Goosed by changes in the discount rate by which the market will value those earnings.

2021 growth: 6.2% from 5.6%And for the entire package of babble and spew—"Here at Babble & Spew we believe...", ZeroHedge with the gory details (and some slightly snarky commentary), August 15:

—Business Insider, August 10

So much can change in less than five months.

Back on March 22, one day before the Fed went all in on central planning by announcing unlimited QE and crossing the Rubicon into buying corporate bonds, Goldman nuked its EPS forecast after the US economy basically shutdown to "fight" the covid pandemic, and cut its near-term S&P forecast to 2,000:

In the near-term, we expect the S&P 500 will fall towards a low of 2000. The stock market is a leading indicator of business trends, and corporate activity continues to deteriorate with no signs yet of a bottom. The first quarter has not even ended and companies have yet to release 1Q results but equities have already collapsed by 32% in one month. The speed of business erosion is unprecedented.

To be sure, Goldman also hedged its bet laying out what it thought was the absolute upside case: one where in the aftermath of the economic collapse, the market - if not the economy - would recover its losses:

If all goes according to plan, S&P 500 EPS will leap by 55% to $170 in 2021, and the index will end 2020 at 3000 (30% above the current level). Earnings and investor sentiment will be recovering later in 2020. Using the Fed Model, applying a Treasury yield of 1% and a yield gap of 465 bp, suggests a P/E multiple of 18x on 2021 EPS and a year-end 2020 level of 3000Well, fast forward to today, less than five months later, when the S&P is now more than a 1000 points above its March 23 lows, closing Friday at a whopping 3,372.85 and just shy of its all time high, and when suddenly the stock market is no longer a "leading indicator of business trends" as Goldman so aptly put it back in late March.

This means that Goldman - which a few months ago quietly capitulated on its bearish case and said its 2020 year-end target reverted back to 3,000 - had found itself in the unpleasant position of chasing the (centrally-planned) market alongside most other sellside research teams,

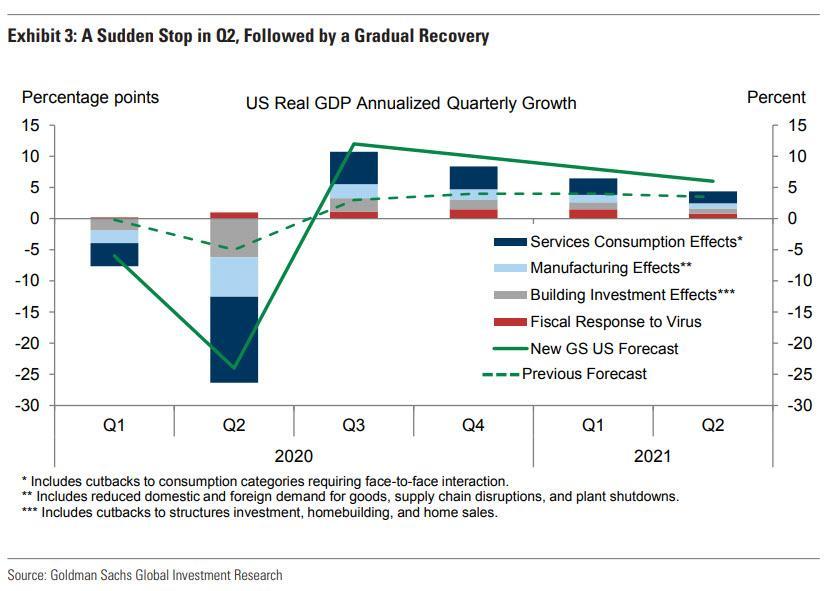

and one week after the bank's chief economist Jan Hatzius hiked his GDP outlook for 2020 and 2021

and chief equity strategist David Kostin hinted that the market was outperforming his cautious take, late on Friday Goldman confirmed that on Wall Street that only thing that matters is price in the rearview mirror, and that so-called "analysts" will goalseek any narrative to justify both the current prices and where momentum impliesit will be in a few months, when Kostin raised his S&P price target from 3,000 to an all time high 3,600.

This is how Kostin began his latest capitulation to the market...

....MUCH MORE