From ZeroHedge:

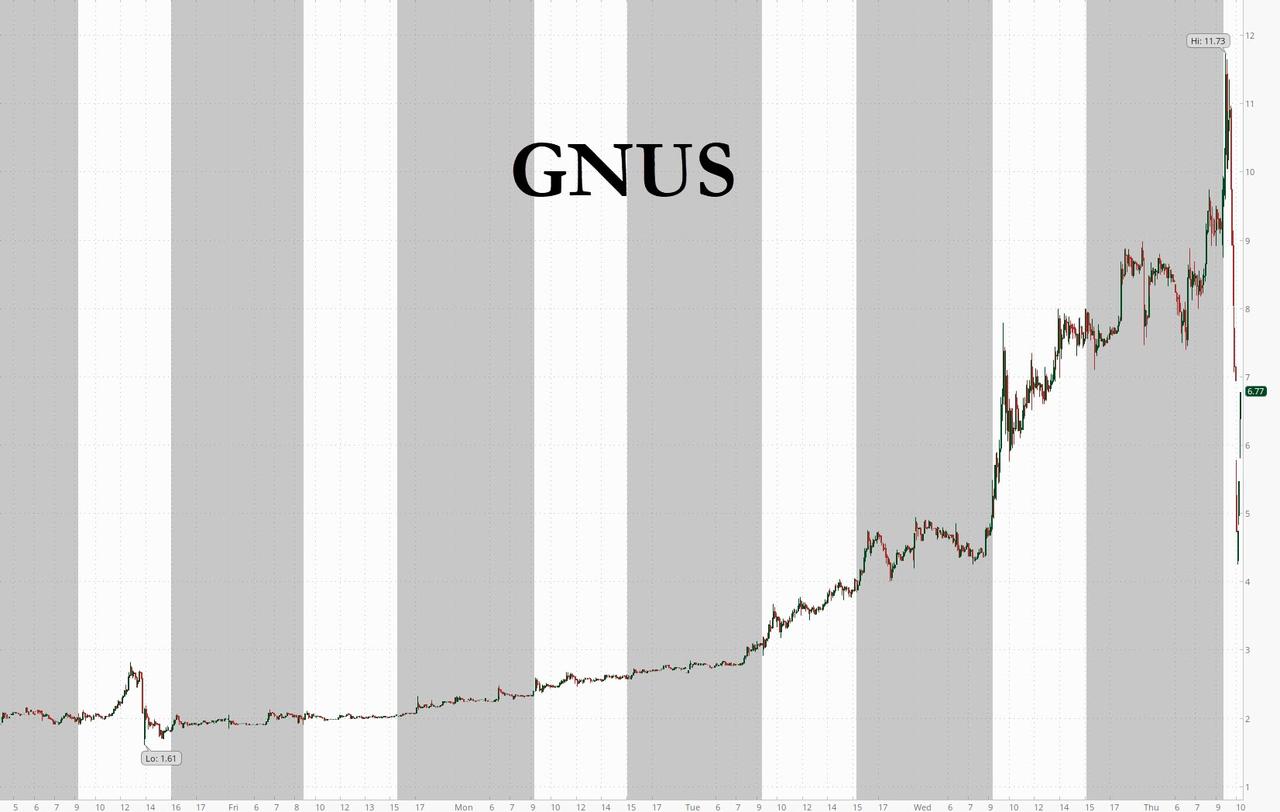

With retail investors taking over the extremely illiquid market, resulting in crazy intraday swings where the horde of robinhood retail traders alone can send a stock soaring (and tumbling)...

... many veteran investors are throwing in the towel on what is emerging as the most furiously ridiculous rally in history in what is now better known as "Jay's market" (with 73% of Wall Street claiming that the market is only up due to the artificial gimmick of the Fed's balance sheet explosion and not due to fundamental factors). And with one after another investing legend such as Warren Buffett, Stanley Druckenmiller, David Tepper boycotting the artificial rally, and either selling or pulling out, today GMO's Jeremy Grantham became the latest to bail on what Bank of America recently called a "fake market."....MUCH MORE

In a letter to GMO investors, Grantham writes that "we have never lived in a period where the future was so uncertain" and yet "the market is 10% below its previous high in January when, superficially at least, everything seemed fine in economics and finance. And if not “fine,” well, good enough. The future paths include many that could change corporate profitability, growth, and many aspects of capitalism, society, and the global political scene."

In short, the veteran value investor known for calling several of the biggest market turns of recent decades admits he has lost his faith in an upside case - unlike the retail daytrading army - and his sense of direction in a world of record uncertainty "which in some ways seems the highest in my experience" and as a result "in terms of risk and return – particularly of the worst possible outcomes compared to the best – the current market seems lost in one-sided optimism when prudence and patience seem much more appropriate."

Grantham also highlights the obvious: that the market and the economy have never been more disconnected, and points out that while "the current P/E on the U.S. market is in the top 10% of its history... the U.S. economy in contrast is in its worst 10%, perhaps even the worst 1%.... This is apparently one of the most impressive mismatches in history."

As a result of this total loss of coherence driven by trillions in central bank liquidity that have propelled a massive wedge between fundamentals and stock prices, GMO, the Boston fund manager Mr Grantham co-founded in 1977, cut its net exposure to global equities in its biggest fund from 55% to just 25%, near the lowest levels it reported during the global financial crisis, according to a separate update from GMO's head of asset allocation, Ben Inker.

That decision, according to the FT, slashed GMO's Benchmark-Free Allocation Fund exposure to US equities from a net 3-4% to a net short position worth about 5% of the $7.5bn portfolio, said Inker, perhaps the first time the fund has turned net short US stocks since the crisis. This, after GMO loaded up on stocks during the sell-off but has since cut offloaded its exposure to the US market following the unprecedented 40% rally in the past 2 months.

"The Covid-19 pandemic “should have generated enhanced respect for risk and it hasn’t. It has caused quite the reverse,” Grantham told the Financial Times. He noted that trailing price-earnings multiples in the US stock market were “in the top 10 per cent of its history” while the US economy “is in its worst 10 per cent, perhaps even the worst 1 per cent”, echoing what he said in his quarterly letter.

And while markets seem to be taking all the negative news in stride, Grantham is worried that the wave of devastation that is coming is unlike anything experienced before:

At GMO we dealt with three major events prior to this crisis, and rightly or wrongly, we felt “nearly certain” that sooner or later we would be right. We exited Japan 100% in 1987 at 45x and watched it go to 65x (for a second, bigger than the U.S.) before a downward readjustment of 30 years and counting. In early 1998 we fought the Tech bubble from 21x (equal to the previous record high in 1929) to 35x before a 50% decline, losing many clients and then regaining even more on the round trip. In 2007 we led our clients relatively painlessly through the housing bust. In all three we felt we were nearly certain to be right. Japan, the Tech bubbles, and 1929, which sadly I missed, were not new types of events. They were merely extreme cases akin to South Sea Bubble investor euphoria and madness. The 2008 event also was easier if you focused on the U.S. housing euphoria, which was a 3-sigma, 100-year event or, simply, unique. We calculated that a return trip to the old price trend and a typical overrun in those extreme house prices would remove $10 trillion of perceived wealth from U.S. consumers and guarantee the worst recession for decades.All these events echoed historical precedents. And from these precedents we drew confidence.While the uncertainties are indeed large, one can triangulate a sufficiently material dose of "certainty" about what is coming, and as Grantham explains further, it is not pretty, especially with the US economy already on the back foot heading into the crisis:....

But this event is unlike all those. It is totally new and there can be no near certainties, merely strong possibilities. This is why Ben Inker, our Head of Asset Allocation, is nervous and this is why you are nervous, or should be.

Because Mr. Grantham gets so much press we include a couple old posts almost every time he catches some ink. From the afore-mentioned "How Good (or bad) Are GMO and Jeremy Grantham's Market Calls?" October 11, 2019:

We have quite a bit on Mr. Grantham, in part because his interests overlap with ours: He's willing to opine on fertilizer and global warming and markets and, well, no cat videos but no one is perfect.And

On the market here's something from 2018 that still rings true:

Grantham, Mayo, Van Otterloo's 7-Year Asset Class Performance Forecast

We've linked to quite a few of the GMO forecasts over the years, but haven't since 2015.

Mr. Grantham's dour outlook was not in tune with what was actually happening in the markets and didn't really reflect our views.

So instead we've taken to linking to his commentaries where oddly enough Mr. G, got exuberantly - and correctly - bullish a few years ago and we have been leaning toward his original melt-up target of S&P 3300 as a blow off top. He hedged a bit in conversation with The Economist April 10 but said there was still a 40% possibility. "An update from Jeremy Grantham".....

Feb 2010

"Grantham’s ‘Horrifically Early’ Calls Challenge GMO"

March 2014

How Good Is Jeremy Grantham's Forecasting Record?

His strong pessimism drives GMO managed funds toward the most stable (large capitalization) value stocks, and these funds have performed fairly well (reflecting perhaps a value premium rather than market timing)....

As noted in that October 2019 post

It would be horribly ironic if Mr. Grantham's most accurate call in the last decade turns out to be S&P 3300 but we are betting that is where the market goes before all is said-and-done (and one of the reasons we can maintain a façade of equanimity in the face of drawdowns such as the Oct. 3 - Dec. 24, 2018 unpleasantness)

CXO Advisory did an analysis of GMO's glory days, 1999 -2009 which caught two major bear markets, the dot.bombs and the Great Financial Crisis, here if you want to take a look.Well the S&P 500 top-ticked at 3,393.52 on February 19 (currently 3,181.37 +69.02) and this time I don't think Mr. Grantham is going to be as "Horrifically Early" as in the past.

CXO is also the source for 2014's "How Good Is Jeremy Grantham's Forecasting Record?" above....

See April 11's ""Stocks will revisit their coronavirus crash low, and here’s when to expect it"" which was preceded by "It's Time To Buy Some Stocks" on Friday, March 20, 2020, 8:40 PM PDT

That was the weekend the DJIA and S&P futures set their lows for that go-round, 18,000 on the Dow.

Sometimes you get lucky.