We have quite a bit on Mr. Grantham, in part because his interests overlap with ours: He's willing to opine on fertilizer and global warming and markets and, well, no cat videos but no one is perfect.

On the market here's something from 2018 that still rings true:

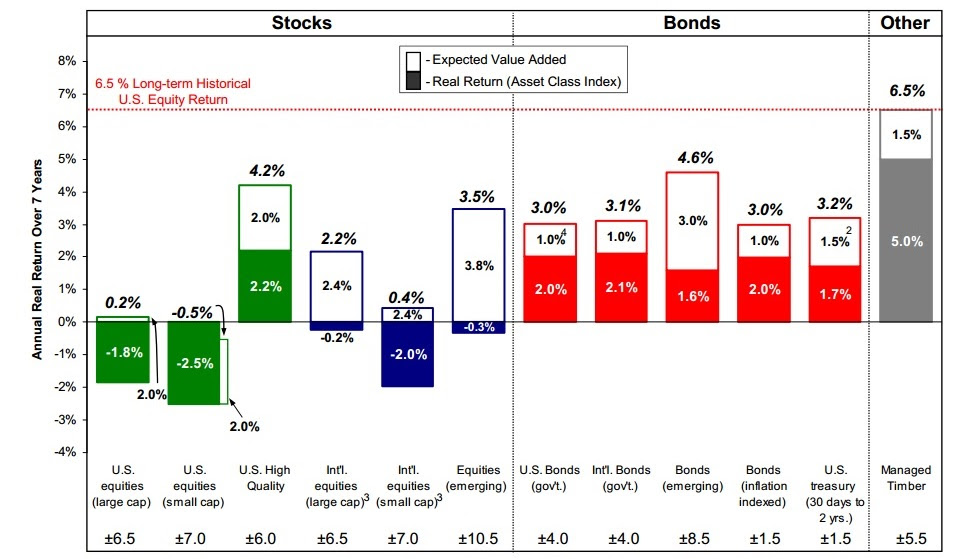

Grantham, Mayo, Van Otterloo's 7-Year Asset Class Performance Forecast

Mr. Grantham's dour outlook was not in tune with what was actually happening in the markets and didn't really reflect our views.

So instead we've taken to linking to his commentaries where oddly enough Mr. G, got exuberantly - and correctly - bullish a few years ago and we have been leaning toward his original melt-up target of S&P 3300 as a blow off top. He hedged a bit in conversation with The Economist April 10 but said there was still a 40% possibility. "An update from Jeremy Grantham"

See special note after the jump.

First up, the April forecast via Advisor Perspectives, 17April:

GMO's 7-Year Asset Class Forecasts Still Favor Non-US Markets

The GMO Asset Allocation team has released its latest 7-Year Asset Class Forecasts.

Most global equity markets declined in the first quarter despite the corporate sector generally reporting reasonable fundamental data. As a result, GMO's 7-year equity forecasts mostly improved over the first quarter (see chart below). Even with these improvements, International and U.S. equities are still forecast to have flat to negative real returns over the next 7 years, with Emerging equities remaining an exception, forecast to have a positive real return of 1.9%.

"To us, the opportunity set for equity investors looks pretty clear: favor non-U.S. markets, especially value stocks in emerging markets," says GMO Asset Allocation team member John Thorndike. "Additionally, with the Fed continuing to raise short-term interest rates and the potential inflationary effects of tariffs and trade wars, we think investors are well served to keep their duration short."

....MORE

And the reason for checking in, from Barron's, July 19, 2018:

EM, Cash May Be Best Spots for the Next 7 Years, Says GMO

GMO has favored emerging markets for a while, but it's an area investors are fleeing. Capital Economics wrote in a note this morning that its capital flows tracker suggests an acceleration in money leaving emerging markets, with an estimated $40 billion leaving in June versus $10 billion in May–marking the highest level in 18 months. "The most plausible explanation for this is that the escalation of trade tensions between China and the U.S., and concerns about knock-on effects on other emerging markets via manufacturing supply chains, caused outflows to pick up," the economists wrote.Some stuff to keep in mind when evaluating GMO's public calls:

Investors watch flows in and out of emerging markets carefully because money flowing in helps fund spending in those countries, and are a major factor for markets. One concern that has loomed over emerging markets is the impact of the Federal Reserve raising rates, which have contributed to sharp declines in some currencies such as the Turkish lira and Brazilian real.

The one currency investors are watching especially closely is China's renminbi, which has been weakening in recent months. In 2015, a decline in the currency contributed to a sharp increase in capital outflows, but Capital Economics says a repeat is unlikely because officials' tolerance for a weaker currency will only go so far. Capital Economics writes that even if overall emerging-market capital outflows accelerate further, most countries are well placed to withstand the hit because of stronger fiscal health than in the past–with perhaps the exception of Turkey and Argentina.

But that's not to say the volatility will go away. BBH currency strategist Marc Chandler told Barron's this morning that while values are being uncovered in the emerging markets, it may be too early to pick a bottom since the Federal Reserve is likely to continue raising rates....MORE

Feb 2010

"Grantham’s ‘Horrifically Early’ Calls Challenge GMO"

March 2014

How Good Is Jeremy Grantham's Forecasting Record?

His strong pessimism drives GMO managed funds toward the most stable (large capitalization) value stocks, and these funds have performed fairly well (reflecting perhaps a value premium rather than market timing).

See also:

GMO 7-Year Asset Class Real Return Forecasts: 2007

From James Montier’s GMO Quarterly Letter, July 2013, titled The Purgatory of Low Returns, download the full PDF here (registration may be required).It would be horribly ironic if Mr. Grantham's most accurate call in the last decade turns out to be S&P 3300 but we are betting that is where the market goes before all is said-and-done (and one of the reasons we can maintain a façade of equanimity in the face of drawdowns such as the Oct. 3 - Dec. 24, 2018 unpleasantness)

CXO Advisory did an analysis of GMO's glory days, 1999 -2009 which caught two major bear markets, the dot.bombs and the Great Financial Crisis, here if you want to take a look.

CXO is also the source for 2014's "How Good Is Jeremy Grantham's Forecasting Record?" above.

On fertilizer, July 2017's:

Interview With Jeremy Grantham: The Rules Have Changed for Value Investors

This is from April 24, we're a bit tardy in getting to it but I'll probably be referring back so here we go.Related, 2016's "GMO's Jeremy Grantham: Buy Natural-Resource Stocks":

One quick note: We think Mr. Grantham is too gloomy and in some specific situations e.g. phosphorus (phosphate) and potassium (potash) running out, is just plain wrong.

See, for example 2012's "Vaclav Smil Takes on Jeremy Grantham Over Peak Fertilizer".

If one had acted on Grantham's shortage ideas by buying Potash Corp. or the Cargill fertilizer spinoff Mosaic back in 2012, one would have had one's head handed to one.

In the last five years POT has declined from $45 to $18 and MOS is down from $59 to $24.

During a big bull market.

This relative performance will of course change, and we think we'll be on top of it when it does but we'll be late, simply because trying to time the turn can be very costly if you're early.

That said Grantham is a sharp guy and very, very experienced so we pay attention when he speaks....

We think he's right but premature.

Mr. Grantham has a habit of being early and because of this his performance record suffers, see:...

And on global warming, he puts his money where his mouth is, funding:

The Grantham Institute for Climate Change at Imperial College, London andHe's also pledged something on the order of a billion dollars to his and Hannelore's (Mrs. G.) foundation.

The Grantham Research Institute on Climate Change and the Environment at the London School of Economics among others.