New York Fed: "Do You Know How Your Treasury Trades Are Cleared and Settled?"

My first thought was "this is a (very) subtle reminder to China that should they decide to dump U.S. Treasuries the clearing and settling of the trade is really, really important."And here, with a more reasoned argument is Alhambra Investments, May 13:

Delaying or refusing transfer and settlement is sometimes argued as an action the U.S. government could take if China raises the stakes in the trade dispute.The downside is such a move would shock other players in the govvy markets, perhaps to the point they would reconsider their participation.

So, the Fed probably isn't warning, subtly or otherwise.

Besides, if China wanted to dump their holdings, the ultimate end-game action for the U.S. is to have the Federal Reserve go bid for a trillion or so and ask the Chinese "What else ya got?"

On to Liberty Street Economics, not coincidentally housed in the same 33 Liberty Street, NYC NY building as the Fed's open market operations desk....

CNY, Its Doom Sisters, And Chinese Threats

It’s a tell-tale sign of someone who doesn’t know what they are talking about. In the realm of global currency systems, anyone who brings up China’s massive stockpile of US Treasury assets inevitably they assign all the power to the Chinese. Xi could destroy Trump if he wanted, bringing down the US in a righteous fit of trade war anger.

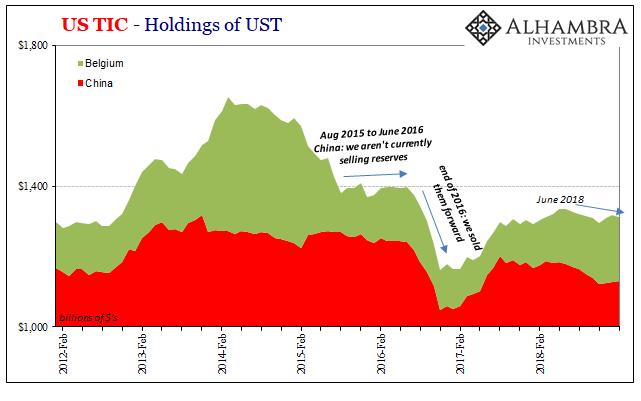

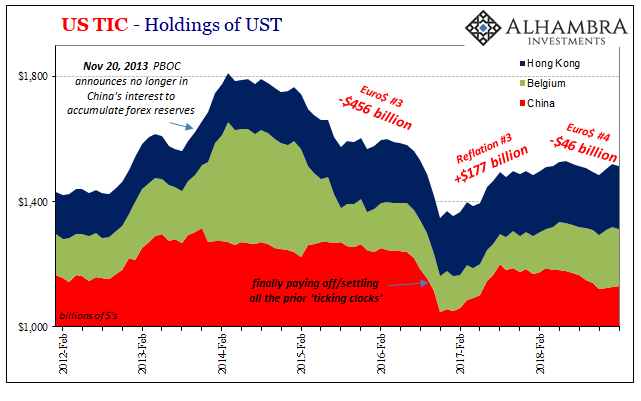

Not only is this totally wrong, it is ignorant of history. Recent history. Toward the end of November 2013, out of nowhere a report appeared in Chinese State media which said officials were reconsidering their foreign reserve allocations.

The country then spent the next several years shedding more than $900 billion in official reserve assets, more than half that in the form of reported UST holdings. The carnage, if the conventional story was right, should have massacred the market for US federal debt. Not only are UST yields lower today than when that announcement was first made, it was the Chinese economy indeed the entire Chinese system that had been transformed in between....MORE

In late 2013, convention held China in high regard especially when it came to its purportedly invulnerable economy. But as they bled reserve assets, that view has shifted entirely. In 2019, the Chinese are leading the world in economic weakness.

In announcing that they would avoid UST’s five and a half years ago, what the Chinese were up to was very different. They were indirectly warning everyone, albeit in their own geopolitical fashion. I wrote in January last year when this “threat” last came up:

How, then, do we view the PBOC’s November 20, 2013, announcement? Over time, I began to see it as more like desperation, the kind of “oh we meant to do that” public statement that is oftentimes crafted only to reassure the public that what turned out to be a big negative was really what they meant to do all along. I have come to believe that by late in that year, Chinese officials knew what was coming (they already had a taste) and were trying to get ahead of the “rising dollar” so that it might not spiral, for expectations, anyway, out of their control (with the media playing right into it, the exact point of my March 2014 article).In other words, they had some idea about what was about to be unleashed – and that it was aimed squarely at China. I think they underestimated its scale and depth, certainly the duration, but in terms of our idiot officials versus theirs, theirs were that much further ahead not that it made much of a difference in the end.

We all suffer for the lack of effective understanding about global reserve currency.

In escalating trade war sparring, another such media report has been issued just today. The Chinese have hinted how they are once more thinking they might sell their UST’s. Predictably, our media, quoting all the right “bond king” experts, sees it as a powerful threat....

HT to and headline from: ZeroHedge

So the takeaway is: China may boycott some auctions but don't bet on them selling willy-nilly