I'm pretty sure that as an adviser to His Majesty's Government the Great Man traded on inside information.

From Naked Capitalism:

There are some strange and interesting passages in Keynes’ General Theory of Employment, Interest and Money – and it is these, I think, that give it its deserved status as a classic. Many of these passages are the tangential reflections of a man – who we should not hesitate to call a genius – on his subject matter. And it is these passages that truly make Keynes what he was: a wise man.*From our November 2010 post "What Would Keynes Have Done?":

One of the most fascinating passages on the so-called Keynesian beauty contest is worth quoting here in full.

[P]rofessional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick, not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view. It is not a case of choosing those which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practise the fourth, fifth and higher degrees. (GT, Chapter 12)Is this an economic point that Keynes is making? To an extent, yes. But at a deeper level it is an ontological point. What he is really referring to is how investors situate themselves vis-à-vis one another as people. If applied to many of our interpersonal relations Keynes’ example would be just as accurate. The fact is that people often – if not always, albeit unconsciously – think about what others are thinking about before they make decisions. Some might call this ‘herd behaviour’, with all the pejorative connotations that calls up; but the fact is that we all engage in this sort of activity to some extent (if not completely) – and it simply remains to be seen how conscious a given individual is of it.

Okay, so maybe there are some people that do not think in such reflective terms, but they are few and far between. People, for example, who believe that they have found some inherent ‘law’ to which the market adheres and who then place their bets based in accordance with this supposed law. Hardcore gold bugs would be a fine example of this. They tend to believe that they have worked out a fundamental Truth of some sort and refuse to take into account that the price of gold may be driven by a Keynesian beauty contest dynamic (i.e. expectations built upon expectations).

Then there are the other extreme. These are the people that, in Keynes’ words, “practice the fourth, fifth and higher degrees” – that is, people who try to work out what other people are working out about what other people are working out about what other people are working out. Do these people exist? No, this is far more likely to be Keynes’ own fantasy – an intellectual thought experiment projected onto reality. In all likelihood there are probably no investors that truly go beyond the third degree which, as Keynes says is, “where we devote our intelligences to anticipating what average opinion expects the average opinion to be.” One gets far too dizzy after Keynes’ ‘third degree’ to think about popular opinion in a way that would produce any really useful information. (Although one could imagine thinking at the ‘fourth degree’ given a singular ‘opponent’, but this is the exception not the rule in investment).

Thought experiment or not, it is interesting – even enticing – to consider how far you can push this logic. This is because this logic, as indicated above, says something fundamental about human psychology – nay, human ontology. We believe in these Others out there with varying degrees of mastery, opinions and information....MORE

We've had a few posts on J.M.K. and his investment performance, here are some tidbits, go to the posts for the rest of the story.:

Keynes The Money Manager

First up, a couple snippets from the one page piece "Keynes The Speculator":

John Maynard Keynes began his career as a speculator in August 1919, at the relatively advanced age of 36 years.You know where this is going don't you:

Keynes traded on high leverage - his broker granted him a margin account to trade positions of £40,000 with just £4,000 equity....

...Keynes soon learned that short-term currency trading on high margin, using only his long-term economic predictions as a guide, was foolhardy. By late May, despite his belief that the U.S. dollar should rise, it didn’t. And the Deutschmark, which Keynes had bet against, refused to fall. To Keynes’s dismay, the Deutschmark began a three-month rally.

Keynes was wiped out. Whereas in April he had been sitting on net profits of £14,000, by the end of May these had reversed into losses of £13,125. His brokers asked Keynes for £7,000 to keep his account open....

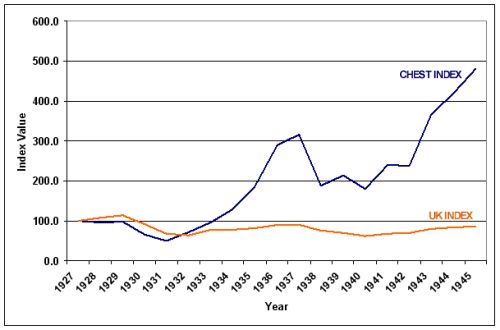

...The performance of Keynes’s fund from 1927 to 1946 is shown below. During these years the Chest grew at an annual compounding rate of 9.1 percent while the general British stock market fell at an annual compounding rate of slightly under 1 percent.John Maynard Keynes: Money Manager (Couldn't Trade Lard to Save His Life)

Chest Fund Performance 1927 to 1946

The whole thing is worth a read....

...My two cents:

In a 1983 paper "J.M. Keynes' Investment Performance: A Note" the authors are dubious of his performance, without casting the aspersion that I do in my comment. They on the other hand have a great tidbit:Investing Tips from the World's Richest Economist

...Investments in commodities were more substantial. The highest annual gain was for ₤17,000 from September 1936 to August 1937 and the highest annual loss, mainly in lard, for ₤12,600 in the following twelve months...We too have commented on the lard market, in the March '08 post "Volatility Getting You Down, Bunky?":

Maybe it's time you looked into the tallow market.

The tallow/grease/lard complex has been traded for five thousand years:

2992 B.C.

Honey I'm home!

Hi dear, anything new in tallow?

Nope. Same ol', same ol'.

2008 A.D.

Ditto.

No not Paul Krugman. The columnist and Laureate knows how to earn money as exemplified by his lending his name to Enron for $50,000 for four days work.For some comments on the Keynes (attributed) quote "Markets can stay irrational..." see Jazon Zweig's MarketBeat post "Keynes: He Didn’t Say Half of What He Said. Or Did He?".

Judging by his temperament on the Sunday talking head circuit (there's that earnings power/branding again), I would think he's more of a hoarder rather than an investor, speculator or gambler.

And no, it's not John Maynard Keynes.

We had a look at Keynes' investing style in "Keynes The Money Manager". After a disastrous start in currencies, which led to the observation attributed to him by A. Gary Shilling: "Markets can remain irrational a lot longer than you and I can remain solvent."

The performance of the Chest Fund (a sidecar of the Kings College endowment) was indeed impressive.

However, it now appears that Keynes only achieved positive results starting in 1932.

It is probable that this timing indicates he was trading on inside information, knowledge of the British government's abandonment of the gold standard. He was an adviser to the gov. and pushed the policy....