This while the dollar index is down 0.29% and the buck is weaker against the euro at 1.1099.

From Alhambra Partners:

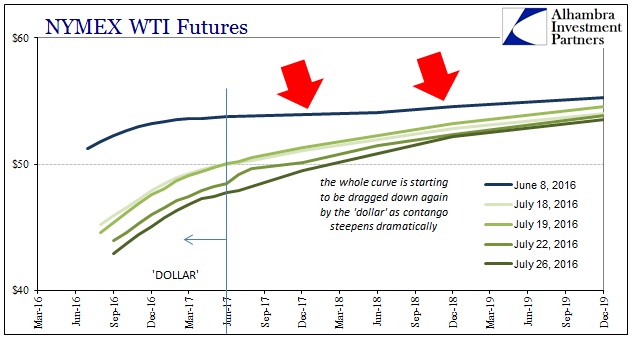

It isn’t just that oil prices are falling, that is only one dimension of the full oil spectrum concentrating in the spot market. The more interesting and important information is contained within the whole WTI futures curve. As “dollar” funding pressure has built up since the front month peak on June 8, it has steepened the curve into deeper contango; raising expectations for even more crude heading toward storage in the near future.

That process continues, but in the past few weeks the entire WTI curve has again been influenced by the front. As we have seen in prior episodes, the “dollar” “wins” by pulling down the shorter maturities first so that those expectations for storage become paramount at the back end (so much oil inventory reduces the willingness of anyone who might be willing to buy and store crude to sell at a future date, therefore a lower price further into the future).

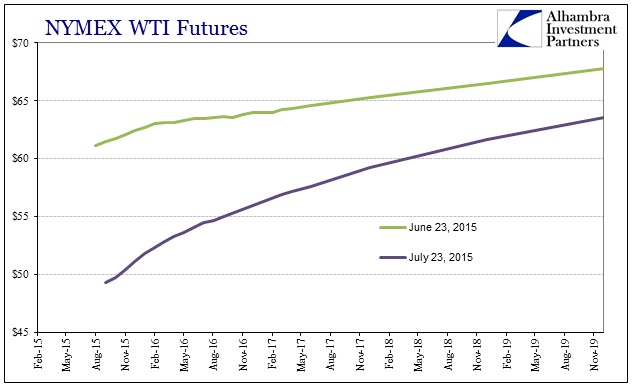

This is all familiar stuff, of course, as the same thing occurred June to July last year. While the scale was a bit larger and more condensed in terms of time (primarily, I think, due to the fact that second surge in oil inventory to start 2016 may have kept a lid on how far oil prices could retrace after February 11, China or no China), the effect on the whole WTI curve is immediately recognizable heading toward the events of last August.

So what seems like clear “dollar” influence should be corroborated by other “dollar” proxies, particularly those that have been especially helpful in sorting out the eurodollar condition during the “rising dollar” period: CNY and JPY. Nothing, however, is ever that simple. Though seasonality and pattern repetition are undoubtedly underlying influences, history only rhymes.

If we take the action in crude oil prices to be a measure of the “dollar”, then we would expect to find CNY falling, too. It isn’t. In fact, CNY has been rather tame and sideways since around July 11. That Monday, the exchange rate to the dollar was just under 6.70. It was also the day that Japanese rumors rekindled 2013-style love of central banking (if only in rump format). Since Japanese banks have been, I believe, a (perhaps “the”) significant source of “dollar” liquidity in China, a hard reversal like that might explain CNY’s much calmer demeanor since then....MORE