From Camelot Portfolios, May 10:

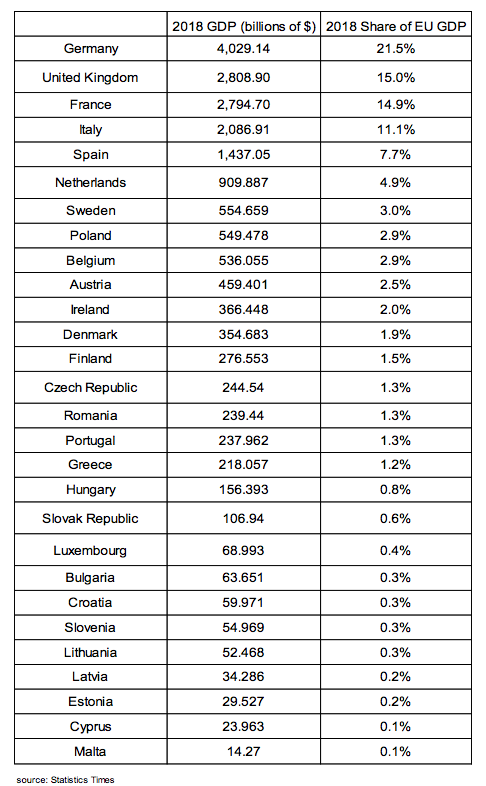

With protests by yellow vests in France approaching their six month anniversary and the European economy showing signs of not a temporary dip, but prolonged weakening, it is a good moment to take a step back and analyze the current situation as well as its implications for the medium to long-term outlook for Europe.As we see it, European economies have been weakening significantly, and even worse, Germany, the European Union’s largest economy comprising almost 21% of the area’s GDP in 2018[i], is on the verge of recession. With Germany the economic locomotive of the euro area, there may not be much reason to be optimistic. The country’s economic problems appear to be structural, due to high taxes, excessive government spending, failed energy policies and other regulatory constraints. Thinking about the years ahead, we aren’t optimistic that the policy response from the German government -- as well as other European governments such as in France, Italy and Greece -- will be strong enough to avoid a prolonged economic malaise for the continent. As a result, we believe that the global economy will suffer from Eurosclerosis in the coming years.

Figure 1: GDP of EU Member States and Share of Total. Source: Statistics Times.

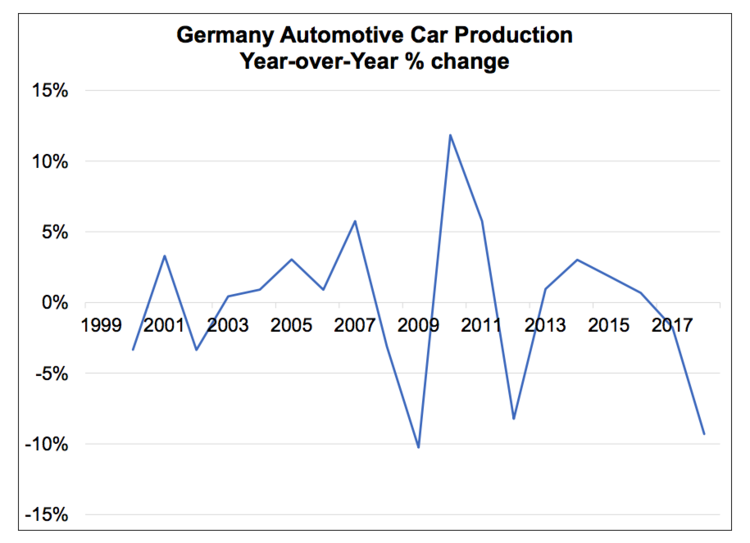

Struggling European EconomiesAccording to the OICA, automobile production in Germany fell 9.3% in 2018[ii], year-over-year. In our view, the prospects for Europe’s leading economy are ominous given that the auto industry is linked to almost 8%% of German GDP.[iii] Business sentiment in Germany appears to have recently turned from euphoria to gloom: as of April 2019, IFO business sentiment has declined 2.8%[iv] while the Markit/BME purchasing managers index has crashed from 58.1 to 44.5 year-over-year[v].

Figure 2: German Automotive Car Production.

Source: International Organization of Motor Vehicle Manufacturers

Optimists could point to low unemployment in Germany, which hovers near 5%, according to the OECD[vi]. But low unemployment data could be misleading because German companies can be reluctant to lay off workers, not only because restrictive labor laws make layoffs difficult and expensive, but also because hiring talent can be a lengthy drawn-out process should the economy recover quickly. Many firms experienced that problem during the last decade of relative economic strength when qualified labor was hard to come by and growth for some firms remained below potential due to labor shortages. While this helps to sustain economic statistics, it can destroy corporate profitability and eventually end up costing investors.....MUCH MORE

According to Eurostat, real GDP growth in Germany is waning, growing only 0.6% in Q4 2018, from 2.8% in Q4 2017[vii]. We are worried about the specter that when Europe’s economic locomotive sneezes, the rest of the continent catches a cold.

Unfortunately, the situation in most of Europe is just as gloomy. According to Eurostat, Italy experienced 0% growth in real GDP year-over-year in Q4 2018 (compared to 1.7% in Q4 2017), while France’s real GDP grew 1.0% in Q 2018 (compared to 2.8% in Q4 2017)[viii]. While Italy seems hard pressed to enact aggressive pro-growth stimulus due to European Union budgetary rules, there doesn’t seem to be much appetite by President Macron to catalyze the French economy by increasing business-friendly incentives. Furthermore, the ongoing protests by the yellow vests inside France, which underscore the economic frustration among many French people, should hamper the growth picture further. And across the Channel, the UK may or may not struggle with Brexit, and while the eventual outcome could be positive, strains during any transition are likely.

The sluggish GDP data in Europe is supported by poor industrial production, which has been declining in Italy, the UK, France and Germany since late 2017. In sum, the four leading European economies appear to be simultaneously entering a state of economic distress.....

Enough footnotes to make Bloomberg's Matt Levine envious.