Market volatility has reared its ugly head once again in recent weeks as the trade war with China took a turn for the worse and global economic data continues to weaken. On Thursday, the Dow lost 286.14 points, or 1.1%, the S&P 500 fell 34.03 points, or 1.2%, and the Nasdaq Composite dropped 122.56 points, or 1.6%. From a technical perspective, the S&P 500 is sitting just above a key support level at 2,800. The S&P 500 has bumped its head or bounced off of this levels quite a few times since early-2018. If the S&P 500 closes below 2,800 in a decisive manner, it would increase the likelihood of further downside.

The Dow Jones Industrial Average is sitting just above its 25,250 support level that it has bounced off of in recent months. If the Dow closes below this level in a convincing manner, it may foreshadow even more downside action.

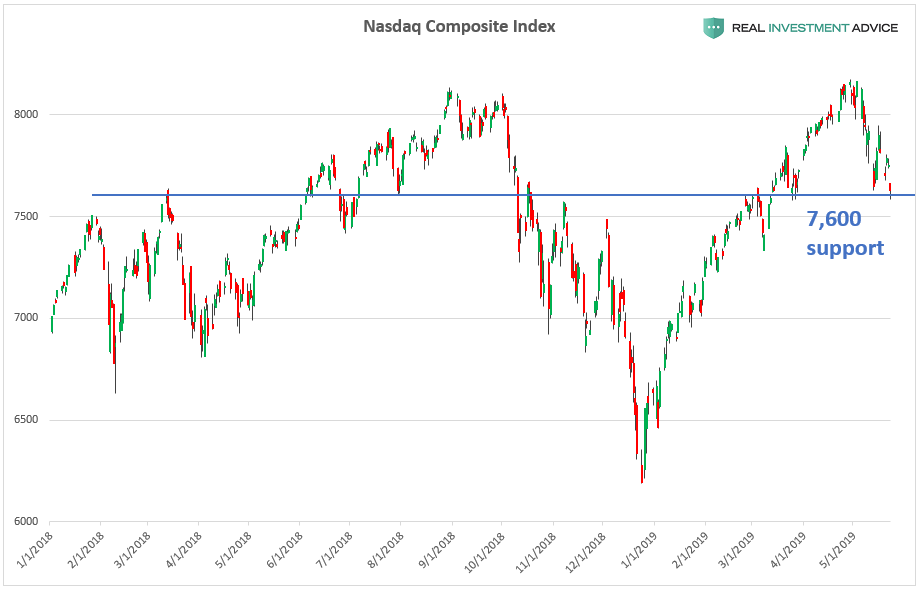

The tech-oriented Nasdaq Composite Index is just above its 7,600 support level that has come into play several times in the past year. If the Nasdaq closes convincingly below 7,600, further bearish action is likely.The Russell 2000 Small Cap Index closed just above its 1,500 support level. If it closes below this level, further weakness is likely....MORE

S&P 500 2,831.61 +9.37 (+0.33%)

Dow 25,599.29 +108.82 (+0.43%)

Nasdaq 7,663.20 +34.91 (+0.46%)