Despite a penchant for double-speak that would make a politician blush, the Fed tells us that its primary focus is unemployment not inflation.

Let me remind readers, however, that an openly nervous Mr. Powell came out in the summer of 2020 with a specific, as well as headline-making, agenda to “allow” higher inflation above the 2% rate.

This “new inflation direction” ignored the larger irony that the Fed had been unsuccessfully “targeting” 2% inflation for years before changing verbs from “targeting” to “allowing.”

Such magical word choices reveal a critical skunk in the Fed’s semantic wood pile.

If, for example, the Fed was honestly “targeting” inflation to no success for years, how could Powell suddenly have the public ability to then “allow” more of what he failed to achieve before, as if inflation was as simple to dial up and down as a thermostat in one’s home?

Dishonest Inflation Reporting

The blunt answer is that the Fed, in sync with the fiction writers at the Bureau of Labor Statistics (BLS), reports consumer inflation as honestly as Al Capone reported taxable income....MORE

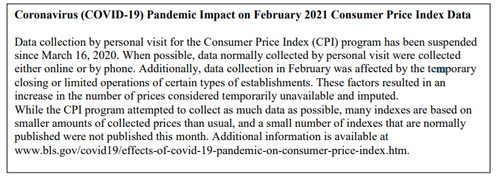

Update: The BLS is basically just admitted it is all BS..."data collection in February was affected by the temporary closing or limited operations of certain types of establishments. These factors resulted in an increase in the number of prices considered temporarily available and imputed"

So take the following data with a pinch of salt (and no there's no conspiracy cover-up here at all to hide the pernicious effects of massive money-printing... that would be crazy talk).

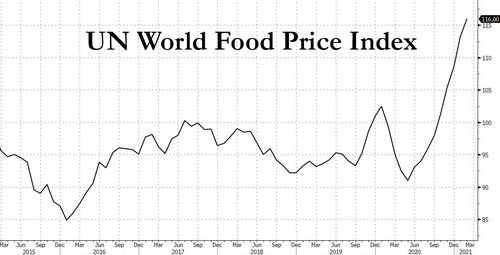

And while you're ignoring the fact the BLS made all this data up, ignore this chart too...

* * *

All eyes this morning are on consumer prices as we near the precipice of last year's collapse and the (artificial) explosion in year over year comps that the short-term collapse will create (temporarily, if The Fed is to be believed). February consumer prices rose at 0.4% MoM - the fastest pace since July, lifting the year-over-year price rise to 1.7% - the highest since Feb 2020....MORE

It would appear the algos missed the fact that BLS made it all up. For example...

what kinda bullshit is this? pic.twitter.com/AjXvhcpQnv

— HedgedIn (@noalpha_allbeta) March 10, 2021

A cooler than expected core CPI print (thanks to fabricated data) appears to have sparked a panic-bid in stocks...MORE