That said, the “crimson thread of suicide”* that was alleged to run through the history of the Chicago Board of Trade was refuted by one of the longer-tenured Secretaries of the exchange:

"There are less cases of suicide arising among members of this board than in any other class."

—George F. Stone, quoted in Donahoe's Magazine, Volume LIII, Jan. - Jun. 1905, pp. 510

On that reassuring note...

From SteelHedge via Medium, April 13, 2019:

In December 2018, a leading European bank sent its customers investing tips for the next year. To navigate “an increasingly challenging investment environment” — among the assets that had been around for ages — real estate, bonds, equities — one could find something refreshing:“The latter stages of the economic cycle have historically been one of the better times to invest in commodities. Overall demand tends to stay high while inventories run low.”Invest in raw materials? What does it mean? The Merriam-Webster dictionary defines investment as “the outlay of money usually for income or profit.” In economics, investment activities are usually directed at adding value. How can raw materials help in this respect?

FROM OBSCURITY TO SPOTLIGHT

Until recently, commodities interested mostly those who produced, traded, or consumed them (except precious metals, which is a different story). Commodity derivatives (futures, options, swaps) were invented to help farmers (and, later, miners and the industry) mitigate market risk through harvesting and economic cycles, and had been predominantly used for this purpose since the nineteenth century. Derivatives speculation was mostly confined to insiders: merchants, brokers, and other intermediaries with information advantage, resources, or clout for contrarian financial bets.

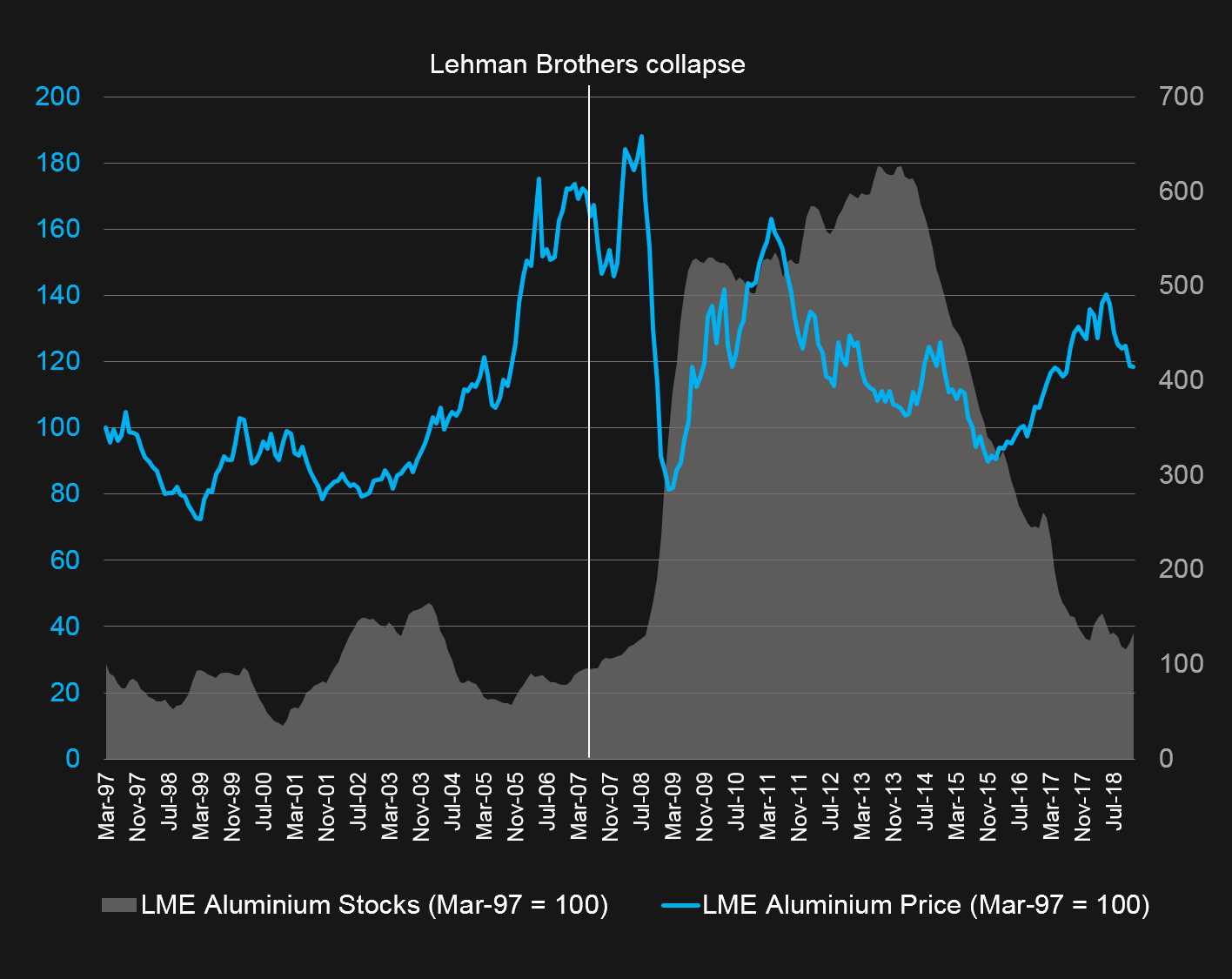

The situation changed in the 1990s, when the investment community realized that prices of hydrocarbons, metals, and crops moved asymmetrically to financial markets, providing a safe harbour in stormy weather (acting as a store of value) or a source of speculative income from their price fluctuations, as exemplified by aluminium in Figure 1. The derivatives came in handy, allowing the building and unwinding of trading positions without the physical ownership of barrels, bars, and sheaves.

Figure 1: Aluminium as an investable asset

Initial investments in commodities were reserved to specialized hedge funds. As the news spread, large institutional investors (banks, insurers, pension and mutual funds) started to pile in, ultimately followed by ordinary folk. For exchanges and brokers that facilitate such transactions, it was a gold mine. Commodity derivatives were previously mostly traded by market participants for risk management — but their hedging needs and therefore the size of a related derivative market were limited by production, trade, and consumption. Speculative trading — and the income it generates — are literally unlimited. The more commodity derivatives were traded, the more money flowed to investors, exchanges, and brokers, incentivizing the creation of a whole new ecosystem.

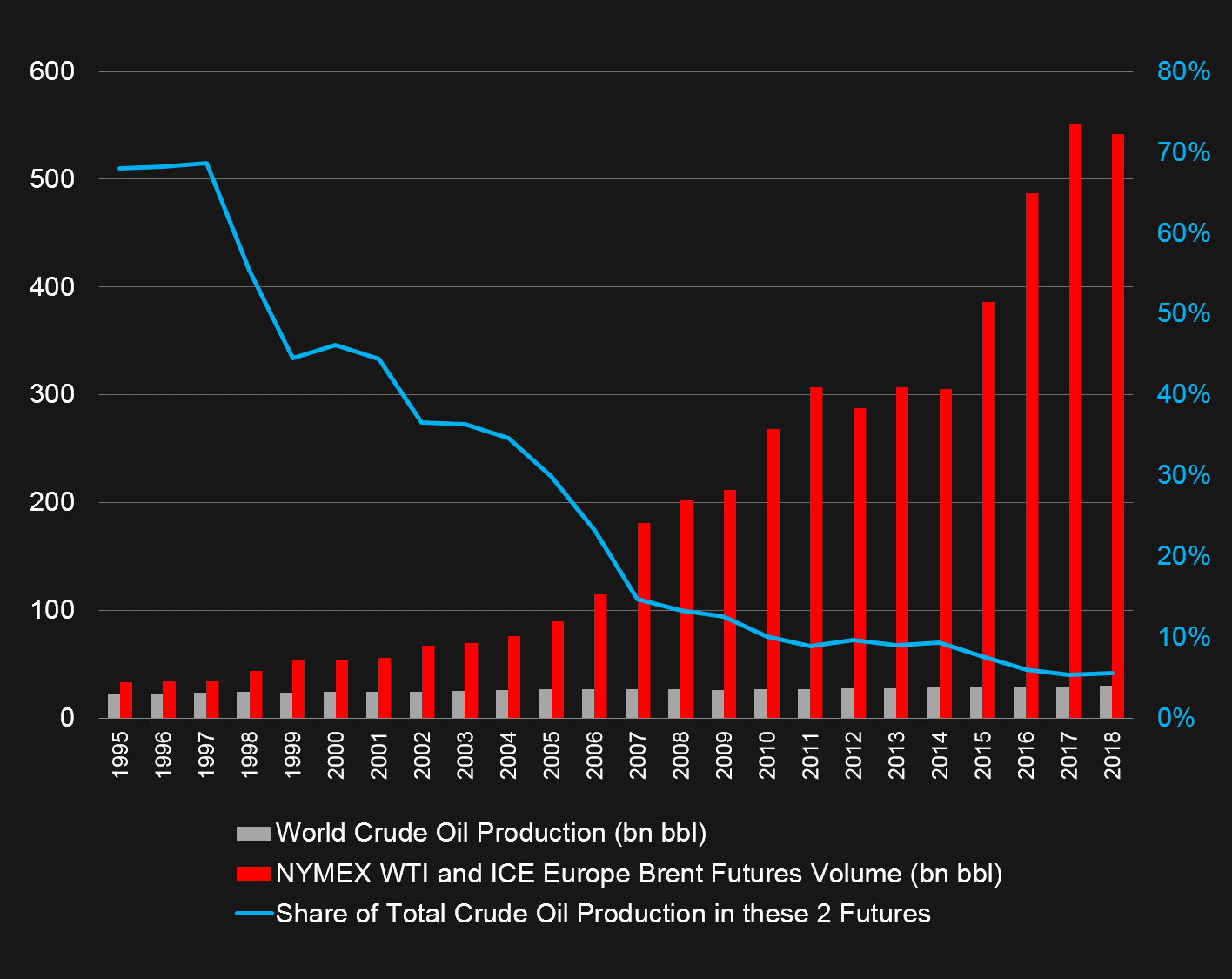

Take crude oil as an example. In 1995, when the oilmen pumped 22.8 bn bbl globally, trading in NYMEX WTI and ICE Europe Brent futures, the world’s two most popular crude derivatives, accounted for 33.5 bn bbl. Last year, production increased to 30.2 bn bbl, but these futures markets alone swelled to 541.6 bn bbl, becoming eighteen times bigger than the global physical output (Figure 2). This is without taking into consideration all other derivatives: other categories (e.g., options, swaps), other oil grades (e.g., Medium Sour, Urals), derivatives for products of oil refining (e.g., gasoline, fuel oil), other exchanges (e.g., MCX, TOCOM), and cross-trading (the same derivative may be traded on several exchanges, e.g., ICE Europe WTI, and, bilaterally, over the counter). On the whole, the derivative market has grown beyond comparison with its physical cousin. Nobody really knows its size and fully understands the interplay between the two (see Box 1).

Figure 2: Oil physical and derivative markets

Considering that revenues of commodity exchanges and brokers depend on trading volumes, the incentives are obvious. In the early days, the exchanges were not-for-profit organizations controlled by their members. For example, two of the forebears of CME Group, the Chicago Board of Trade and the Chicago Butter and Egg Board, were founded in 1848 and 1898 as voluntary associations of prominent merchants. (This setup didn’t guarantee orderly trading, though, as various instances of market manipulation, such as the Ferruzzi soybean scandal of 1989, indicate). In the 2000s, both exchanges demutualized, turned into for-profit stock corporations, and merged. Today, most prominent commodity exchanges are for-profit companies. According to CNN, last year institutional investors owned around 87 percent of CME Group and 92 percent of Intercontinental Exchange (ICE), the two bourses reining in the Western commodity markets.

In less than three decades, commodity investing has turned from exotic to mainstream. It is marketed by any broker and investment advisor worth their salt, and exchanges vie for global dominance in commodity futures and related services, which has become a big business.

From 2003 to 2017, a combined net income of CME Group and ICE jumped twenty-nine times, from $175 million to more than $5 billion, with profit margins around 60 percent. In 2017, CME Group alone cleared more than four billion derivatives worth more than $1 quadrillion, which is a 1 with 15 zeros. Both exchanges report trading and clearing fees together, but if the London Stock Exchange is any guide, the latter may rake in more than the former because of increased regulation. The rise of quantitative funds, automated and high-frequency trading (now over half of CME Group volume), and passive investing increase demand for data feeds and services, which already bring to LSE twice as much revenue as trading.

According to the Futures Industry Association, global trading in futures and options grew from 188 million contracts in 1984 to 30.3 billion contracts in 2018. Having made 17.3 percent of this market last year, commodities are on course to become the second-most traded derivative category ahead of equities (Figure 3). Most part of that trading had nothing to do with the needs of the real economy — that is, the original purpose of risk reduction the derivatives were originally invented for.....

....MUCH MORE

HT, by a circuitous route, the Financial Times' Neil Hume who highlighted a much shorter version of this piece that was run as an opinion piece in the FT.