Developments in the oil tanker market in the past decade dominated by geopolitics, says shipping association BIMCO.

Crude oil and product tanker markets alike have faced high volatility in recent weeks and months, largely due to geopolitics and the constantly evolving situation in the global oil markets. The first major disturbance since the fall in the oil price between the fourth quarter of 2104 and first quarter of 2016 came in the fourth quarter of 2019, after which freight rates have bounced back despite a collapse in demand.

In these extraordinary times, the freight rates are driven by external forces rather than the supply and demand fundamentals of the oil tanker market. However, as the situation slowly begins to normalize, these fundamentals will once again take over with overcapacity being a recurring problem.

Between 2010 and 2019, the cargo carrying capacity of the crude oil tanker fleet grew by 42.2% and the product fleet by 49.5%. This compares to much lower growth in demand over the same period of 6.3% and 18.1% respectively. Overall, the tanker fleet grew by 190.5 million DWT to 622.6 million DWT at the end of 2019. Just under a third are oil product tankers while the rest are crude oil tankers.

“The volatility currently experienced by the tanker market, and the record high freight rates across many of the sectors in particular, dwarfs the ups and downs which were seen in the majority of the previous decade. The market cannot rely on geopolitics to keep rates this elevated in the longer term and the oil tanker market will once again feel the pressure of its poor fundamentals,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

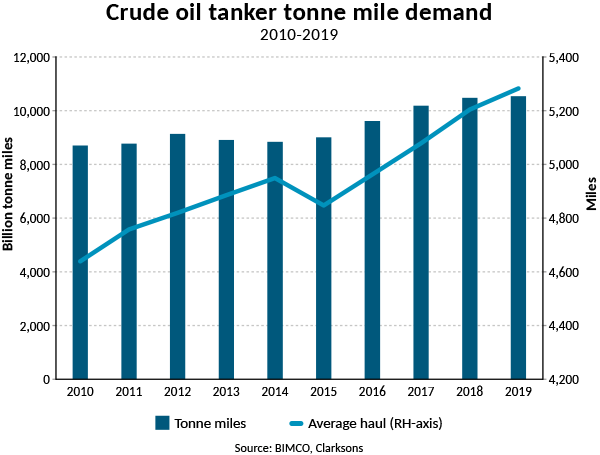

Much longer crude oil hauls as US starts exportingMeasured in tonnes, growth in demand for oil product tankers has exceeded demand growth for crude oil tankers, up 18.1% and 6.3% respectively. However, over the course of the decade, the average sailing distance for crude oil tankers has increased, meaning that the 6.3% growth in tonnes has translated into a 21.1% increase in tonne mile demand. Oil product tankers on the other hand, have seen tonne mile demand rise at a slightly slower pace than demand measured in tonnes, as the average sailing distance has decreased slightly....

....MUCH MORE