FT Alphaville reminded us so here's a big 'ol hat tip ma'am.

Here are some of our posts on the verde side of Gazprom:

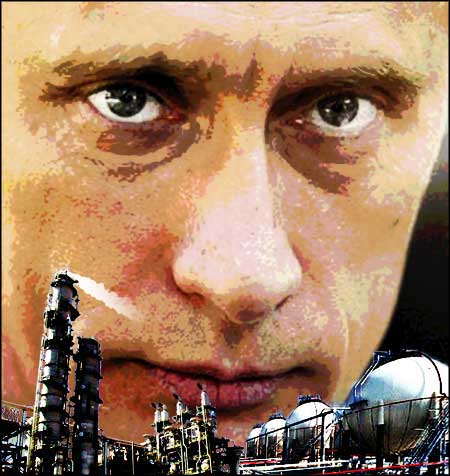

Russia to Stockpile $58 Billion of Kyoto CO2 CreditsSpeaking of control we have some posts on Gazprom's control shareholder, who, although he only owns 4 1/2% of the outstanding has veto power at the strategic level, links after the jump.

Fixing Leaky Gas Pipes Seen as Next CO2 Grab

Russia: What a Scam We Have in Carbon

Gazprom's plan for control. And EU Gas Market Prices

From the Streetwise Professor:

Showing its deep, deep concern for the environment, Gazprom is warning about the hazards of natural gas fracking:See also:

But in a sign the phenomenon is in fact being taken seriously, the board of directors at the world’s biggest gas producer, state-owned OAO Gazprom, this week highlighted environmental risks and the high costs of production in Europe.Now surely, this has absolutely nothing to do with the fact that expanded gas production, especially in Europe, would be devastating for Gazprom. The experience in the US shows how quickly the gas market can turn. In 2006, the consensus prediction was that the US was facing a low supply-high price gas future, and that the country would be a gas importer. Gas prices were well north of $10/mmbtu. A few short years later, the US supply situation was turned on its head. Gas prices are now in the mid-$3/mmbtu range, and the play of the day is to figure out how to export gas to Europe and Asia.

“The production of shale gas is associated with significant environmental risks, in particular the hazard of surface and underground water contamination with chemicals applied in the production process,” Gazprom said in the statement following the board meeting.

LNG sourced from the Middle East or the US is already a near-to-medium term threat to Gazprom, as the ongoing disconnect between gas prices and oil prices (which determine the price of Gazprom gas under its long term contracts) indicated. Even a modest increase in production in Europe would put even more pressure on the company. And as the US experience shows, that increase can take place extremely rapidly (though for a variety of reasons such speed is unlikely in Europe)....MORE

"It’s Amazing: You Poke Gazprom, and Putin Screams" (OGZPY)

UPDATED:"Gazprom and Igor Sechin: The Dale Carnegies of Gas"

Putin Takes a Stand Against Wind Power

(computation of Putin's net worth)

...Setting Gunvor aside, both of the oil and gas companies are down considerably from their YE '07 market caps: 4 1/2% of Gazprom is worth around $6 billion while 37% of Surgutneftegaz clocks in at $12 1/2 bil....Nice Shack: "RuLeaks posts photos of alleged 'Putin Palace'"

Quick, what's Vlad's net worth?

From Foreign Policy's Passport blog:

RuLeaks, a WikiLeaks type site owned and operated by the Russian Pirate Party, was shut down by a denial of service attack yesterday after posting photos of a lavish mansion alleged to be Prime Minister Vladimir Putin's estate on the Black Sea. The site, and the photos, are now back up.

The existence of the "Putin palace" on the Black Sea was discussed by the Washington Post's David Ignatius in an article last year. According to Russian whistleblower Sergey Kolesnikov, the still under-construction digs cost more than $1 billion, include an amphitheater and three helipads and is being "predominantly paid for with money donated by Russian businessmen."....