From the WSJ's Real Time Brussels blog:

The U.S. Federal Reserve’s decision to buy more long-term U.S. Treasurys, known as quantitative easing, has provoked much criticism here in Europe. This debate, however, raises an interesting question: Why shouldn’t central banks always buy and sell longer-term debt to control interest rates over all time periods?*We've had a few posts on J.M.K. and his investment performance, here are some tidbits, go to the posts for the rest of the story.:

Central banks in normal times manipulate rates by dealing mainly in short-term government debt. When inflation is seen as a risk, central banks sell short-term debt to raise yields, and when inflation is tame, banks buy it to lower yields and promote growth.

These market operations directly impact short-term rates. But central bankers hope and assume that changing short-term rates also impacts longer-term rates by changing investors’ expectations of the future path of monetary policy. And it is longer-term rates that are economically important, because they determine whether people will make significant investment decisions, such as building a factory, hiring a worker or buying a house.

This idea is known as the “expectations hypothesis,” and unfortunately for central bankers, empirical studies show that for the most part it doesn’t accurately describe the relationship between short-term and long-term government debt yields. That is, long-term rates move in the same direction as short-term rates but not by magnitudes predicted by the expectations hypothesis.

- Everett Collection

- John Maynard Keynes in 1941.

This would appear to be a major problem for the current practice of monetary policy. Are central bankers fiddling around with short-term rates, while the more important longer-term rates exhibit a life of their own? If so, maybe the Fed and other central banks should always deal in debt across a range of maturities, so that the government can firmly control long-term interest rates.

John Maynard Keynes advocated this possibility in his magnum opus, the General Theory of Employment, Interest and Money:

Perhaps a complex offer by the central bank to buy and sell at stated prices gilt-edged bonds of all maturities, in place of the single bank rate for short-term bills, is the most important practical improvement which can be made in the technique of monetary management....MORE

…

The monetary authority often tends in practice to concentrate upon short-term debts and to leave the price of long-term debts to be influenced by belated and imperfect reactions from the price of short-term debts; — though here again there is no reason why they need do so.

Keynes The Money Manager

First up, a couple snippets from the one page piece "Keynes The Speculator":

John Maynard Keynes began his career as a speculator in August 1919, at the relatively advanced age of 36 years.You know where this is going don't you:

Keynes traded on high leverage - his broker granted him a margin account to trade positions of £40,000 with just £4,000 equity....

...Keynes soon learned that short-term currency trading on high margin, using only his long-term economic predictions as a guide, was foolhardy. By late May, despite his belief that the U.S. dollar should rise, it didn’t. And the Deutschmark, which Keynes had bet against, refused to fall. To Keynes’s dismay, the Deutschmark began a three-month rally.

Keynes was wiped out. Whereas in April he had been sitting on net profits of £14,000, by the end of May these had reversed into losses of £13,125. His brokers asked Keynes for £7,000 to keep his account open....

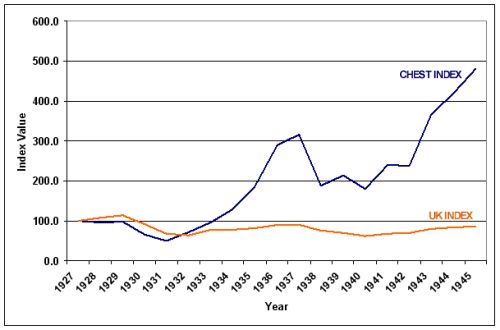

...The performance of Keynes’s fund from 1927 to 1946 is shown below. During these years the Chest grew at an annual compounding rate of 9.1 percent while the general British stock market fell at an annual compounding rate of slightly under 1 percent.John Maynard Keynes: Money Manager (Couldn't Trade Lard to Save His Life)

Chest Fund Performance 1927 to 1946

The whole thing is worth a read....

...My two cents:

In a 1983 paper "J.M. Keynes' Investment Performance: A Note" the authors are dubious of his performance, without casting the aspersion that I do in my comment. They on the other hand have a great tidbit:Investing Tips from the World's Richest Economist

...Investments in commodities were more substantial. The highest annual gain was for ₤17,000 from September 1936 to August 1937 and the highest annual loss, mainly in lard, for ₤12,600 in the following twelve months...We too have commented on the lard market, in the March '08 post "Volatility Getting You Down, Bunky?":

Maybe it's time you looked into the tallow market.

The tallow/grease/lard complex has been traded for five thousand years:

2992 B.C.

Honey I'm home!

Hi dear, anything new in tallow?

Nope. Same ol', same ol'.

2008 A.D.

Ditto.

No not Paul Krugman. The columnist and Laureate knows how to earn money as exemplified by his lending his name to Enron for $50,000 for four days work.

Judging by his temperament on the Sunday talking head circuit (there's that earnings power/branding again), I would think he's more of a hoarder rather than an investor, speculator or gambler.

And no, it's not John Maynard Keynes.

We had a look at Keynes' investing style in "Keynes The Money Manager". After a disastrous start in currencies, which led to the observation attributed to him by A. Gary Shilling: "Markets can remain irrational a lot longer than you and I can remain solvent."

The performance of the Chest Fund (a sidecar of the Kings College endowment) was indeed impressive.

However, it now appears that Keynes only achieved positive results starting in 1932.

It is probable that this timing indicates he was trading on inside information, knowledge of the British government's abandonment of the gold standard. He was an adviser to the gov. and pushed the policy....