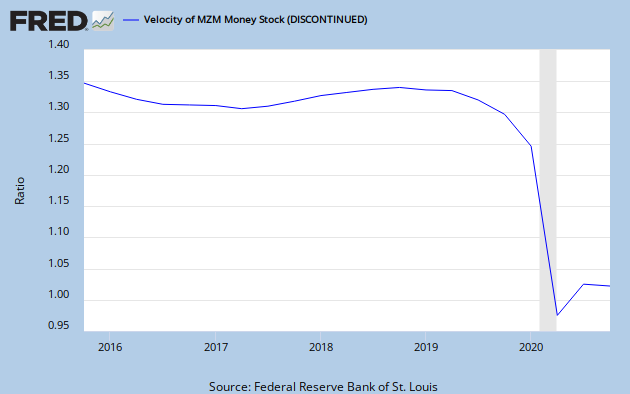

We like FRED. Here's the velocity of Money of Zero Maturity:

Here's the headline story from MoneyNews:

If you are interested in promoting long-term, sustainable economic growth, I submit the velocity of money is more pertinent than the quantity of money (quantitative easing).

Apparently, many modern economists haven’t focused sufficiently on this economic parameter.

Simply stated, the velocity of money indicates how frequent monetary transactions occur. The same dollar, through multiple transactions, creates one dollar of income for multiple entities. Therefore, income can expand via numerous transactions while the monetary base (supply of physical currency, which excludes credit in the form of loans) remains constant. Hence, sustainable economic growth can be achieved with a stable supply of physical money.

The art is to create an environment that empowers monetary velocity to remain vibrant and grow.

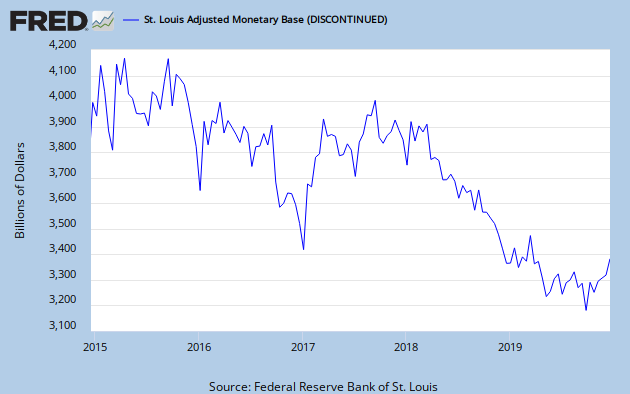

The St. Louis Reserve Bank reports that monetary velocity fell 75 percent from mid-2008 to mid-2009, despite a 100 percent increase in the monetary base (from nearly $1 trillion to almost $2 trillion). An increase in the quantity of dollars is insufficient to generate the utilization of those dollars: they remain static in the form of excess reserves, available for transactions at some later date.

In 1978, MIT economist Nathan Mass developed a model to describe why excess liquidity in the form of monetary aggregates (capital) is insufficient in creating meaningful economic activity and growth. This scenario is referred to as the “liquidity trap.” He stated: “The weak impact of monetary stimulus on real activity arises because additional money has little force in stimulating additional capital investment during a period of general overcapacity.”

“Due to persistent excess capital, which cannot be reduced as fast as labor can be cut back to alleviate excess production, unemployment actually remains higher on the average following the drop in production."

Essentially, an increase in the monetary base exacerbates the overcapacity of capital. The excess supply of capital reduces its cost and provides less incentive to innovate and create investment opportunities. The excess monetary aggregates may be myopically consumed by endeavors with little future potential.

Ironically, higher borrowing costs (interest rates) provide additional incentive to generate more innovative, long-term investment opportunities. This enables an environment that fosters strong, sustainable economic growth (healthy transaction velocity with a more stable monetary base).

In analyzing a regression analysis of the monetary base and velocity in the United States, John Mauldin, president of Millennium Wave Advisors, demonstrates how a stable monetary base with nearly 0 percent growth can generate a growth in velocity and income of 6 percent (note: income equals quantity of money times velocity). The study also indicates that a percentage increase in the money base ironically causes a decrease in monetary velocity by an equal percentage. The net positive effect on economic growth is low, if any.

The same analysis for Japan is striking: it suggests a zero percentage gain in velocity with a stable monetary base of 0 percent growth. This reflects the ill-fated accommodative monetary policy in Japan for two decades, which solidified an intense liquidity trap. Monetary velocity for Japan would increase only if the monetary base contracts. Less available money may actually inspire innovative, entrepreneurial activity, which creates positive economic feedback: an environment that can sustain long-term growth.

The U.S. can avoid the liquidity-trap environment experienced in Japan by focusing less on the quantity of money (quantitative easing) and more on its velocity.

The Japanese phenomenon was unique in that quantitative easing (creation of monetary aggregates) was concurrent with a massive increase in debt issuance. During the U.S. depression of the 1930s, government debt as a percentage of GDP was reduced to 125 percent from 270 percent (a 50 percent decrease). However, total debt (private and public) in Japan tripled in the past two decades to 470 percent of income, according to a 2008 McKenzie study.

Debt issuance is highly inefficient in promoting economic growth. The level of debt required to generate a dollar of income quadrupled during the past four decades in the US: from $1.53 in 1960 to $6.00 in 2000. Moreover, studies by Dr. John Taylor, of Stanford University, suggest the velocity of money generated by government expenditures is roughly 50 percent of that for private expenditures, which translate to lower economic growth....MORE