Combine an El Niño winter with an uptick in production and you've got dogs and cats living together, mass hysteria at the NYMEX, etc.

From RBN Energy:Dreaming Of A White Christmas – Could U.S. Natural Gas Production See Surprise Winter Uptick?

U.S. natural gas production has been essentially flat this summer as many producers curtailed, deferred or delayed drilling and well completions earlier in the year. However, some of the same producers, particularly in the Northeast, in their most recent earnings calls, indicated they expect to meet their 2015 production targets by increasing output this winter. In today’s blog, we look at how and why producers defer production and the potential impacts on the market in Q4.

It’s not surprising that some gas producers deferred well completions this summer. Rates of return have been squeezed all year by a combination of low oil, liquids and gas prices. In response to lower prices, producers have made significant capital budget cuts (see Free Fallin’). And besides low prices and returns, Northeast producers in particular have faced midstream capacity constraints that push down prices to bargain basement levels and make it harder to find economically viable routes to market for new production. Producers responded by laying down rigs (Rig Cuts Deep, Output High!) and shifting their drilling activity and spending towards their most productive acreage (thereby cutting costs and increasing rig efficiency). Additionally, those producers that can afford to hold off production (losing cash flow in the short term – something not all have deep enough pockets to do) have used numerous tools and tricks for delaying production while they weather this tough market environment. These include drilling the minimum required to hold on to leases for future development (see Hold On Tight By Production), not completing (i.e. fracking) already drilled wells and choking back big initial production (IP) rates to restrain output until a pipeline tie-in or better pricing becomes available. Producers typically prefer to defer new production volumes in these ways rather than to shut-in existing wells that are producing, because (as we explained in You Can Pay Me Now, Or Pay Me Later) shut-in economics rarely make sense long term.

The gas production picture has varied across the country with slight growth in the Northeast being offset by declines elsewhere. The Northeast (Marcellus and Utica) continues to drive production growth as it has for the past few years, in particular buoyed by new drilling and record IPs in the dry gas window of the Utica Shale. However, if Northeast producers have delayed completing and tying in wells because of low prices then they could rapidly increase production when conditions improve. Recent earnings calls suggest that some Northeast producers believe that the last quarter of 2015 (i.e. winter) is the time when they could crank up output from deferred wells in order to meet 2015 targets.

The main reason that Northeast producers might be eyeing higher gas production during 4Q2015 is in response to seasonally higher prices. Gas prices tend to be higher in the gas winter months (Nov-March) than in the gas summer months (April-Oct) and typically peak between December and February, because more gas is needed for residential and commercial heating during winter than for electricity generation for air conditioning usage during the summer, at least when assuming normal weather. An abnormally cold winter can cause demand and prices to spike (like we saw in the winter of 2013-14), though price spikes would be dampened in the case of a supply surplus, as they were this past winter (2014-15). A mild winter would exacerbate price weakness in the winter.

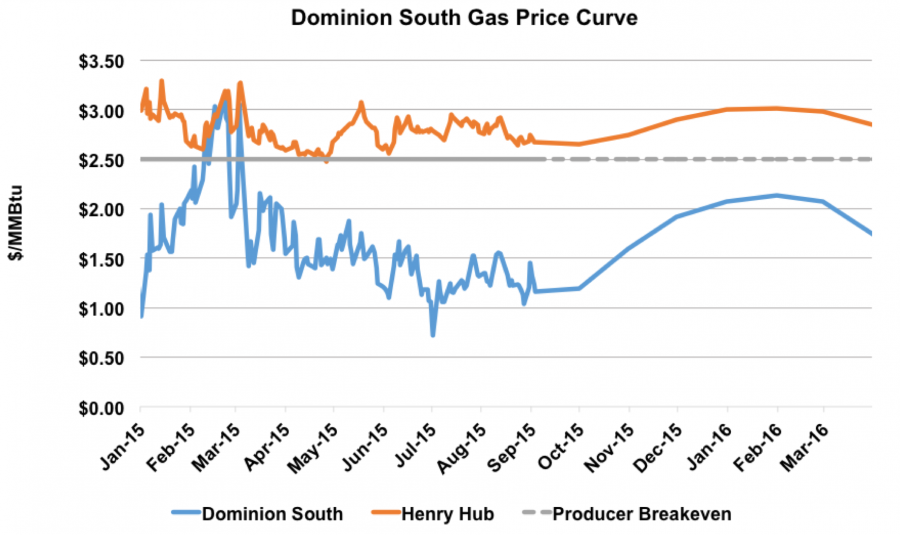

To see if the forward curve (trader’s view today of prices for future delivery) supports the idea of higher production this fall, we looked at the price curve for Dominion South, the benchmark pricing point for some Appalachian (Northeast) production, compared to the U.S. natural gas benchmark pricing point Henry Hub (Figure 1). The left side of the graph shows historical daily cash prices from January 2015 through present (Sept. 9) for Henry Hub and Dominion South (Dom S), based on NGI data; and the smooth lines on the right side are the forward curves from October 2015 through December 2016 for the same pricing points, per EOXLive gas forwards data via Morningstar.

Note that the Henry Hub forward curve (orange smooth line) remains relatively flat to price levels seen earlier this summer of $3/MMBtu. This reflects the overall market view that generally gas prices are not expected to increase significantly this winter because (as we have discussed previously) storage levels are likely to end the winter at or near record levels (see Hold Me Tight). In contrast, while Dominion South forward curve prices (blue line) remain at a discount to Henry Hub, they do indicate greater strength this coming winter than Henry Hub. So far this summer Dom S cash prices have averaged $1.38/MMBtu, well below the average breakeven cost for producers of $2.00 to $2.50/MMBtu. However, the forward curve, which can be viewed as assuming normal weather, is pricing Dom S winter gas over 60 cents higher, closer to an average of $2.00/MMBtu. And while that is still below the breakeven cost for most producers in the Marcellus, it offers all producers improved cash flow from gas sales compared to what they could get this summer as well as the opportunity to capture upside premiums on peak demand days (e.g. during freezing weather) that could significantly exceed breakeven levels if winter turns out to be colder than normal....MOREOctober futures $2.722 up 2.9 cents

February's $3.045 up 2.0 cents