From Alhambra Investments:

Eurodollar To Fundamental

By most accounts the Asian “dollar” was quiet last night but now the “regular” eurodollar is in full form. That might suggest greater care with these terms as the yen appears to be in that latter mix despite geographically belonging to the former. For purposes of clarification, then, since Japanese banks were among the original sources of the eurodollar buildup (and the second most difficult of the 2007-08 bottlenecks) in my view they belong to the eurodollar whereas Chinese, Hong Kong and those of perhaps newer entrance form the Asian dollar. The fact that one, the seemingly ancient eurodollar, is alive today while the other is not might again suggest fracture though still quite attached.

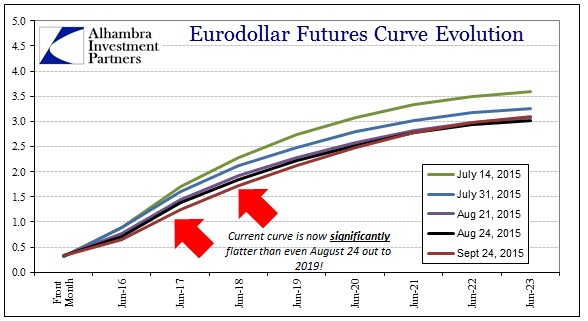

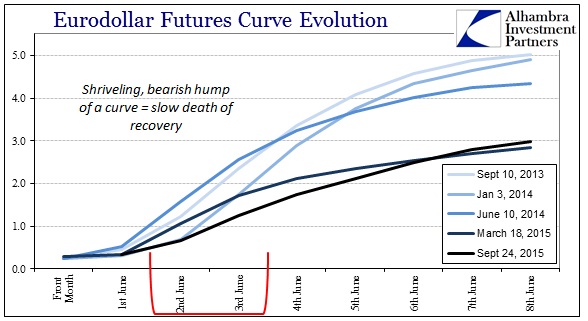

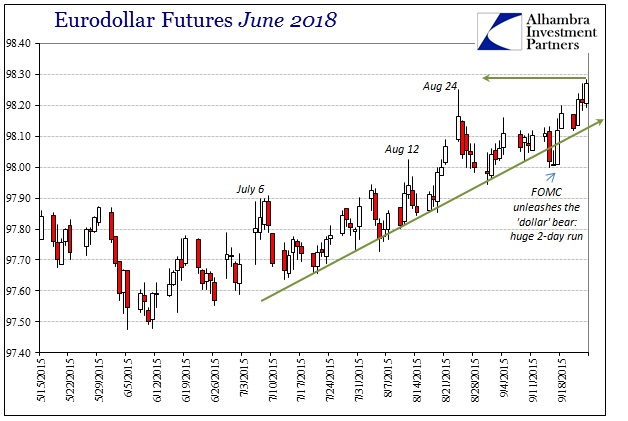

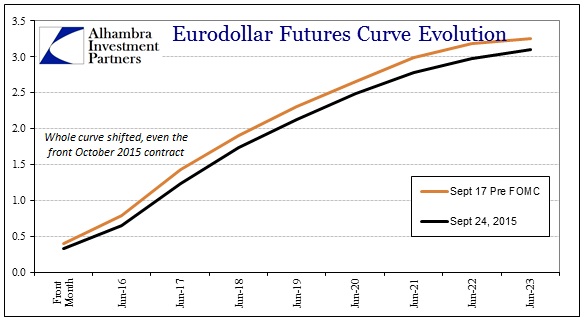

At the moment, eurodollar futures seem to be most indicative of today’s higher tendency toward liquidation. As noted recently, the eurodollar curve has barely paused lately, especially after the FOMC failed to act for the nth time. The curve has been a shriveling, bearish hump for awhile, but that has seemingly amplified in the past week. The June 2018 eurodollar futures has traded today well above the highest price on August 24.

Among the major currency proxies for the “dollar” only the real (nothing new) and yen really stand out. Combined with the eurodollar curve’s trends shown here, and the fact that the Asian dollar is not readily apparent (SHIBOR fixed the same as yesterday, offshore CNH HIBOR was lower O/N and only slightly higher 1W and out), that might suggest more and deeper economic concern rather than raw financial adjustment (though one certainly follows the other). The fact that US stocks and the corporate bubble are aligned with the angry eurodollar seems to further that interpretation....MORE