, February 6, posted by Claire Jones, from IHS Markit:

Seeking to explain the lack of observable short covering in shares of Tesla since the start of December

After Tesla reported an unexpected quarterly profit on October 23rd, its share price was launched into an upward trajectory. Between October 23rd and the end of November the share price increased by 30%, while the short interest declined by an estimated 23%. The reaction from shorts surprised no one, as Tesla was already one of the most shorted US equities in terms of dollar value and percentage of shares outstanding, leaving relatively few short sellers to get involved as shares were substantially above the 2019 low observed in May. What happened next, however, has left some scratching their heads at the resiliency of short sellers in the face of a relentless rally which took shares up to $780, or +136% since the start of December. There may be more to the story than meets the eye, if that eye is trained only on the stated short interest.

- Convertible bond arbitrage may constitute half of reported short interest

- Suggests smaller losses for directional shorts than exchange SI would imply

- Hedging of call options sold to Tesla may be contributing to price move

The short interest in Tesla shares was 24.9m shares for January 15th settlement, published by NASDAQ, per FINRA regulated broker dealer disclosures. This suggests that short positions in the electric carmaker only decreased by 1.3m over the first two weeks of 2020 (-5%), while the share price rallied by 24%. Similarly, in December the share price increased by 27%, while the short interest declined by just 8%. Overall that means a 13% reduction in shares short during that 1.5-month span, while the share price increased by 57%. This certainly implies some pain for directional short sellers, however it's worth considering another group which likely increased their short position in share terms during that time: the owners of Tesla's convertible bonds.....MUCH MORE

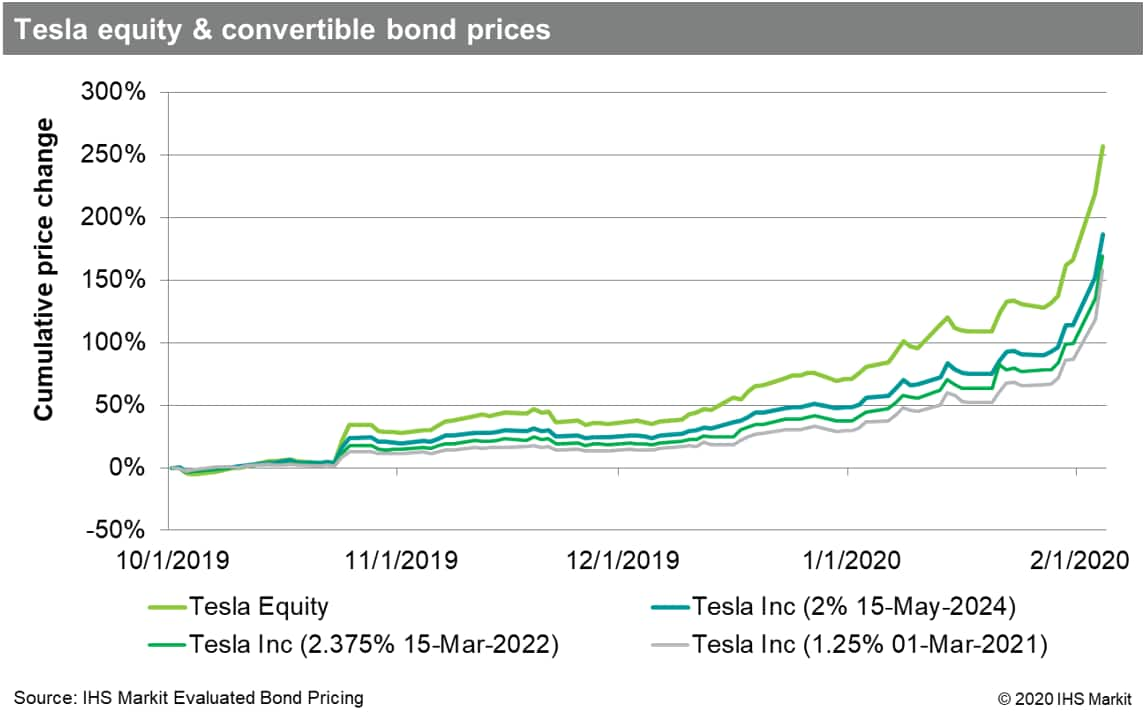

Since the start of December, the price of the Tesla 1.25% 2021 convertible bond increased by 96%, through February 3rd, compared with the 136% increase in the price of the Tesla common equity. For a convertible arbitrageur, there is be a tendency to increase short positions in the common shares up to the point where the delta to the share price reaches 1, meaning that the change in price for the convertible bond equals the change in price for the equity. That appears to be happening now. On February 3rd, the common share price increased by 19.9%, while the 1.25% 2021 convertible increased in by price by 17% (the other two Tesla convertible bonds also saw price increases greater than 17% on the 3rd). As of 10:30am on February 4th, the price of the 1.25% 2021 convert was +18% day over day, per IHS Markit Evaluated Bond Pricing dataset, while the Tesla equity was up "only" 16%.

The implication is that convertible arbitrageurs have likely been increasing their short positions over the last three months and may have only recently completed the process of hedging the embedded options in this last push higher in share price. That may also mean that directional shorts have reduced their exposure by a much larger amount than suggested by looking at the total short interest. If the owners of the convertible bonds have fully hedged the shares into which their bonds could be converted, that would imply 12.7m shares short, just over half the short interest reported for January 15th. Given the 50% increase in share price since January 15th it seems reasonable to assume some amount of directional short covering, however that analysis is muddied for reasons we'll discuss after a brief discursion....

The stock is up $45.97 (+5.75%) at $846.00 on a generally down day.