Why yes, yes I have and here's another of her tweets that demonstrate same:

And the headline story from Zerohedge:"The Treasury is increasing pressure on the Fed to extend the duration of their purchases. It is almost a necessity now." -- Priya Misra at TD Securities on the massive increase in Treasury issuance https://t.co/QXKbDtj2D9— Colby Smith (@colbyLsmith) August 6, 2020

Precious metals are getting pummeled this morning as real rates rise amid vaccine optimism and hotter than expected inflation data...

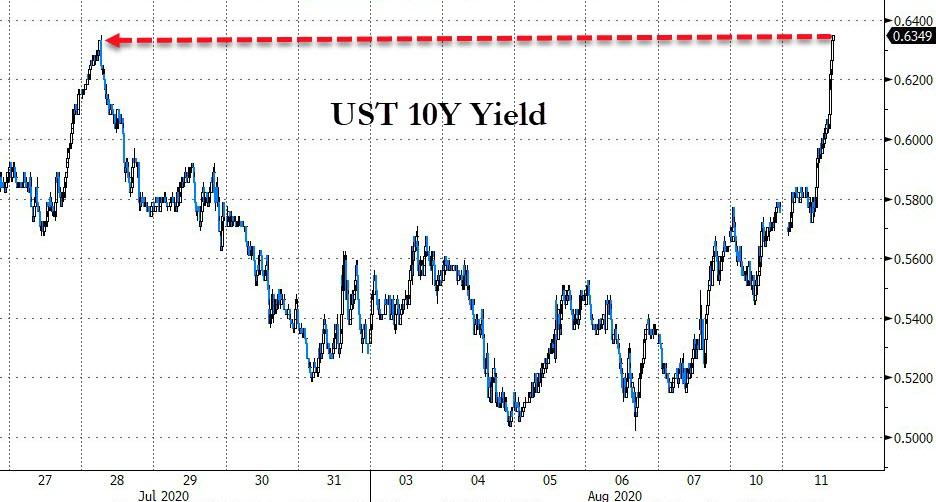

Bonds are also getting slammed with 10Y Yields back above 60bps at 10-day highs...

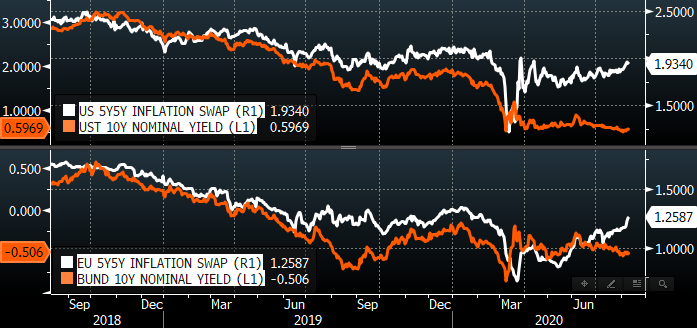

As Nomura's Charlie McElligott reiterates (from his call last week), "inflation expectations" are beginning to adjust higher - Inflation swaps in U.S. and Europe (fickle traders, no doubt) are beginning to tell a story of nascently accelerating global views towards forward inflation - something that was inconceivable to nearly all just a few months ago and now coinciding with the back-to-back weeks of U.S. M2 decline, showing a decrease in risk-aversion and saving and a “less bad” economic outlook from corporates.

And as real yields rise, gold prices fall...

As the Nomura MD has noted over the past few weeks, the SPX macro factor regime has transitioned from “Liquidity” macro factor measures which led the March Equities recovery:

....MORE1. Fed QE Expectations - 1y5y USD Rate Vol,

2. Fed Rate Cut Expectations - ED$ Curve,

3. USD Liquidity - FX Basis Swaps

If interested see also:

"Treasury Announces Record $112BN Quarterly Debt Sale, Unveils Tsunami Of New Bond Issuance"

As noted in the introduction to July 30's "Tech stocks set to lead market higher Friday after the big four post blowout earnings, QQQ gains 1%":

The thing to keep an eye on are rates, not equities.Gold and Negative Real Interest Rates

Sometime in August we expect Treasury issuance to exceed Fed buying causing a backup in rates.

Current ten year: 0.5410% -0.0380% .

Since the Fed can buy any amount they want, up to and including all issuance (and even all outstanding!), the mismatch will by definition have to be a deliberate decision, although it won't be communicated as such.

Right now equities are a distraction that will trade higher for a few weeks....

Head Of NY Fed's Trading Desk Says If Markets Continue Improving, "Fed's Purchases May Stop Entirely"

You have been warned. (a few times now)

June 22

Wolf Richter: " I, Who Hates Shorting, Just Shorted the Entire Stock Market. Here’s Why"

....Either way though, he also gifted us with this lovely little Easter Egg:

Fed Ends QE, Total Assets Drop. Liquidity Injection EndsThat reduction in support for risk assets will take a while to play out, maybe August which would set up first a bond and then an equity decline going into September - October.

by Wolf Richter • Jun 18, 2020

Something that some very big money wishes to see happen.