"...Best And Worst Performing Assets In April And YTD"

From ZeroHedge:

For stocks, April was certainly not the cruelest month, as the

risk-on rally continued with the S&P 500 posting 4.0% total returns

following the strong 13.6% rally in 1Q. The month ended with a mini

meltup, as the S&P set record highs four times in April on a closing

basis, three of them in the last three trading days of the month.

Overall, the S&P 500 is up 18.2% YTD, 26% since the December low,

and sits 2% above its prior high in September 2018.

As BofA notes, the April rally was led by mega-cap stocks -

the largest 50 stocks outperformed the overall market by 50bps, while

the equal-weight S&P 500 index lagged by 30bps. Global equities also

posted strong gains (but lagged the S&P), rising 3.7% in local

currency terms and 3.4% in USD, with all MSCI regions gaining. US stocks

outperformed other asset classes including bonds (LT Treasuries -1.7% /

IG corp. +0.6%) and cash (+0.2%). The VIX index fell 4% (down 48% YTD),

while gold slipped for the second straight month (-1.0% in April).

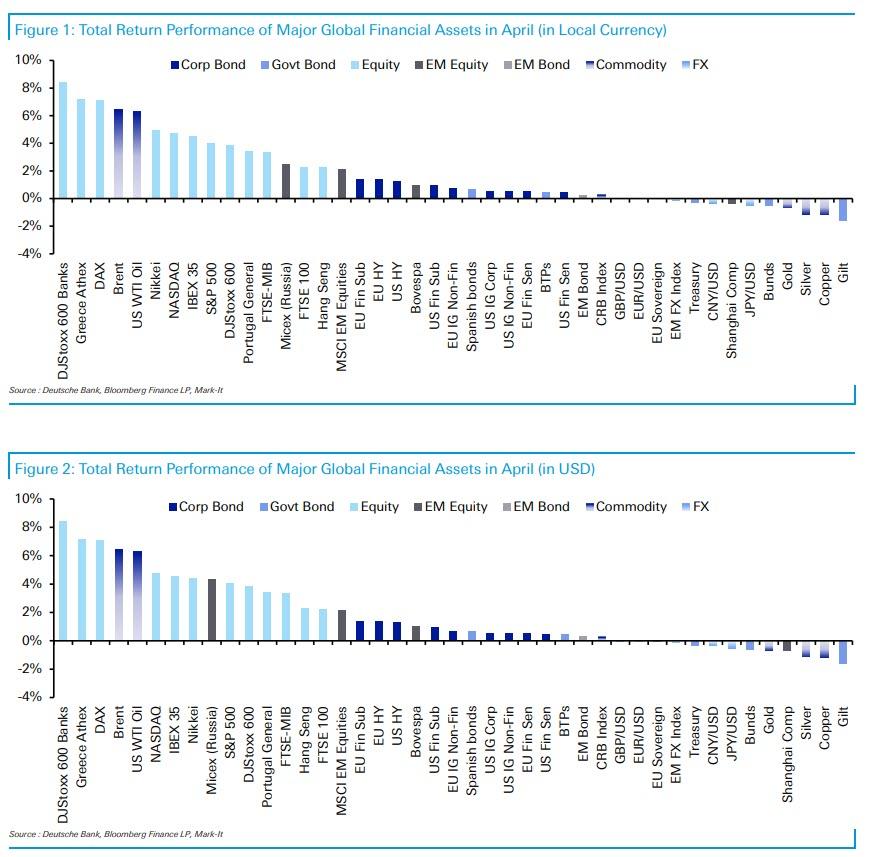

It wasn't just the US, however, and as Deutsche Bank writes, there

were strong returns across the board for most equity markets globally as

shown below. Central banks falling into a dovish line one-by-one, data

continuing to favor this goldilocks environment, earnings season so far

being taken positively, trade headlines by and large incrementally more

positive and a continued lack of volatility all contributed to the

favorable backdrop for risk assets, according to the bank's Craig Nicol.

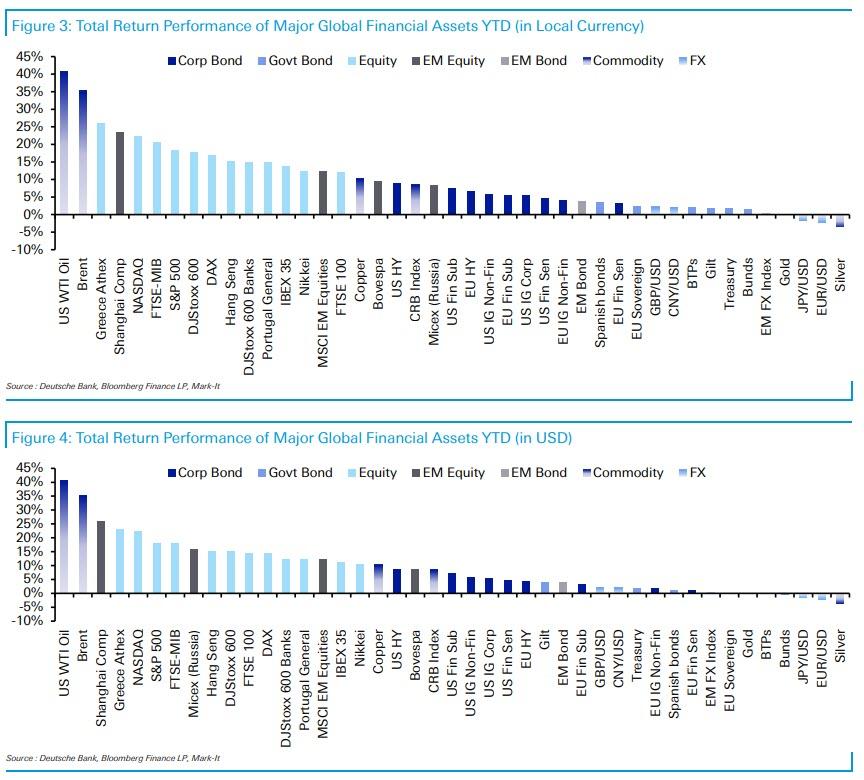

And while returns weren’t quite so spectacular for rates and

commodities, which lagged the broader rally, however, by the end of the

month, 30 of the 38 assets in Deutsche Bank's sample still finished with

a positive total return in local currency terms and also

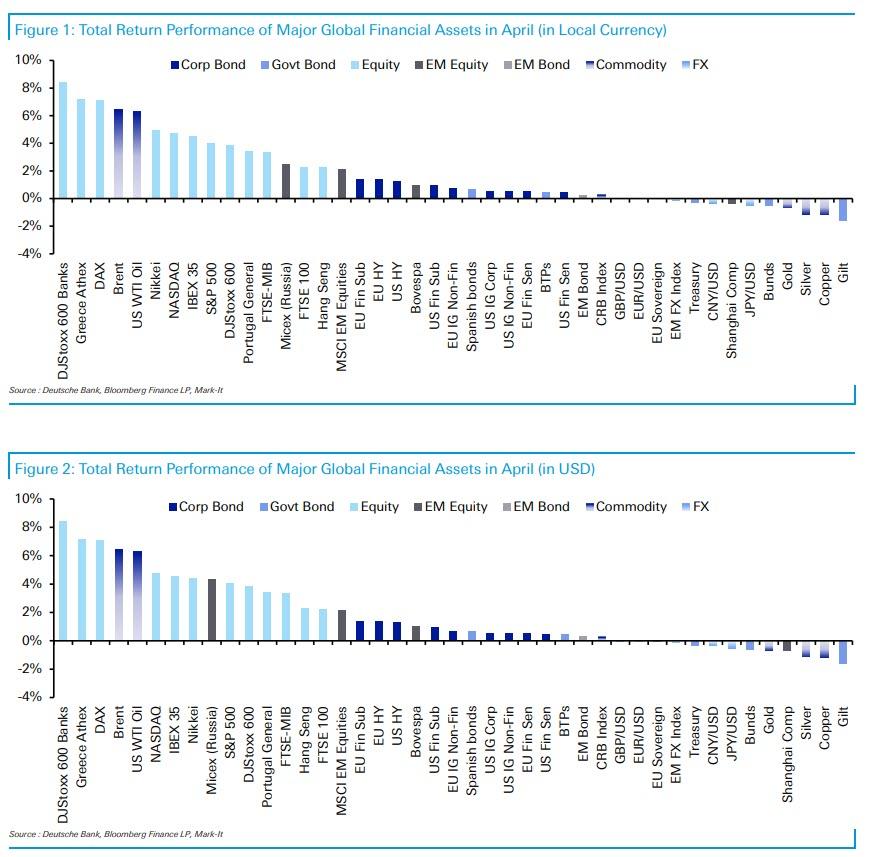

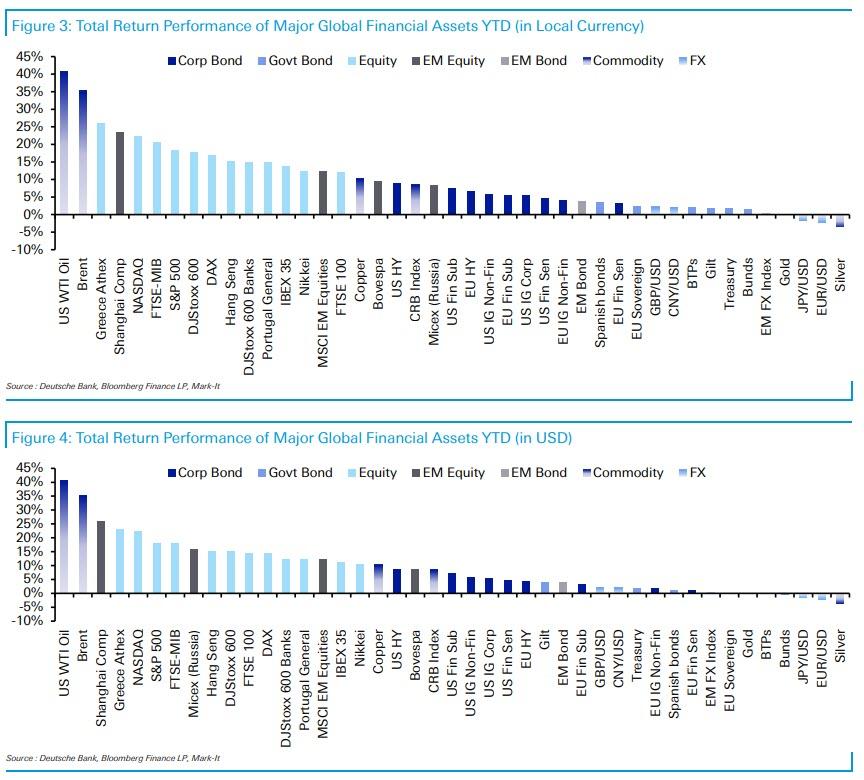

dollar-adjusted terms. This means that YTD, we’re now at 37 out

of 38 assets up in local currency terms and 35 in dollar terms. In local

currency terms, this is now the strongest start to a year through the

first four months since 2007....MORE