From Musings on Markets:

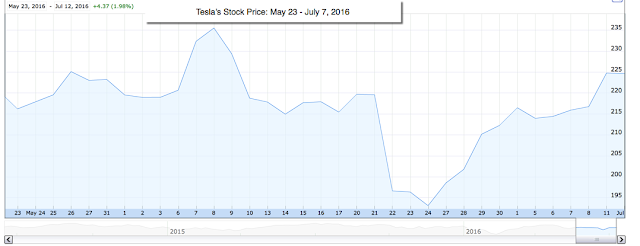

The last few weeks have tested Tesla’s shareholders and frustrated short sellers in the stock. Shareholders have had to weather a series of bad news stories, ranging from a failure to meet its shipment targets in the last few months to a fatality with a driver using its autopilot function to a surprise acquisition of Solar City. While each of those stories has created pressure on the stock, the price has held up surprisingly well, frustrating long-time short sellers who have been waiting for a correction in what they see as an overhyped stock.

So, what gives here? Why has Tesla’s stock price not collapsed facing this adversity? I think that Tesla's price action illustrates the power of the “big story” and the sometimes difficult-to-understand market dynamics of story stocks.

Story StocksIn earlier posts, I have made a case for valuation being a bridge between story and numbers, with every number telling a story and every story being captured in a number. Thus, while your final valuation may be composed of forecasts of revenue growth, profit margins and reinvestment, it is the story that binds together these numbers that represent the soul of the valuation.

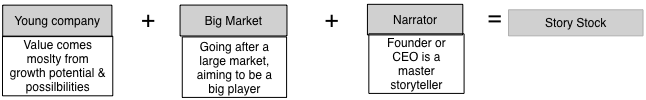

That said, the balance between stories and numbers can vary across companies and for the same company, can change across time. For most companies, it is the story that comes first, with numbers following, and for others, it is the numbers that tell the story.There are some companies that I would classify as story stocks, where the story is so dominant in both how people price the stock and what determines its value that the numbers either fade into the background or have only a secondary effect. There are three characteristics that story stocks share:

Amazon remains one of my longest-standing examples of a story stock, a company, with a CEO (Jeff Bezos) who was and continues to be clear about his ambitions to conquer big markets, told that story well and acted consistently with it. You can see why Tesla also has the makings of a story stock, going after a big market (automobiles and perhaps even clean energy), with an unconventional strategy for that market and a larger-than-life CEO in Elon Musk. With story stocks, it is the story that dominates how the market perceives the stock, and that has consequences:The key to understanding story stocks is deciphering the story behind the company, then checking that story for reasonability and making it your own.

- Story changes and information: it is shifts in the story that cause price and value changes. An earnings report that beats expectations (in either direction) or a news story of significance (good or bad) may not have any effect on either (value or price) if it does not change the story. Conversely, a shift in perceptions about the business story, triggered by minor news or even no news at all, can trigger major price changes.

- Wider disagreements: When a company’s value is driven primarily by numbers, there is less room for disagreement among investors. Thus, when valuing a company in a market with steady revenue growth and sustainable profit margins, there will be less divergence in what investors think the stock is worth. In contrast, with a story stock, investor stories can span a much wider spectrum, leading to a much bigger range in values, as illustrated with Uber in this post.

The Tesla Story

So, what is Tesla’s story? To structure the process, let me lay out the dimensions where investors can differ on the story and how these differences play out valuation. The first is Tesla's business, i.e., whether you see Tesla primarily as an automobile company that incorporates technology into its cars, a technology company that uses automobiles to deliver superior electronics (battery and software) or even a clean energy company with its focus on electric cars. The second is focus, i.e., whether you believe that Tesla will cater more to the high end of whichever business you see it in or have mass market appeal. The third is the competitive edge that you see it bringing to the market, with the choices ranging from being first to the market, superior styling & brand name and superior (proprietary) technology. The fourth is the investment intensity needed to deliver your expected growth, with much higher reinvestment needed if you consider Tesla a conventional manufacturing company (like autos) than if you see it as a tech company. Finally, there is the risk in the company, with the auto story bringing with it the risks of cyclicality and high fixed costs and the tech story the risks of being rendered obsolete by new technologies and shorter life cycles.

Previously:The value that you attach to Tesla will be very different if you consider it to be an automobile company, catering to a high-end clientele than if you view it as an electronics company with a superior technology (in electric batteries) and a mass market audience.My thinking on Tesla has changed over time. In my first valuation of the company in September 2013, I valued it as a high-end automobile company, which would use its competitive edges in branding and technology to generate high margins, with investment and risk characteristics more reflective of being an auto than a tech company. The resulting inputs into my valuation and valuation are summarized below:...MUCH MORE

April 2014

The Man Who Hated Tesla: Professor Damodaran Revises His "The Stock is Worth $67" Call (TSLA)

September 2013

Tesla: Even More on Aswath Damodaran's $67.12/share Valuation (TSLA)

September 2013

Tesla: More on the $67.12 Valuation (TSLA)

September 2013

Sure, He Called the Top In Apple and He Called the Bottom in Facebook But Tesla Fair Market Value at $67.12? (TSLA)

If interested see also:

Prof.Damodaran's Handy Uber Valuation Template (or, How to Price a Narrative)