Just between thee & me, this is one of the best things we could see for medium-term U.S. equity market stability, cutting some froth off the top. Pretty good timing as well.

First up, from Bloomberg, January 19/20:

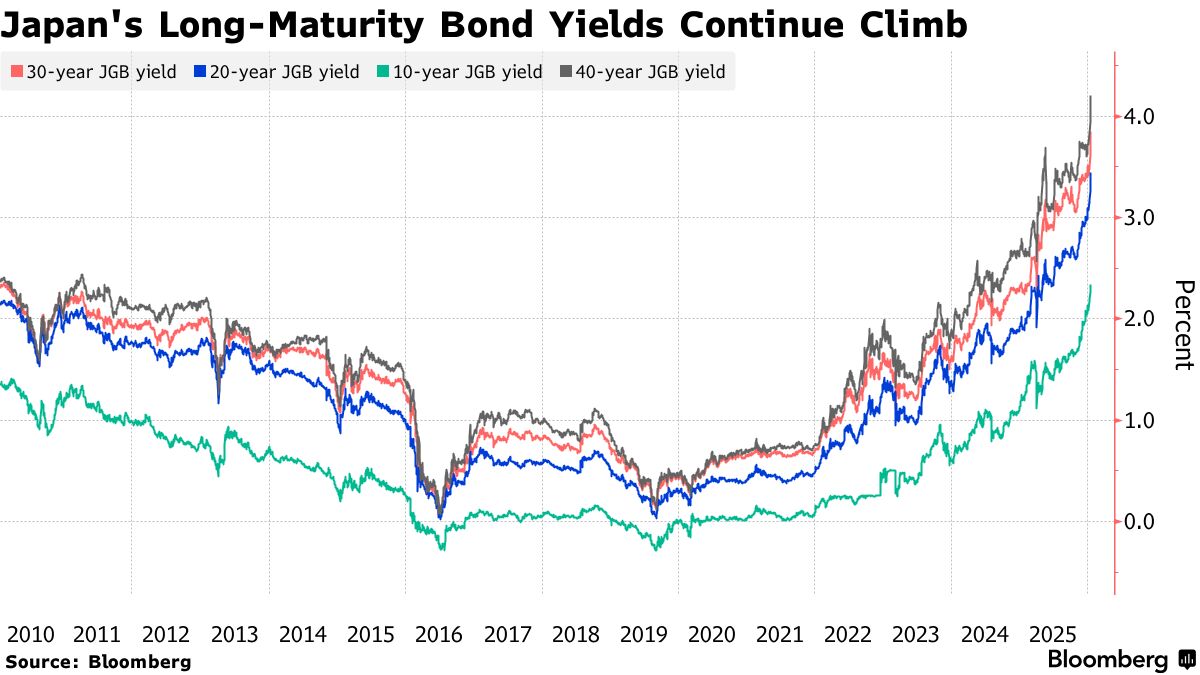

Japan Bond Meltdown Sends Yields to Record High on Fiscal Fears

The slump in Japanese bonds deepened Tuesday, sending yields soaring to records as investors gave a thumbs down to Prime Minister Sanae Takaichi’s election pitch to cut taxes on food.

The 40-year rate rocketed past 4% to a fresh high since its debut in 2007 and a first for any maturity of the nation’s sovereign debt in more than three decades. The jump in 30- and 40-year yields of more than 25 basis points was the most since the aftermath of President Donald Trump’s Liberation Day tariffs onslaught in April last year.

A lackluster auction of 20-year earlier underscored broader worries over government spending and inflation. Treasuries, already under pressure on concern that tariffs may dim the allure of US assets, extended declines as the selloff in Japanese debt accelerated.

Since Takaichi took office in October, the 20- and 40-year yields have risen about 80 basis points. Investors are on guard for moves in Japan spilling over into global markets amid the prospect of continued volatility in Tokyo trading ahead of the snap poll Takaichi is scheduling for Feb. 8.

“There is no clear funding source for the consumption tax cut, and markets expect it to be financed through government bond issuance,” said Yuuki Fukumoto, senior financial researcher at NLI Research Institute. “The bond market is effectively the canary in the coal mine,” Fukumoto said, adding that “it’s hard to see a scenario where buying bonds makes sense.”....

....MUCH MORE

And the headline story, also Bloomberg, January 19/20:

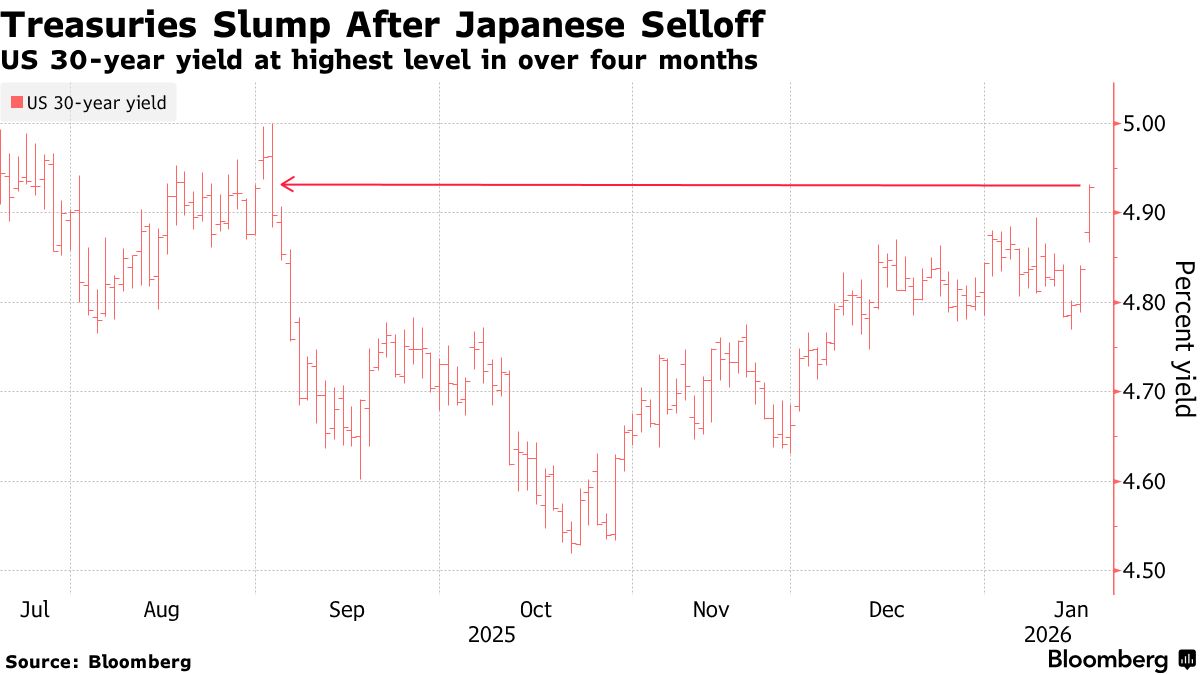

Treasury yields rose to the highest in more than four months as a fierce selloff in Japanese bonds spilled over into global debt markets.

Longer maturities led losses, with US 30-year yields rising nine basis points to 4.93% and 10-year yields up seven basis points to 4.29%, the highest levels since Sept. 3.

Trading of the securities resumed following a US holiday on Monday, with investors reacting to a tumble in Japanese bonds, as well as rising tensions between Europe and the US over control of Greenland.

Concern around Japan’s fiscal outlook sent yields on the nation’s 40-year debt rocketing above 4% in the Asian session, the most on record. That’s weighing on long-dated debt around the world, with 30-year bonds also underperforming in Europe.

“Yields on JGBs have reached levels that make investing in US Treasuries unattractive on a currency-hedged basis,” said Ronald Temple, chief market strategist at Lazard Asset Management. “If JGB yields continue to rise, a rational choice by Japanese investors could be to move capital back to Japan.”....

....MUCH MORE