Seriously, what does this crap even mean:

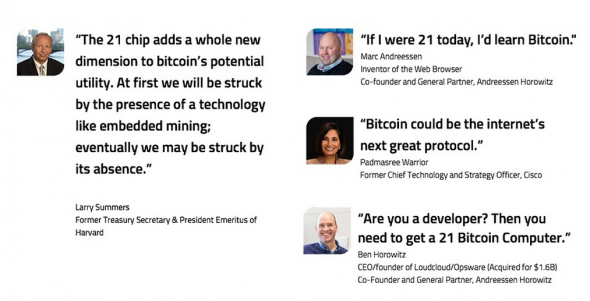

“The 21 chip adds a whole new dimension to bitcoin’s potential utility. At first we will be struck by the presence of a technology like embedded mining; eventually we may be struck by its absence...."Long time readers may remember Larry from such hit posts as:

- Frontline's "The Warning": Now Taking Prop Bets on When Obama Fires Larry Summers' Ass

- The Essential Larry Summers: How He and Alan Greenspan Laid the Groundwork for the Financial Crisis and Larry Lost $1.8 Billion for Harvard

- Breaking: "Summers Expected to Leave White House After Election" (and some thoughts on arrogance)

- Economists for Firing Larry Summers Changing Name to "Economic Policy Advice for President Obama"

- Larry Summers and Treasury Policy: Don't Never, Ever Trust Whitey

You can read a lot about Mr. Srinivasan in "The Silicon Valley Secessionist Clarifies His Batshit Insane Plan" or, for just a soupçon, we have on offer, "Climateer Line of the Day: Uh Oh Andreessen Edition":

...Bitcoins are like “tulips you can send anywhere in the world in arbitrary quantities”.

-Andreessen Horowitz partner Balaji Srinivasan

Mr.Srinivasan may not be aware that, since ca. 1637 or so, tulips have not had the best connotation in the world of finance....Oh, yeah, the trigger for this rant, from FT Alphaville:

21 (grams of digital coke)

In movie parlance, 21 grammes is said to be the weight of the soul.

Keep this in mind as we explore 21 Inc’s big product reveal this week — a $399.99Raspberry Pi that’s also a “bitcoin computer” — which, according to endorsements from Larry Summers (he of secular stagnation fame), Marc Andreessen and others, could be as big as the internet if not a solution to world peace.

The 21 Bitcoin Computer, from 21.co, built atop a platform originally aimed at promoting the teaching of basic computer science in schools, supposedly allows you to mine bitcoins in the background while doing regular computing stuff.

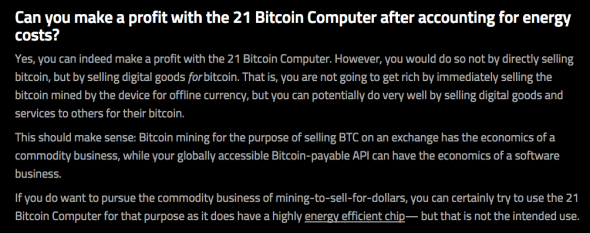

Yet the sum of bitcoins earns is so small that 21 doesn’t even pretend that you can cover the original upfront price of the device, let alone make a profit. You’re paying for the right to waste electricity servicing the bitcoin network in return for a bitcoin shaving that earns you some sort of ‘node’* stake in the system.

Vitalik Buterin at Ethereum has crunched the numbers and he points out:

So you’re paying $399 upfront and getting $0.105 per day or $38.3 per year, and this is before taking into account network difficulty increases, the upcoming block halving (yay, your profit goes down to $0.03 per day!) and, of course, the near-100% likelihood that you won’t be able to keep that device on absolutely all of the time. I seriously hope they have multiple mining chips inside of their device and forgot to mention it; otherwise you can outcompete this offering pretty easily by just preloading a raspberry pi with $200 of your favorite cryptotokens.

You can read more about how the 21 device is fundamentally loss making on 21.co (yes, a Colombian domain). There you will also find useful information about how the value of bitcoin isn’t really underpinned by shameless rent seeking but — who’d have thought — productivity and output. Usefully, 21.co also offer the community these pearls of wisdom about how economics work:

For those now thinking Larry Summers + Miners + Pointless Wasted Energy + Productivity illusion must equal = THE BIGGEST KEYNESIAN COALMINE EXPERIMENT OF ALL TIME… Who knows. Maybe. It’s certainly more convenient than staging a faux alien invasion.

...MORE