Hong Kong Riots Reveal A Looming Crisis At The World's 6th Largest Bank

Earlier today, in addition to the chaos surrounding the escalation of the US-China trade and currency war, we also got news which slipped under the radar that the CEO of HSBC, one which with $2.6 trillion in assets is the largest UK bank and the 6th largest bank in the world by assets, was unexpectedly quitting and his departure would also lead to mass layoffs, with the bank set to fire 4,000 workers, or about 2% of its workforce.

And while today's market massacre succeeded in sweeping the HSBC news under the rug, one can't help but wonder: is HSBC, which has had almost as many run-ins with the law as one particular infamous German bank, going to be the next Deutsche Bank?

For the answer we went to one of our blogging friends who runs the Strategic Macro blog, and who conveniently took a look at some of the cockroaches in HSBC's basement. What he found was troubling, especially in light of the ongoing turmoil in Hong Kong which at any given moment is just a few minutes away and a false flag provocation away from a Chinese invasion.

Courtesy of the Strategic Macro blog, we present:

HSBC's exposure to Hong Kong real estate

So conventional wisdom is that post-Basel III the banks hold a lot of capital against loans and are run conservatively. And in a normalised market this is very true I think.

However when you are calculating LTVs and RWAs and PDs against bubble valuation levels, are they still appropriate? If you calculated it against replacement costs, the LTVs would go through the roof, and so would RWAs and the banks would be left with an CET tier 1 equity deficit to be covered by a rights issue. Any losses and higher RWAs on impaired loans would further cost equity.

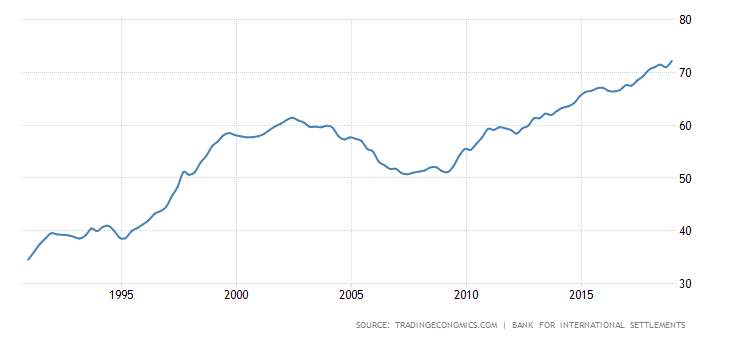

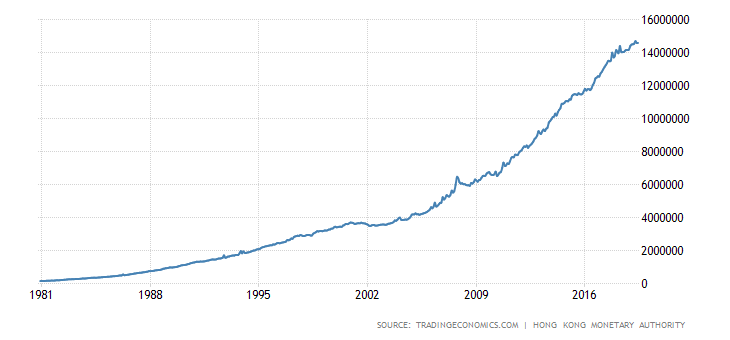

So Hong Kong real estate which yields 1-2% rental yields in many cases, vs a Prime lending rate which is 5.15% is an enormous, negatively carrying bubble, propped up by speculation and Chinese capital flows.

HSBC is the 800lb gorilla in a banking system where M£ is >5x GDP.

M3 and Household debt to GDP:

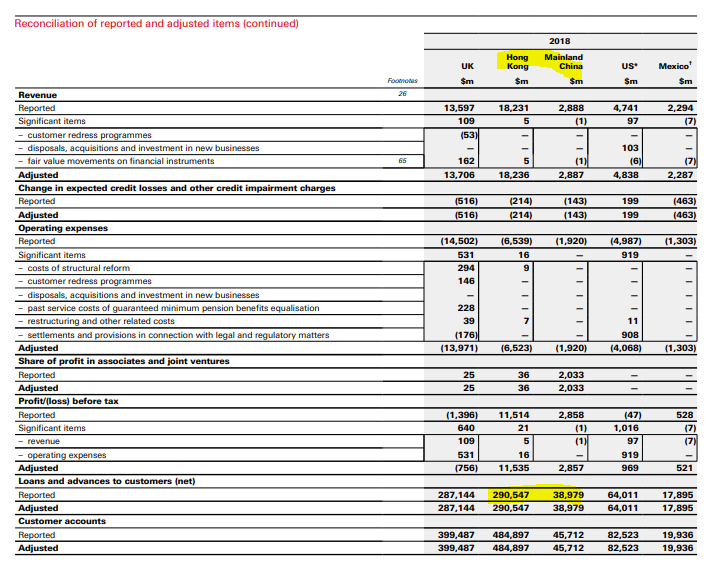

Here are some excerpts from HSBC's financials and Pillar 3 statements for Dec 18.Downside risk scenario involves small house price drops and ongoing economic growth....

HSBCs 2018 AFS. $300bn plus exposure to HK and China.

....MUCH MORE

As George Takei might say