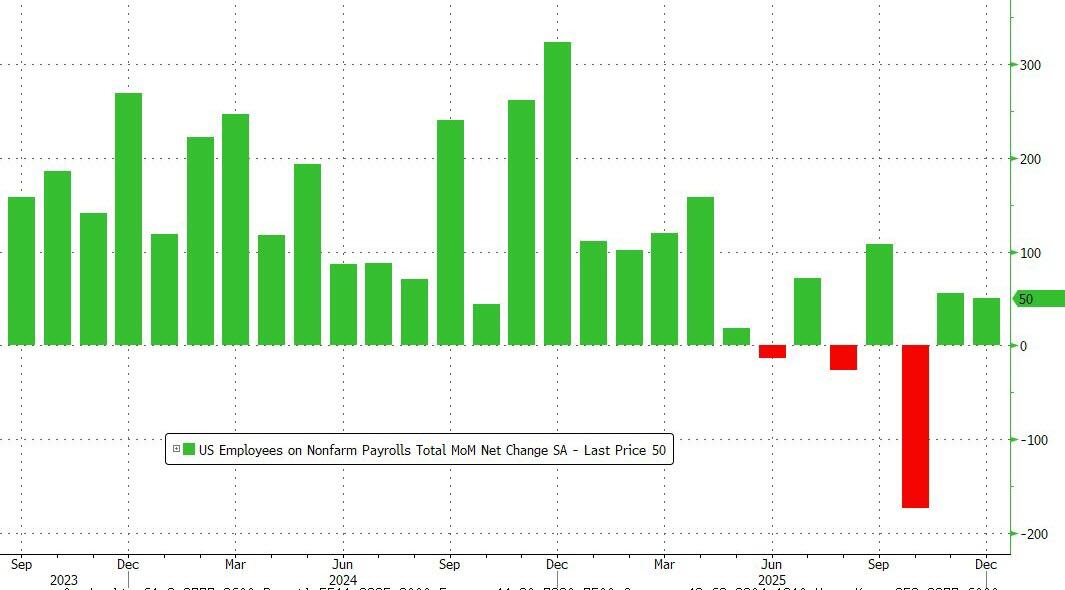

This is not the 2019 job market and unless your expectations are ratcheted down, reality will continue to mess with your olden-times 150,000 per month mental anchoring, troubling the bliss you deserve and are otherwise moving toward.

From ZeroHedge, January 9:

Ahead of today's jobs report, expectations were that the NFP number would show another rebound from the terrible Sept/Oct prints, but remain muted (or else spark fears about reheating and an end to the Fed's easing cycle). Well, that's precisely what we got moments ago when the BLS reported that in December the US gained 50K jobs, a modest miss to estimates of 50K, but smack in the middle of JPM's sweet spot range of 35K-75K (as previewed earlier) which would be best for the market.

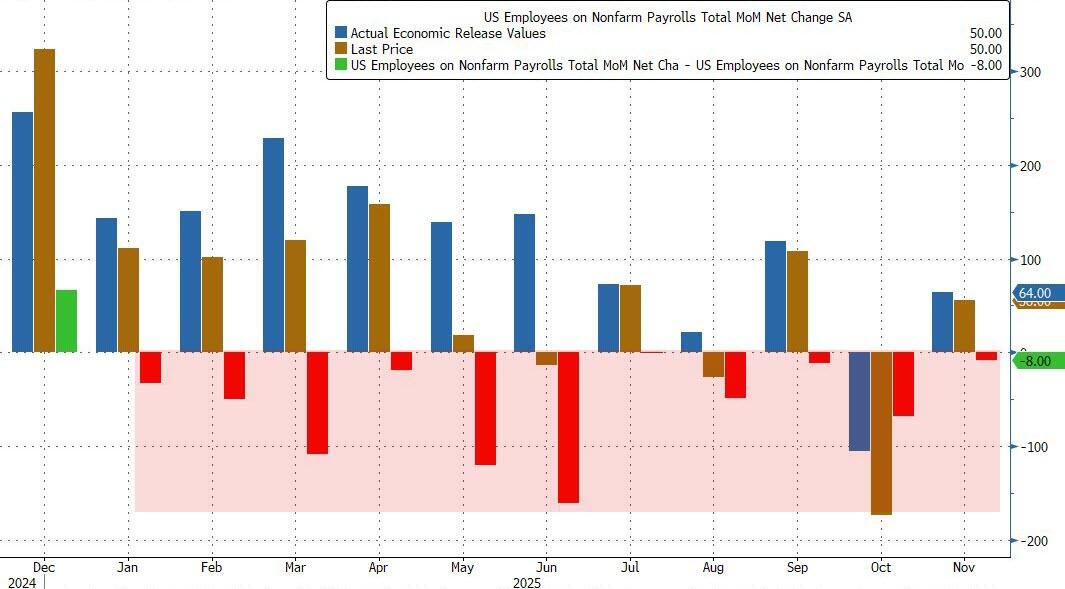

The change in total nonfarm payroll employment for October was revised down by 68,000, from -105,000 to -173,000, and the change for November was revised down by 8,000, from +64,000 to +56,000. With these revisions, employment in October and November combined is 76,000 lower than previously reported. Notably, as shown in the chart below, the initial NFP print has now been revised lower in every single month of 2025.

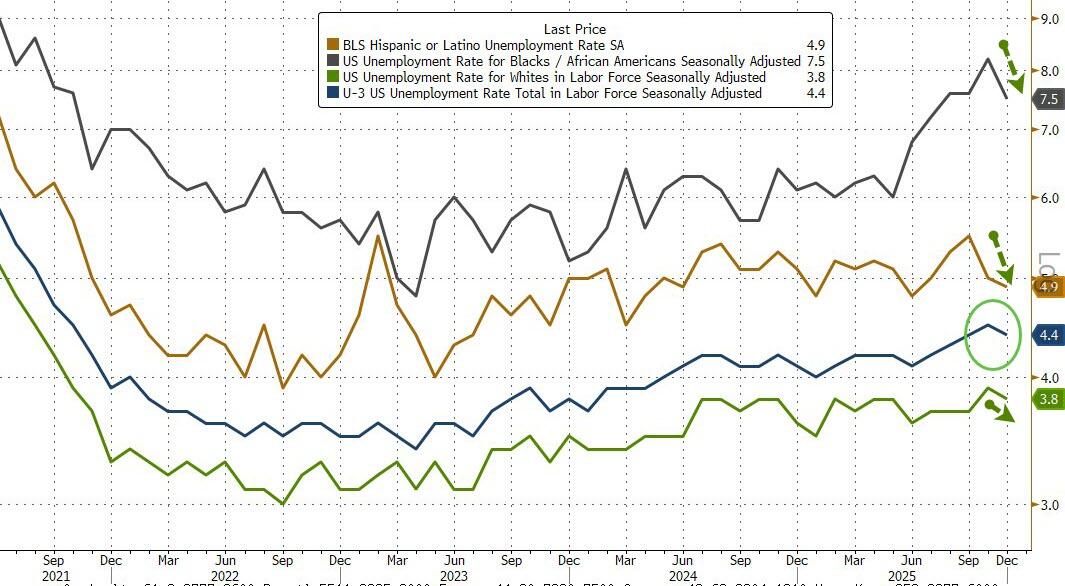

While there was NFP print was on the weak side, there was a modest improvement in the unemployment rate, which dipped from a downward revised 4.5% (was 4.6% originally) to 4.4%, which still is the highest since 2021, save for Nov 2025. Among the major worker groups, the unemployment rates for adult men was 3.9%, adult women 3.9%, teenagers 15.7%, Whites 3.8%, Blacks 7.5%, Asians 3.6%, and Hispanics 4.9%.

Labor force participation dipped fractionally from 62.5% to 62.4%, in line with estimates. The employment-population ratio, at 59.7%, was also unchanged in December. These measures have shown little change over the year....

....MUCH MORE