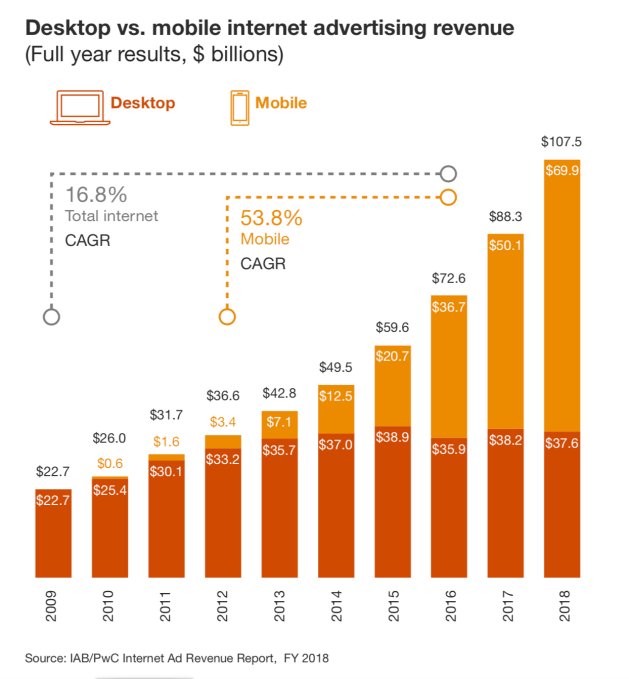

Digital ad spending in the United States exceeded $100 billion for the first time last year, according to the latest internet advertising report from the Interactive Advertising Bureau and PricewaterhouseCoopers.Specifically, total domestic spending reached $107.5 billion, a 22% increase from 2017. Mobile advertising has become increasingly dominant, growing 40% year-over-year, to $69.9 billion. And video ad spending grew 37% to $16.3 billion.

Sue Hogan, the IAB’s senior vice president of research and measurement, said that in the past, mobile ad spend has lagged behind time spent on those devices. But now, she said, “That parity is almost being reached. Eyeballs are being followed by dollars.”

PwC partner David Silverman acknowledged that this leads to an obvious follow-up: Once ad dollars catch up to consumer attention, will growth slow? In Silverman’s view, “the industry has found ways to evolve” in the past, and it will again.

“There’s other shifts that are occurring now,” he added, pointing to the growth in digital audio advertising (up 23% to $2.3 billion), as well as other areas like out-of-home advertising and bringing ads to new devices.And from The Motley Fool, April 8:

One of the recurring concerns about the digital ad industry is its dominance by Facebook and Google. While the IAB report doesn’t single out specific companies, it does measure concentration in terms of how much spending is going to the top 10 ad sellers. In 2018, those sellers collected 77% of total spending — the IAB says the percentage has fluctuated between 69% and 77% in the past decade....MORE

...Several big ad agencies more than doubled their spending on Amazon last year as the company ramped up its advertising business. The banners atop search results and sponsored listings within search results grew increasingly common. Amazon doesn't break out its ad revenue, but its "other" revenue line item, which consists mostly of advertising, more than doubled in 2018, to $10.1 billion.Previously:

Most of Amazon's revenue growth is coming at the expense of another digital advertising giant: Google, the Alphabet company. The majority of the increase in Amazon ad budgets came from Google search ad budgets at some of the biggest ad agencies, according to a report by The Wall Street Journal....

April 2019

"Amazon quietly removes promotional spots that gave special treatment to its own products as scrutiny of tech giants grows" (AMZN)

March 2019

"Amazon is blocking ads for products that lose money" (AMZN)

January 2019

Behavioral Econ.:"Advertising and the Death of Don Draper"

January 2019

"Amazon’s Biggest Bull Says It Should Disrupt Gas Stations" (AMZN)

And dentistry!

(captive audience for advertising)

Sept. 2018

Media—Amazon Wants To Run Digital Advertising and Subscriptions For Newspapers

Sept. 2018

"Amazon is number three in online ads, closing in on Google and Facebook" (and why they're going to need it) AMZN

July 2018

"Jeff Bezos and Amazon have the advertising industry looking over its shoulder" (AMZN)

July 2018

"Amazon ad sales top $2 billion, its fastest-growing segment" (AMZN)

January 2018

Platforms: Amazon Could Make Billions From the Ad Business (AMZN)

April 2017

Media: Google and Facebook's ‘Digital Duopoly’ and What Role Advertising Plays in All of It (plus Jeff Bezos and Izabella Kaminska stop by) GOOG; FB; AMZN

November 2016

Google, Facebook And a Deep Dive Into The Future of the Future (GOOG; FB)

October 2012

Amazon’s Next Big Business Is Selling You (and your data) AMZN

And many more, use the 'search blog' box if interested.