The Fed is funding consumption circuitously via Treasuries and government stimulus spending, shifting impact from asset prices to consumer prices.

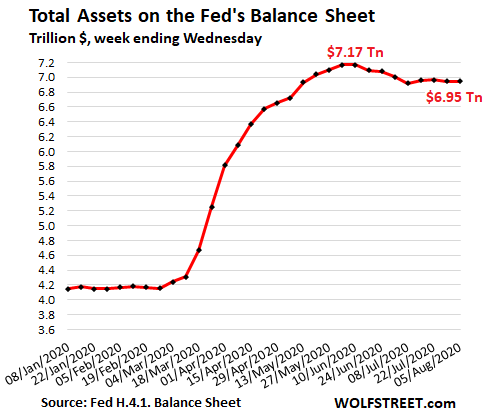

Total assets on the Fed’s balance sheet for the week ended August 5, released this afternoon, declined by $4 billion from the prior week, to $6.945 trillion. In the week ended June 10, total assets eked to a peak of $7.17 trillion. In the eight weeks then, they have fallen by $224 billion:

Repos continue to be zero, week 5.The Fed is still offering huge amounts of repurchase agreements every day, but since it made them purposefully less attractive in mid-June by raising the bid rate, there have been no takers:...

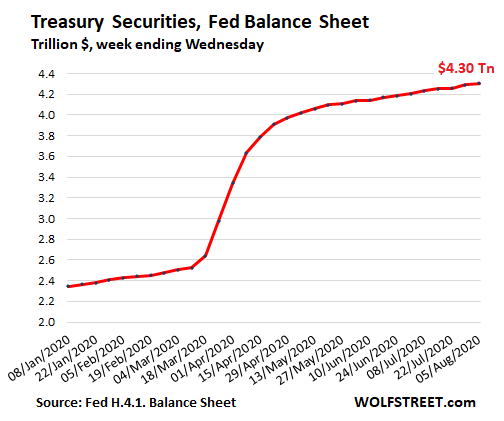

*****....Treasury securities rose by $12 billion to $4.30 trillion.

Think about this: The government is issuing an enormous amount of new debt to fund the stimulus spending, such as the stimulus payments to consumers and the large-scale unemployment insurance payments. Much of this stimulus money is spent by consumers which supports the economy. When the Fed buys Treasury securities as the government issues them, it in essence sends its funds on a circuitous route via those Treasuries and the government stimulus into consumption. This mechanism is shifting part of the impact from asset prices to consumer prices....MUCH MORE