That is up 0.034 (+6.6019%), going the wrong way for most macro bets but not yet worrying.

As noted in the introduction to July 30's "Tech stocks set to lead market higher Friday after the big four post blowout earnings, QQQ gains 1%":

The thing to keep an eye on are rates, not equities.The FT's Colby Smith has been keeping an eye on this.

Sometime in August we expect Treasury issuance to exceed Fed buying causing a backup in rates.

Current ten year: 0.5410% -0.0380% .

Since the Fed can buy any amount they want, up to and including all issuance (and even all outstanding!), the mismatch will by definition have to be a deliberate decision, although it won't be communicated as such.

Right now equities are a distraction that will trade higher for a few weeks....

Here she is a couple days ago:

And as our kick-off to July 24's "Gold and Negative Real Interest Rates"The Treasury department plans to borrow an additional $2.2tn through the end of the year -- $947bn between July and September and an additional $1.2tn between October and December https://t.co/IzDBrPlOO3— Colby Smith (@colbyLsmith) August 3, 2020

And today's headliner from ZeroHedge:

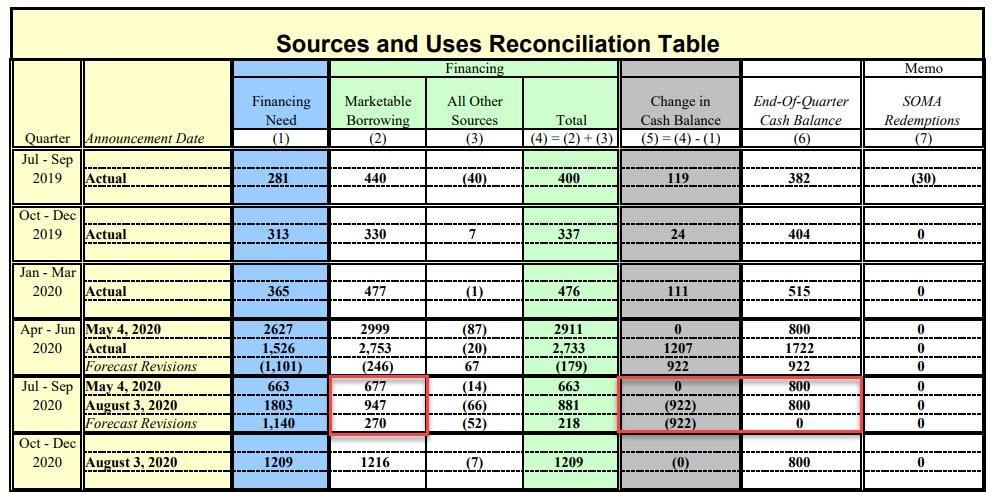

Just two days after the Treasury unexpectedly hiked its forecast for debt issuance in the current quarter by $270BN from $677BN to $947BN (after a record $2.75 trillion last quarter)...

... it was generally expected that today's quarterly refunding announcement would be another blowout with the Treasury expanding its issuance of longer-term debt in coming months, after depending mainly on shorter-dated bills to fund the record deficit.

Sure enough, it was all that and more.

Specifically, the Treasury announced that it would offer a record $112 billion of long-term Treasurys to refund approximately $49.5 billion of Treasury maturing on August 15, 2020. This issuance will raise new cash of approximately $62.5 billion. The securities are:

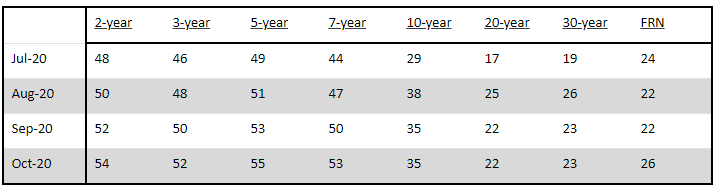

In addition, the Treasury also announced that it anticipates increasing the sizes of the 2-, 3-, and 5-year note auctions by $2 billion per month. As a result, the size of the 2-, 3-, and 5-year note auctions will each increase by $6 billion by the end of October. Treasury also anticipates increasing the size of the 7-year note auction by $3 billion per month over the next three months. As a result, the size of the 7-year note auction will increase by $9 billion by the end of October.

- $48BN in 3-year notes maturing August 15, 2023, Exp. $48BN vs $42BN in May;

- $38BN in 10-year notes maturing August 15, 2030; Exp. $35BN, vs $32BN in May;

- $26BN in 30-year bonds maturing August 15, 2050, Exp. $25BN vs $22BN in May;

Treasury is also announcing increases of $6 billion to both the new and reopened 10-year note auction sizes, and increases of $4 billion to both the new and reopened 30-year bond auction sizes starting in August.

The table below presents the anticipated auction sizes (in $ billon) for the upcoming quarter; of note, the schedule exceeds that TBAC's recommendations, suggesting a mismatch with primary dealers:

In total, the Treasury expects that over the three months through October, it will ramp up nominal coupon issuance by a total of $132 billion compared with the previous quarter; it also intends to increase auction sizes across all nominal coupon tenors over the August-October quarter, with larger increases in longer tenors (7-year, 10-year, 20-year, and 30-year). Treasury also intends to modestly increase auction sizes for FRNs while leaving auction sizes for TIPS unchanged.....MORE

over the July-September quarter, Treasury anticipates borrowing to be $947 billion (compared to the $2.753 trillion of realized borrowing in the April-June quarter). The July-September borrowing need will ultimately depend on the final provisions of the additional legislation....

Related:

Jubilation: Keynes and the Euthanasia of the Rentier

Head Of NY Fed's Trading Desk Says If Markets Continue Improving, "Fed's Purchases May Stop Entirely"

You have been warned. (a few times now)

Wolf Richter: " I, Who Hates Shorting, Just Shorted the Entire Stock Market. Here’s Why"

....Either way though, he also gifted us with this lovely little Easter Egg:

Fed Ends QE, Total Assets Drop. Liquidity Injection EndsThat reduction in support for risk assets will take a while to play out, maybe August which would set up first a bond and then an equity decline going into September - October.

by Wolf Richter • Jun 18, 2020

Something that some very big money wishes to see happen.