Last week, in his weekly market comment, John Hussman posted an interesting chart (see below) comparing the corporate profit to GDP ratio and the subsequent growth rate in corporate profits. I have previously posted on profit margins (see here and here) and will now further explore what profits margins at current levels imply about the next five years for the S&P 500 index....MORE

But first a question: why is the current level of corporate profit margins so important?

When looking at the market through a P/E (Price divided by earnings) framework it becomes obvious that any price appreciation, by definition, must come from an expansion in the P/E multiple, an increase in earnings or both. Experts disagree on what, exactly cause an expansion or contraction in the P/E multiple but the general consensus is that it is due to the level of inflation, interest rates, investor sentiment or a combination of the three.

The current S&P 500 P/E multiple based on trailing twelve months earnings is 17.88; a level that is in the top 26% percent of monthly periods since 1900. The average multiple over that period is 15.68. Looking at the Shiller PE 10 or CAPE, the current multiple of 21.75 is higher than all but 18% (242 out of 1331, nearly half of which have occurred since 1999) of monthly occurrences. The post-1900 average for the CAPE is 16.29. Using either method, the current P/E multiple is above average historical levels. Based on this, it would appear auspiciously sanguine to count on a significant expansion in the multiple to drive returns. With multiples near the upper 20% of their historical range it is important to look at potential earnings growth as a source for price appreciation.

Earnings growth can come from two sources; economic growth and an expansion in the corporate profit margin. Economic growth, as measured by GDP, while certainly volatile from year to year has, over the longer term, remained fairly consistent. The general consensus seems to be that we are in for a period of average to below average growth so it would seem imprudent to count on returns from above trend growth in GDP. That brings us back to profit margins as a key driver of returns on a broad based index, in this case the S&P 500, over the next five years.

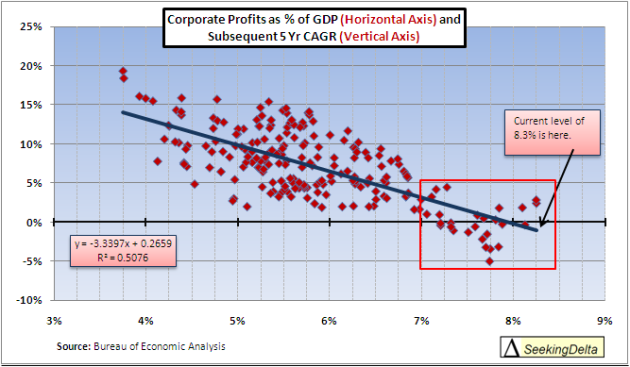

The following chart (click on any chart for a larger view) was posted by John Hussman in his November 15th market comment; I have recreated it for use here.

As can be seen in the chart (profit to GDP on right hand scale and 5 YR CARG inverted on the left had scale), the level of corporate profit to GDP is fairly indicative of the subsequent five year growth in profits. The correlation between the two metrics is -.73, which means that as corporate profits to GDP rise the subsequent growth in profits decline. Another way to analyze the data is through a scatter plot.

The current level of corporate profits, at 8.3% of GDP, is higher than the great majority of other periods. Furthermore, when profits are greater than 7% of GDP there are no examples of five year annualized profit growth at more than 5% (the box above).

Next we examine the percent change in the corporate profit ratio. Again, the subsequent change in the ratio is negatively correlated to the current level at -.58. Over the next five years based on the historical evidence we should expect the current profit ratio of 8.3% to decline.

With the negative correlation between present profit levels and future growth firmly established we move on to examining just what the current profit levels mean for future growth. See the next two tables that breakdown both the subsequent five year compound annual growth rate (CAGR) in corporate profits and the five year change in corporate profit to GDP ratio.

Looking at these tables it is clear that the annual growth in profit is highest when beginning at low profit margin levels. Furthermore, this high growth is primarily driven by an increase in the margin not by exceptional GDP growth. This is evidenced by the average change in margin percentage in Table 2.

Related:

President Obama Has Been Very Good For Corporate America

Update to "President Obama Has Been Very Good for Business