From Counterpoint Research, December 15/16 2025:

- Global smartphone shipments in 2026 are expected to shrink 2.1% due to rising memory costs.

- We have revised down our 2026 smartphone shipment forecast by 2.6%pts, with Chinese OEMs seeing the biggest downward revisions.

- In terms of price bands, the low-end segment is the most impacted, but the impact is being felt broadly.

- DRAM price surges have already increased low-, mid- and high-end smartphone BoM costs by around 25%, 15% and 10%, respectively. We are expecting further cost impacts in the 10%-15% range through Q2 2026.

- ASPs have been revised up 6.9% YoY (from 3.6% in our September update) as cost pass-through and portfolio rebalancing move wholesale ASPs higher.

Seoul, Beijing, Berlin, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, Taipei, Tokyo – December 16, 2025

Global smartphone shipments are expected to decline 2.1% in 2026 as surging component costs are likely to impact demand, according to Counterpoint Research’s latest Global Smartphone Shipment Tracker and Forecast.

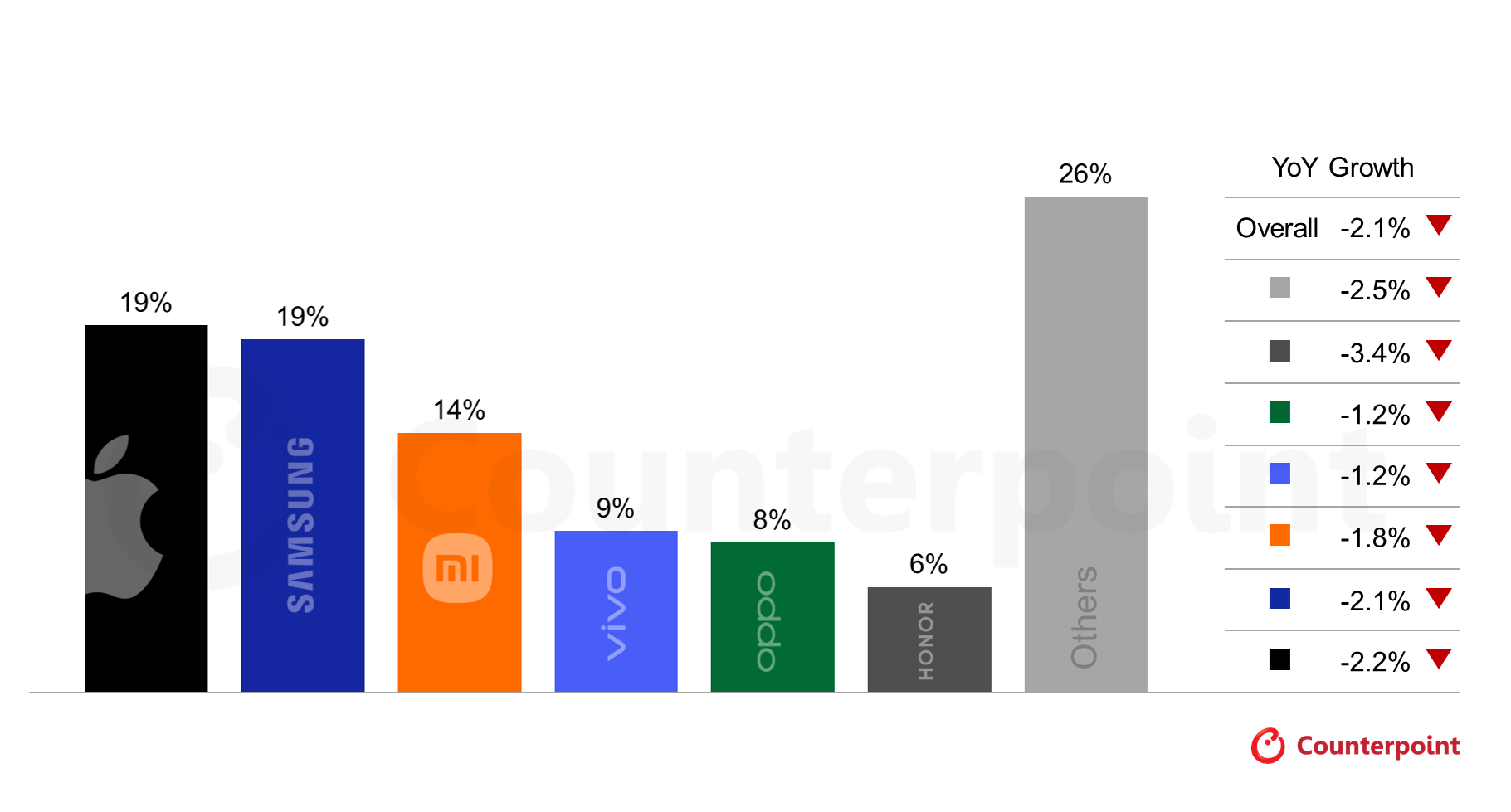

Global Smartphone Market Share and YoY Growth by Key OEM, 2026(E)

Source: Counterpoint Research Global Smartphone Shipment Tracker and Forecast, Dec 2025 Update.

Note: Figures may not add up to 100% due to rounding

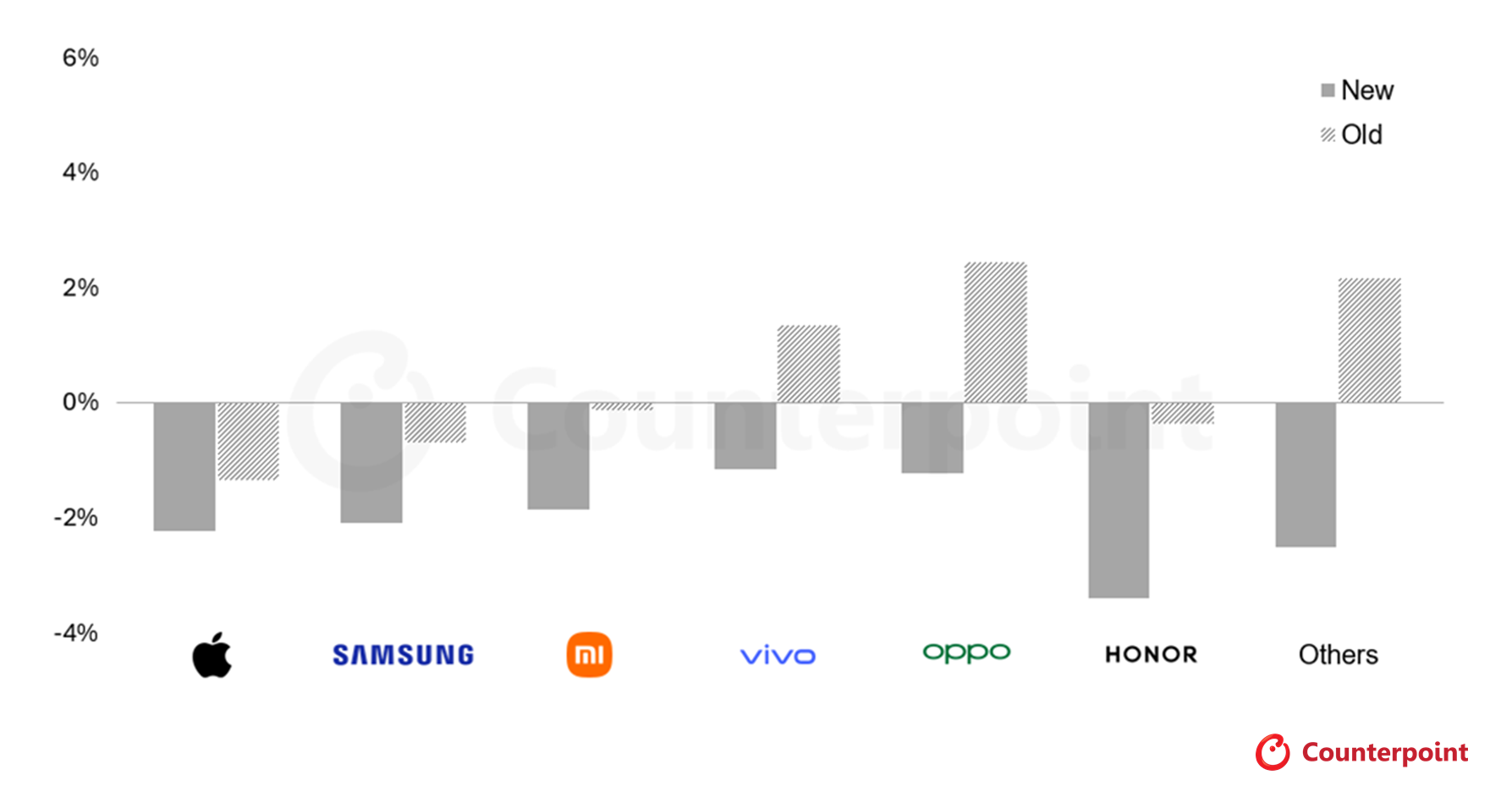

This 2.1% decline translates into a 2.6%pt downward revision in our 2026 forecast, with key Chinese OEMs like HONOR, OPPO and vivo seeing the biggest deltas from previous estimates.

Smartphone Shipment YoY Growth Forecasts and Revisions, 2026

Source: Counterpoint Research Global Smartphone Shipment Tracker and Forecast

Note: New forecast Dec 2025, old forecast Nov 2025

“What we are seeing now is the low end of the market (below $200) being impacted most severely, with BoM (bill of materials) costs increasing by 20%-30% since the beginning of the year,” said Research Director MS Hwang. “The market’s mid- and high-end segments have seen 10%-15% price increases.”....

....MUCH MORE

This follows on the earlier story of the 50% price increase for PlayStation storage.