Yesterday I saw an FT Alphaville post by Izabella Kaminska and noted it with "Izzy/Khartoum", with the intent of linking to it after double checking that no one had sneaked a triple-leveraged long ETF into the mix as the DJIA was dropping 450 points.

I looked at the "Khartoum" bit a half-dozen times without realizing why I had saved/annotated the piece and it wasn't until this morning that I remembered Khartoum was a reference to the British General Gordon whom the Sudanese Muslims had decapitated and whose noggin the Mahdi had ordered put in a tree for all to see.

Duh, the memory jog was Gordon.

Next time I should maybe go with gin or knot or something.

From FT Alphaville:

Bob Gordon’s not getting in your driverless car

The first batch of reviews for Robert Gordon’s new book The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War are feeding through the blogosphere. Here, for example is Diane Coyle’s take. She’s mostly appreciative of the work but not entirely convinced Gordon’s central thesis that innovation today is slower and less important than it was in the 20th century has been entirely proven.

She is more sympathetic, however, about the issue of headwinds slowing down whatever innovation-driven growth there might otherwise be.

We haven’t read the book ourselves yet, but reading Coyle’s review it’s clear Gordon uses the book to expand in more detail on some of the ideas presented in his October 2015 paper Secular Stagnation on the Supply Side: U.S. Productivity Growth in the Long Run. That paper, itself, expands on his core thesis that the days of miracle growth are long gone and that slower growth lies ahead.

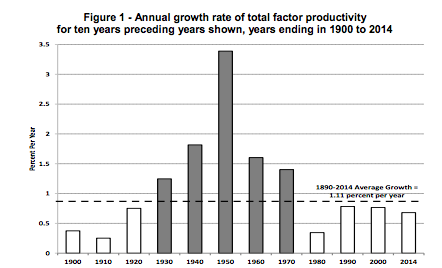

To wit, here’s a recap of some of the newish points Gordon was making back in October, plus this chart, which really tells the story in our opinion:

One point Coyle focuses on in her critique is Gordon’s “obsession” with the digital economy as the barometer of all new innovation in the system and his argument that recent innovations are occurring mainly in entertainment, communication and IT, which are less important than their related precursors (radio, telecoms and TV)....MUCH MORE

In his paper, however, Gordon’s sets the case in more clear-cut terms. The point really is that the world has already experienced its growth boost from digital and mobile communication innovation and that, more pertinently, all new ICT related innovation is now encountering diminishing returns as a result. That is to say, there is something different about information-fuelled growth compared to technique-fuelled growth. The former’s advantage for some reason stales more quickly than the latter’s....

In our link to The Enlightened Economist's review last Wednesday I mentioned a few of our prior posts on Gordon and concluded with:

...For those in search of the full experience, FT Alphaville has a lot of posts, and here's a conversation at the University of Chicago I was going to link to but decided against at the time. From the Booth School of Business' Capital Ideas magazine: Transcript: Can innovation save the US economy?I mean "a lot" of posts.

Tangentially related:

Beating a Dead (robotic) Horse